Insync Index Indicator for Tradestation - MultiCharts - Complete guide

The Insync Indicator is an easy to use consensus style oscillator indicator conceptualised by Norm North in 1995-Consensus indicators use many indicators to output a value

Please visit the product guide above if you require this day trading indicator for a different trading platform.

A nice piece of code from Norm North of North Systems which uses a summation of 10 different components, ranging from commodity channel index, relative strength index (RSI) and money flow index to moving average convergence/divergence, Bollinger bands, among others.

The Insync Index ranges from -65 to +65

and signals when the extreme point is reached and then retreats back

from it. From that point on, you're on your own..

Insync index contains two volume based

indicators, Ease of Movement and Money Flow index.

These

indicators each contribute scores of + 5 to - 5 to the consensus

reading, and if you do not have trade volume enabled they will not

assign the correct values, this effectively renders Insync useless.

So to make matters simpler I have added the input REALVOLUME =

TRUE / FALSE to this indicator.

While this has the effect of

reducing the range of Insync index to +55 and -55, ( if FALSE is

selected ) it at least means that the two volume components are

removed from the calculation

and enable the remaining 8 indicators

to work correctly. If this is not done, Insync will never reach the

extreme points required to signal a trade.

Also you need to

be aware, some version of Tradestation have a version of Money Flow

Index which is not correctly coded.

I have the correct code

here that can be used to replace the erroneous function. If you plot

Money Flow Index in your Tradestation, and note how it looks, if the

line is jerky and stepped, it

the incorrect code version which does

not follow the right formula as it was designed. If you need the

correct code then please mail me.

How to use Insync Indicator

Insync is best employed as a watch-dog over a large workspace of

instruments, with alerts given when the extreme levels are reached.

It is not an "Always in the market" indicator and hence needs to

be protected with trailing stops. (Do not wait for the other extreme

before exit trades)

WARNING This indicator works well in

sideways ranging markets, but is NOT SUITABLE FOR TRENDING MARKETS

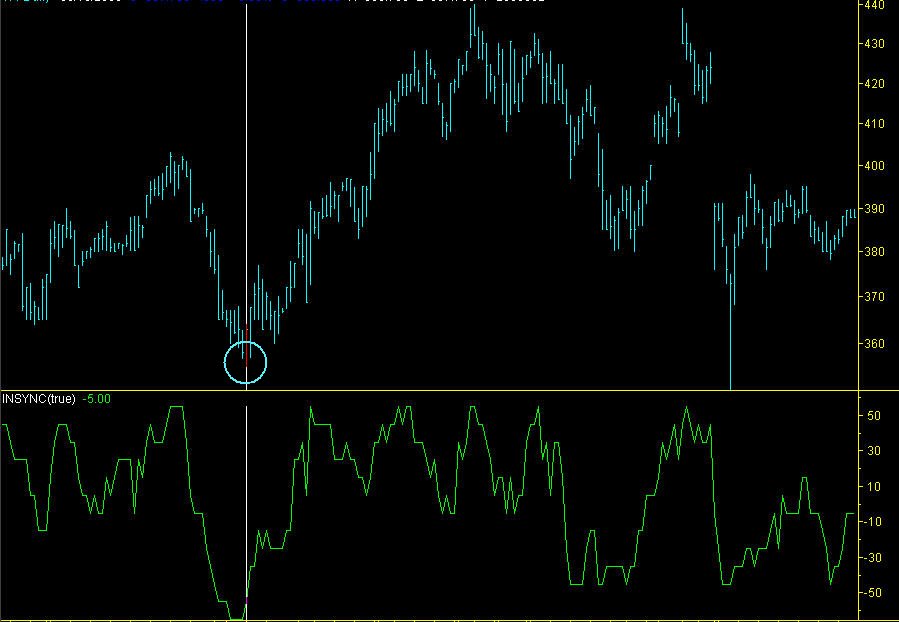

North intended buy signals when Insync reached -65 then rose

away from it. Sell signals when reaching +65 and falling from it

This indicator works well if the signals are confirmed with

Candlestick patterns

This indicator often works well on

markets which are not profitable when testing trend following

systems

My studies show that trading when Insync is not at

the full extreme points of +-65 reduce trading profits

significantly.

However you will see many great moves coming

from 55 or 60 values, which will drive you insane....you have been

warned

Some of the shortcomings of Insync have been addressed

in the Precision Index Oscillator shown at the bottom of the page

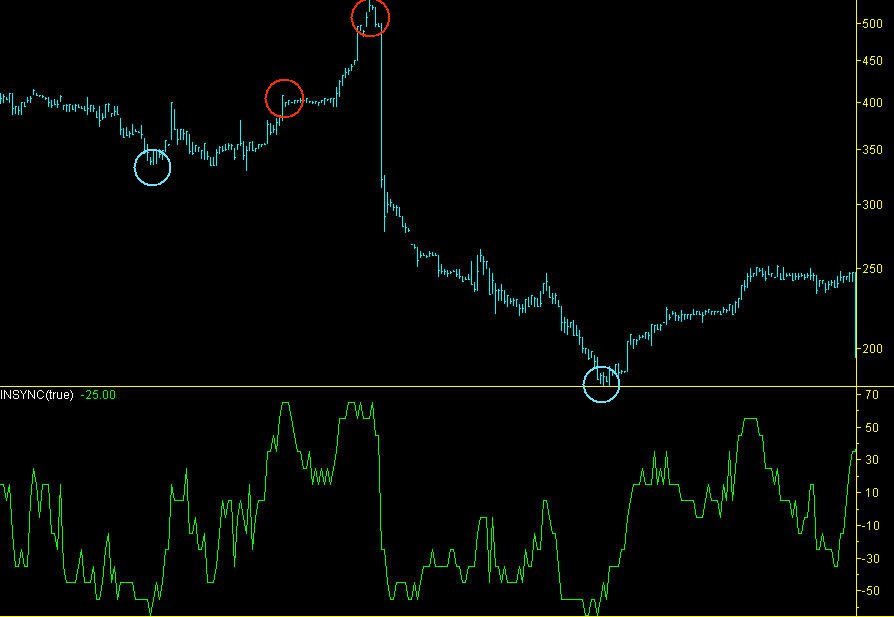

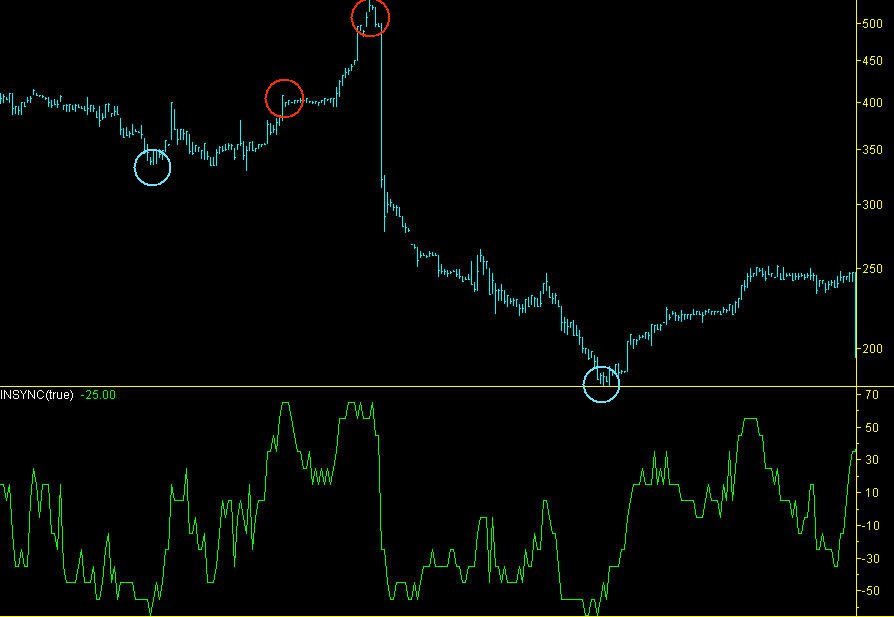

Chart examples of Insync Index show how it functions in a home trading system....

The Circles denote when Insync touched

+65 and -65, you can see the last trade lost, showing you need

trailing stops...

Insync index indicator on UK stocks

You will wait a long time for Insync to get to 65, so its best

to make a radar screen and then attach an alert to it.

This

indicator can be used in conjunction with the

day trading permission

indicator here which helps to filter trades to be taken only

when conditions are suitable.

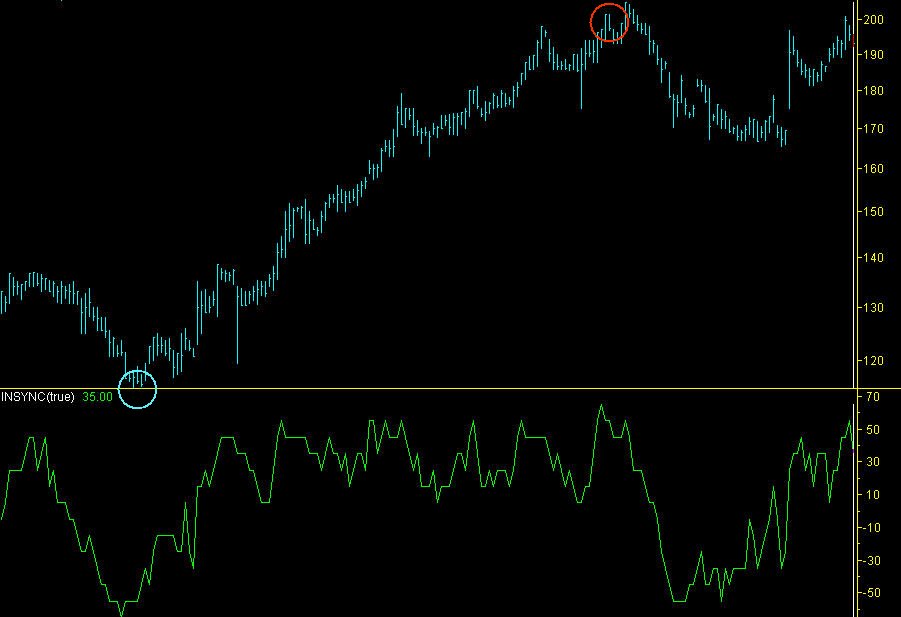

Insync indicator on UK stocks

The probability of a

trades winning fades dramatically if you trade on 55 or 60, this is

an annoying aspect

Insync index indicator trade

signals

All the subsequent high points after the long signal

failed to reach 65, so the best policy is to exit on a trailing stop.

The Insync indicator buy signal is marked with the white line.

If you want to get the Insync index indicator for Tradestation or

MultiCharts you can get it free if you score above 1150 in the

Trading IQ Game here.

If you like

Insync Index you might be interested to see the Precision Index

Oscillator shown below which is available for the following trading

platforms

MetaTrader 4 (MT4),

Tradestation,

TradingView,

MultiCharts,

NinjaTrader 7 and 8.

Introducing the Pi-Osc indicator

by Precision Trading Systems

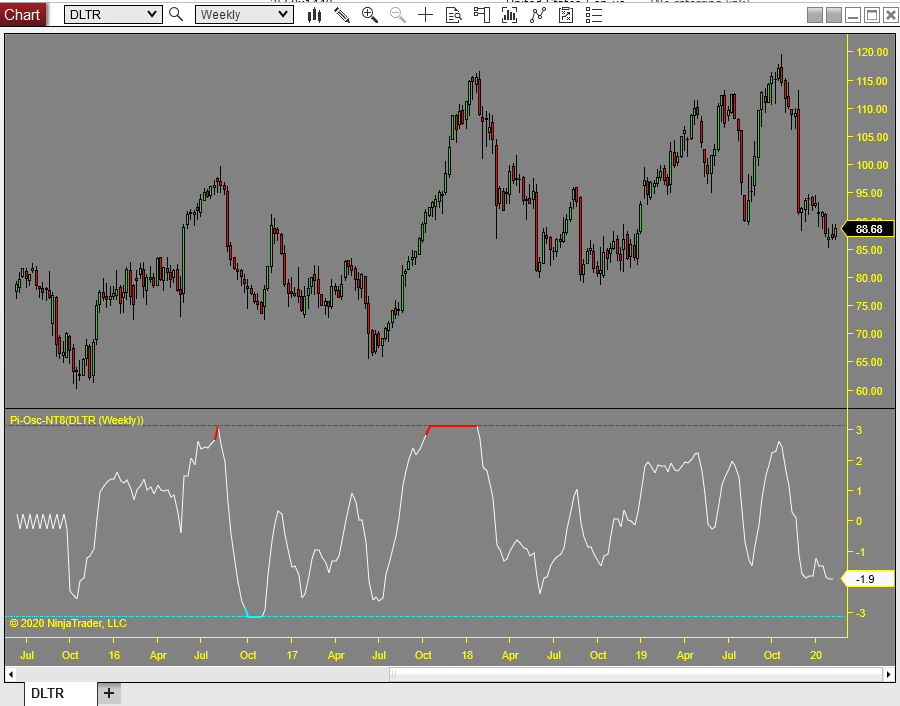

The Precision Index Oscillator show

below on weekly data in the image below. Designed to help you

identify precise tops and bottoms.

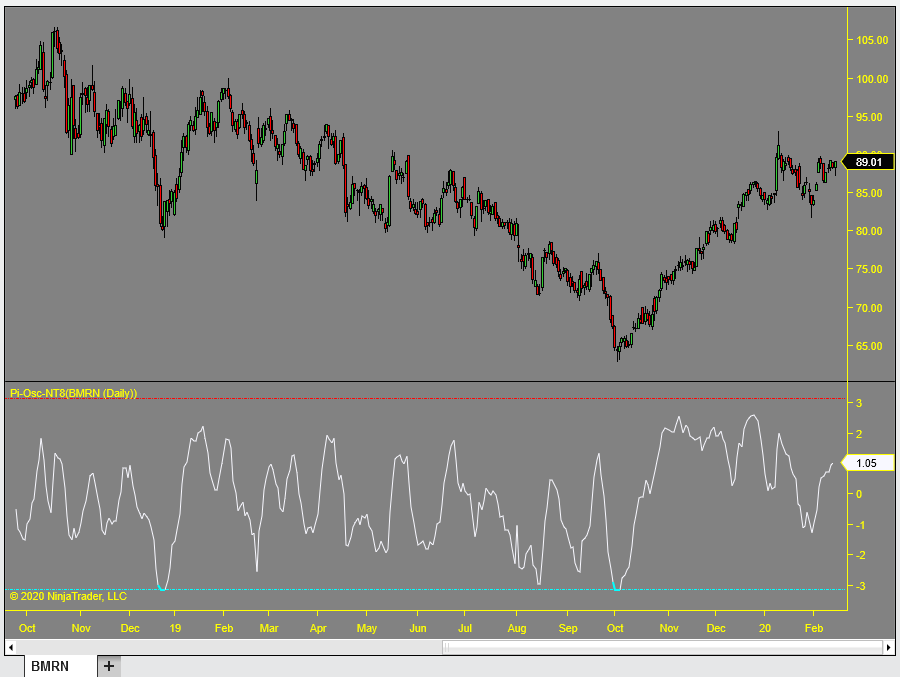

The shot below shows the Pi-Osc

on a daily chart finding two perfect bottoms

The signal to buy is generated by the bounce up from

-3.14

This product is available for several platforms which can be

found in the product guide here

The help and advice of customers is valuable to me. Have a suggestion? Send it in!

The contact page here has my email address and you can search the site

If you

like what you see, feel free to

SIGN UP to be notified of new products - articles - less

than 10 emails a year and zero spam

Precision Trading Systems was founded in 2006

providing high quality indicators and trading systems for a wide range of

markets and levels of experience. Supporting NinjaTrader, Tradestation, MetaTrader, TradingView and

MultiCharts.

About

rr

Admin notes

Page Created June 18th 2023 - New responsive page GA4 added canonical this. 5/5 html baloon

Cookie notice added links dt page