Percent asymmetric Indicator and Strategy for MultiCharts

If you require this item for a different platform please visit the product guide

It can also be used as indicator only when used in manual trading or for automated day or position trading

The video below shows Percent asymmetric on speeded up data.

Configured thus Long stop

is 15% Short stop is 12%

As markets generally have an upward bias, the size of longs is set to

buy 10 and shorts are selling 5, click the screen to pause to understand

how it operates.

The Percent Asymmetric is user-friendly for all traders from beginners to experts. It works on both automated and manual trading, whether real-time or end-of-day (EOD).

System introduction

Percent asymmetric is highly suitable for beginners as it uses fixed percentage inputs which you control

to you own needs

Percent asymmetric can produce has high risk to reward ratios as it is a high performance trend following models.

Advanced features

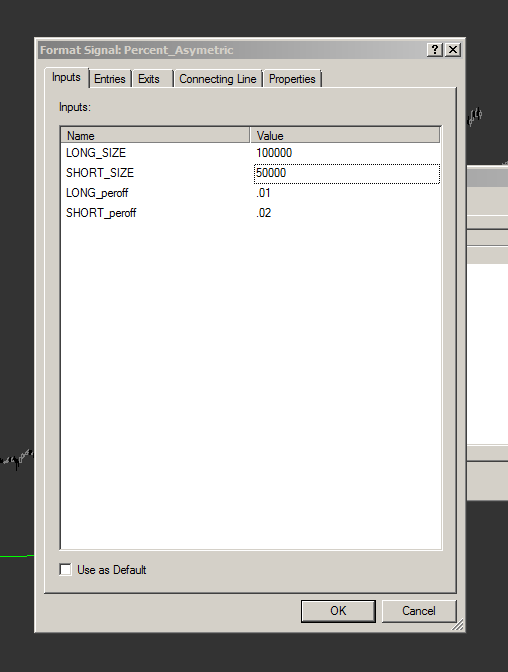

User inputs can be different for long and short entries EG. Enter long when 2.5% off the lowest low but enter shot when 3% off the highest high.

Hence the name asymmetric.

Advanced latency protection is

built into this product to enable it safely shut down when prices

are moving faster than your pc and internet during day trading

sessions.

Virtually infinite range of percentage settings for microscopic adjustment to fit any

market data behaviour.

Non-fractal in behavior. This is

due to the large array of periods used in the volatility equation.

It does not behave in the same was as a moving average when time

frame is changed.

Standard features

Percent settings are completely ignoring

the time frame of your chart so you can use any time frame of tick,

minute, hourly, daily bars and candles. Etc.

Simple to read colour changing plot that provides

a simple at a glance position detection depending on colour

The default use is as a stop and reverse model

Percent asymmetric can be used for position trading ( holding overnight ) or set to close trades at any time you specify if

you are intra day trading

Trade long and short or long only or short

only

If you set short size to 0 it will just

exit long when the stop is hit.

If you want short only just

set long size to 0

To use for both, then set long size and

short size to the amount you need.

View

license prices for Percent asymmetric for MultiCharts

View

Percent asymmetric instructions page

The Long

and short sizes can also be configured as unequal or asymmetic values.

(This is useful in a very strong or very weak market)

For example in a strong bull market

you might want to buy 100 and short just 20 contracts or shares as the

long is more likely to be a winner.

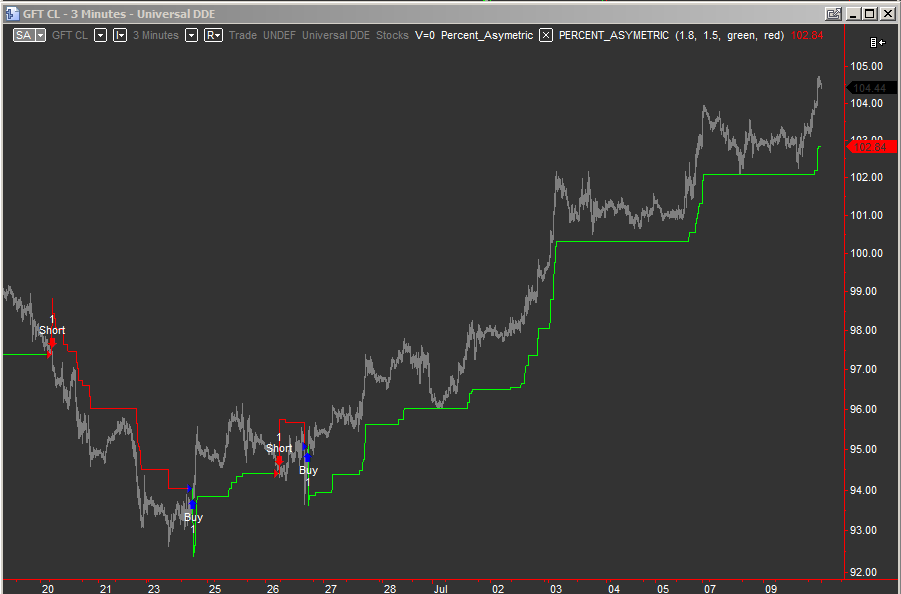

Percent asymmetric on 3 minute chart of Crude oil futures (CL)"

The percentage settings are long = 1.8% and

short =1.5% which enables a fast changing set up.

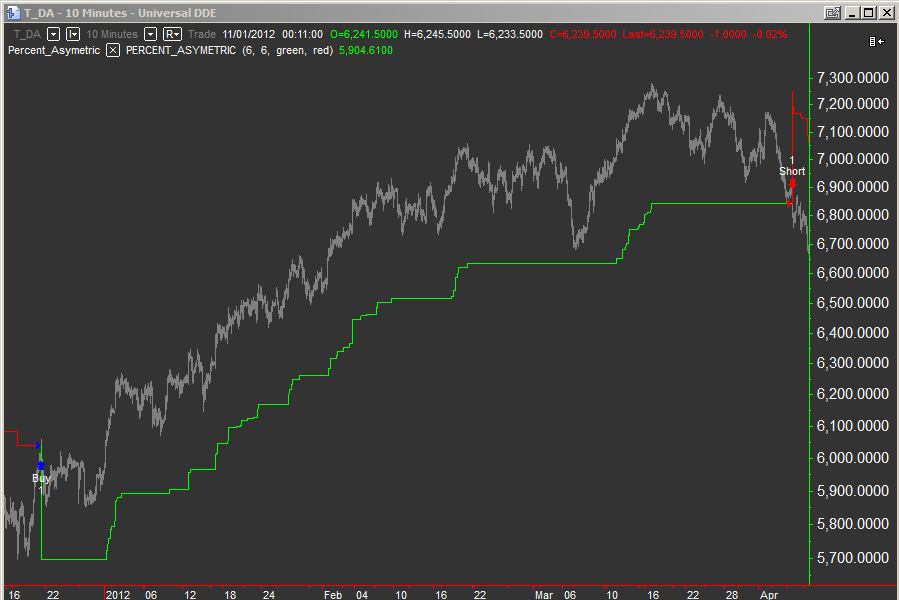

The Percent asymmetric below on Nasdaq futures 10 minute

chart

View

Percent asymmetric instructions page

Percent asymmetric settings guidelines

View

Percent asymmetric instructions page

Read the full article on how to test a trading strategy which shows

the correct method to use in backtesting a strategy

correctly.

IF YOU HAVE ARRIVED AT THIS PAGE AS A

BEGINNER THEN HERE ARE SIX TUTORIAL PAGES TO GET YOUR KNOWLEDGE UP TO A

BETTER LEVEL

How to trade part 1

How to trade part 2

How to trade part 3

How to trade part 4

How to trade part 5

How to trade part 6

Qstick

Educational videos

1929 crash

Trading IQ Game tutorial

PLAY FOR FREE

Trading IQ Game AND WIN PRODUCTS

View

license prices for Percent asymmetric for MultiCharts

Instructions

for use

The help and advice of customers is valuable to me. Have a suggestion? Send it in!

The contact page here has my email address and you can search the site

If you

like what you see, feel free to

SIGN UP to be notified of new products - articles - less

than 5 emails a year and zero spam

Precision Trading Systems was founded in 2006

providing high quality indicators and trading systems for a wide range of

markets and levels of experience. Supporting NinjaTrader, Tradestation and MultiCharts.

Page Created June 18th June 2023 to

replace old page - New responsive page GA4 added canonical this. 5/5 html baloon

cookie notice added video added

About