|

|

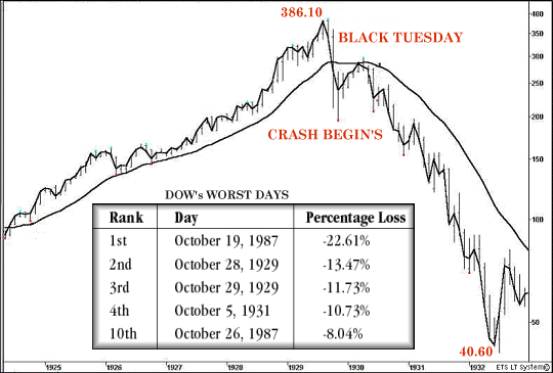

The Crash of 1929 with videos with amusing and horrific data

1987 Crash Calculator Site Map

Many similarities between the 2020 covid crash and the 1929 crashes can be observed.

A crash is coming and it could be terrific "Roger Babson" his prediction was known as the Babson break.

Note the corona virus is the excuse or catalyst, how this market responded to a rate cut dictates that there is a bearish

mood in the air.

The forgotten point is that during the 2008 credit crunch crisis the problem was "fixed" by printing money thus kicking

the can further up the road. Printing money will be done again and this time in a much bigger way.

The correct law or (procedures) of nature dictate that the fittest will survive, and the weak will not, but we now have

Japanization measures where nobody is allowed to fail and they get increasingly large bail outs from the government

The resulting outlook leads to hyper-inflation in prices and stock indices.

Just a yesterday the Federal reseverse announced a $1.5trillion stimulus package to aid the economy.

Please note there is a danger of a major derivatives firm going bust very soon and that the credit crunch problems of 2008

still exist and very much worse than it was in 2008.

The reader will note that the price of gold was rising to new highs a long time before the Corona virus arrived.

March 13th 2020

Prior to 1929 crash

1. Easy credit makes everyone rich (See video 1)

2. Too many people are already long of property and stocks. (Nobody left to buy)

3. High leveraging is available to people, even those with poor credit ratings.

4. The markets become dependent on credit to sustain themselves.

5. The markets make all time highs 1 year before the crash.

During the 1929 crash

1. The inevitable domino effect sweeps through the market causing a succession of margin calls.

2. People try to sell, but there are no buyers. (See video 2)

3. Markets go into nosedive

4. Regulators try to stem the declines but succeed only in making things worse. (See video 3)

5. Regulators clamp down on short selling, and blame speculators for declines. (See video 5)

6. Bank runs cause panic withdrawals from banks

7. People rush to buy gold

8. All these things will happen again ...and again

The aftermath....continued below videos

|

|

|

|

The crash of 1929 Part 1

|

| The crash of 1929 Part 2 |

| The crash of 1929 Part 3 |

| The crash of 1929 Part 4 |

| The crash of 1929 Part 5 |

View 1929 chart, dates and scenarios |

| 1929 data showing percentage declines and dates |

|

|

1929 data showing pe ratios, and sinsiter observations |

|

|

|

|

|