The TVI indicator uses trade volume and price to calculate its values. Gives advance warning of a breakouts.

Is Trade volume index a better indicator than Demand index or Money flow index?

Well the simple truth is that these are not directly comparable. It is like as asking if a squirrel is better than duck, it

would depend on the intended uses of the duck or the squirrel I guess.

Trade Volume Index indicator is a very useful tool to assist your decisions.This Indicator was conceptualised by Steve B Achelis and is in my tool box as its quite a piece of ingenuity.

For smooth and simple definition of volume action this indicator is a real gem for definition

Trade volume index makes its calculation from both volume and price in a combined algorithm which is remarkably

elegant in its design.

Please note that if the security plotted does not have volume data then the result from TVI will be no plot.

If you plot the indicator on the chart and it appears to have massive values, this is normal and is the only thing

about it which makes it a bit tricky to interpret. But it is definately worthy of a review and has proved itself to me

over many years of using it.

How to use Trade Volume index:

Interpretation

From Steve B Achelis, author of

Technical Analysis from A-Z

Trade Volume Index (TVI) show whether

a security is being accumulated (bought) or distributed (sold).

The

TVI is designed to be calculated using intraday tick price data.

The TVI is based on the premise that trades taking place at higher

"asking" prices are buy transactions and trades at the lower "bid" price

prices are sell transactions.

When prices create a flat resistance

level and the TVI is rising, look for a breakout to the upside.

When

prices create a flat support level and the TVI is falling, look for prices

to drop below the support level.

Steve Achelis is one of the most

highly regarded technicians of the last 30 years, I have always admired

his work

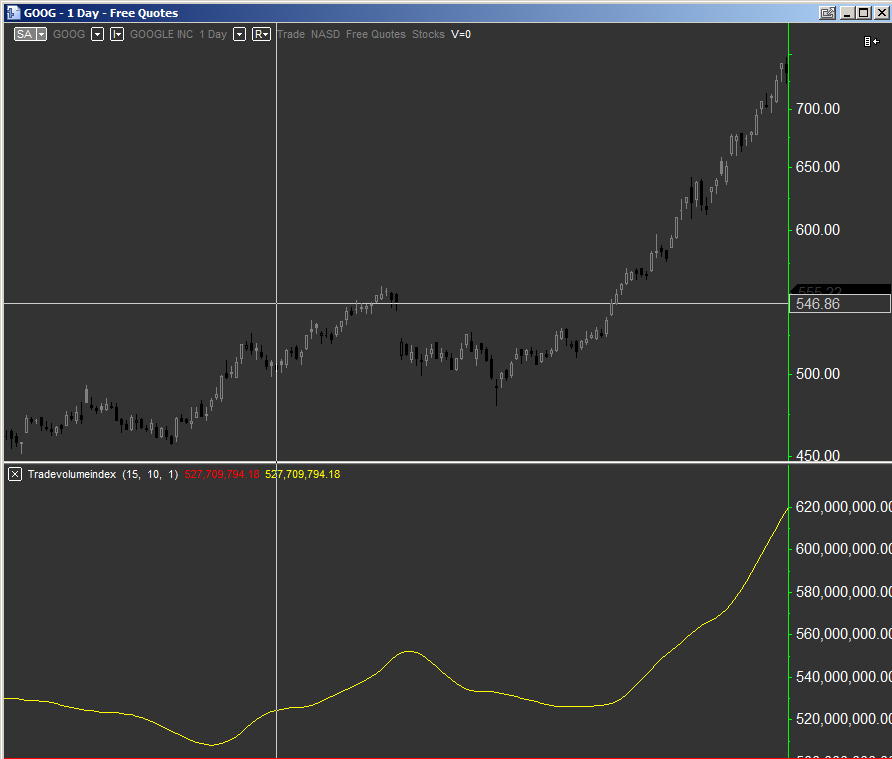

The image below shows length 24 trade volume and smoothing of 29.

The simple method here is using it in a slowed down design, much slower than its originally designed use for tick charts.

Trades are taken when it changes direction, nothing else is used.

Limitations of trade volume index as it was originally intended:

The raw indicator (unsmoothed) in its original form is the best one to use for tick data studies.

However trading on microscopic time frames is not usually optimal as the cost of dealing and the bid ask spread are

acting like high taxation against the small profits encountered in tick based time frames. Particularly in Forex.

Yes it was designed for 1 tick charts, but in those days such technology as TVI was not available to everyone and it

would have been more advantageous to use it then. Futures, securities and Cyrptos such a Etherium, Cardano and

Bitcoin all produce volume action which is compatible to use with TVI.

The current markets are much

more chaotic and random so it is suggested to increase trading time frames

and

indicator sampling length to give trade volume index a fair chance to make a profit.

How to use trade volume index as a cross over trend indicator:

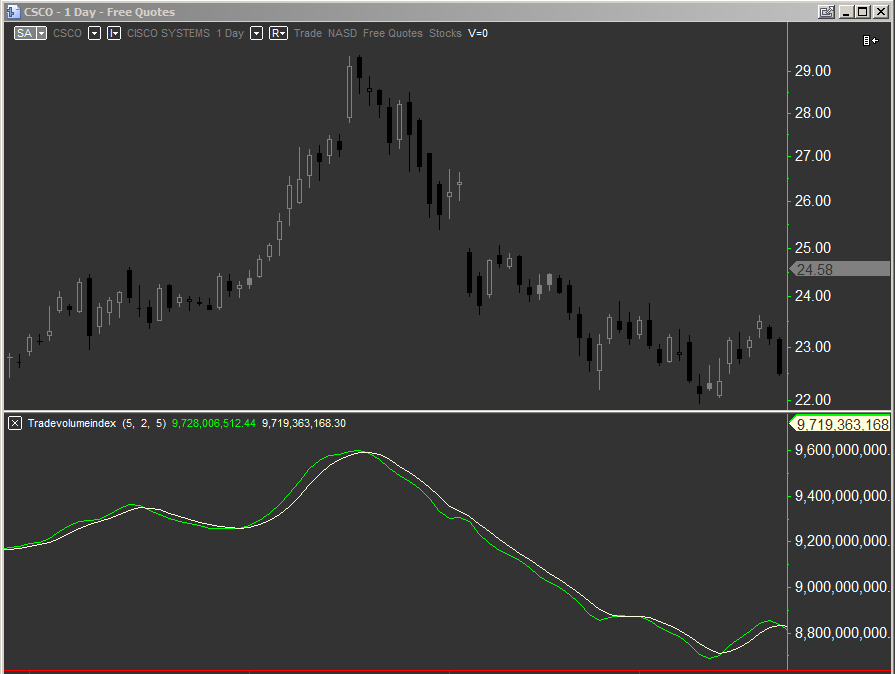

Below is a daily chart of Cisco with TVI length 5 with smoothing 2 and a 5 period moving average plotted in white.

The resulting modification by Precision Trading Systems gives this tool a few more advantagoes uses in addition to

the above we see its

power in trend defination measured when the two plots cross over each other.

Whilst you still have a the indicator plot printing out huge numbers to confuse you, these can be ignored and the

focus can shift to the

changes in direction, this is why it is not a fair deal to compare TVI with demand index or money flow index or insync

etc. They are way too different to be compared in juxtapose as TVI is not your typical type of oscillator.

Trade volume index as long term trend indicator:

As with the shot above TVI below is used in a manner outside of the scope for which its use was intended.

But see for yourself how nicely it adds up all those tick of buying and selling to give us a nice simple output to define trend direction.

The regular type of oscillating volume indicators such as demand index and money flow index are notably excellent for finding divergences

but in the case of Trade volume index, they occur infrequently and can't be given the same kind of judgement or even regard than the two

areformentioned items.

Its not from the same "family" of indicators.

See another great indicator here

called the Qstick

Some other useful volume based indicators:

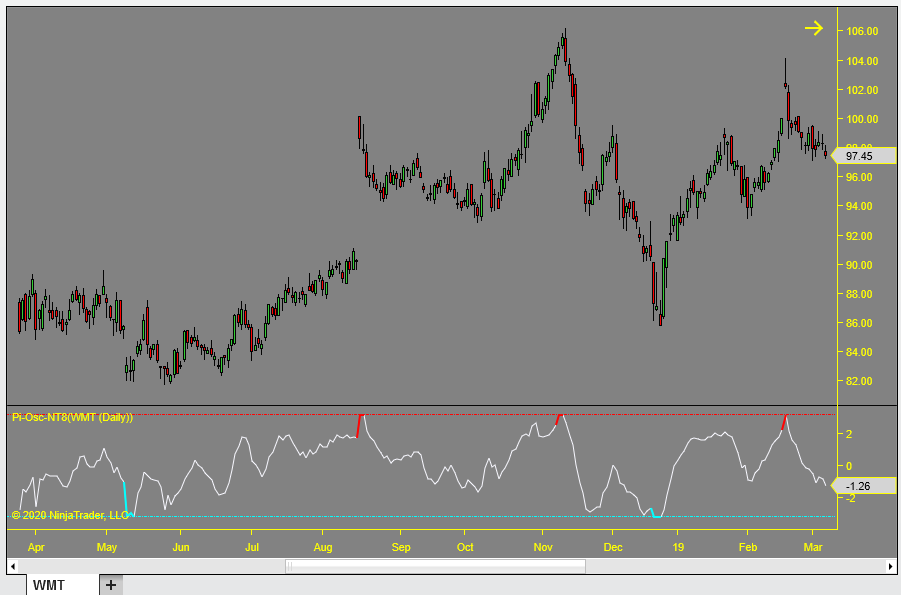

Precision Index Oscillator (Pi-Osc) in the image below uses decay theory and an array of indicators to make a simple

to use tool that anyone can use. Available in four different platforms now and more coming, see product guide.

This generates potential buying and selling opportunities by bouncing away from + or - 3.14 to give simple clarity to the user.

Thanks for viewing this page, I hope it was helpful.

Feel free to SIGN UP to be notified of new products - trading stories - less than 10 emails a year & ZERO SPAM

~ About ~

Precision Trading Systems was founded in 2006 providing high quality indicators and trading systems for a wide range of markets and levels of experience.Supporting NinjaTrader, Tradestation, TradingView, MetaTrader 4 and 5 and MultiCharts.

Admin notes

Page updated - May 16th- p1 GS -7- added GA4 code- canonical this. Some html4 code <font> on tags 1st June 2023 fixed schema - Aug 22nd 2023 fix headers 5-5 bal GS- 6 Sept13 2023 -GS7 reword