Precision Probability Index for MultiCharts comes with two strategies

Please visit the product guide above if you require this

Tradestation product for a different trading platform.

The

contact page here has my email address and you can search the site

If you

like what you see, feel free to

SIGN UP to be notified of new products - articles - less

than 10 emails a year and ZERO spam

Precision Trading Systems was founded in 2006

providing high quality indicators and trading systems for a wide range of

markets and levels of experience. Supporting MultiCharts, Tradestation and

NinjaTrader and soon TradingView.

Page updated July 12th 2023 - New responsive page GA4 added canonical this. 5/5 html baloon

videos added

Precision Probability Index - Computing the precise probability of one price being higher than another any number of bars into the future with 100% mathematical accuracy

This indicator for MultiCharts gives you the trader the exact probability of your trade doing what you want it to do. No more guessing in a fully configurable format

Indroduction and concepts of Precision

Probability Index for MultiCharts

Precision Probability Index herein

referred to as PPI was a very complex programming task for me and I

was well rewarded for the time invested.

Its a unique piece of kit

that is nothing like anything else out there. You can use it

on any time frame in ticks charts, minute charts, hourly, daily and

most exotic bar types.

There are two

strategies included in the package.

1.

The Signal Line strategy

which is shown in the video below.

This is

NOT trading on the probabilities exactly but when the probability

trend changes direction ( which is a unique approach )

2. The Above Below

strategy

which trades on the crossing of zero

using exact mathematical probabilities ( which you can edit

to add a "dead spot" threshold to prevent over trading )

The

PPI line crossing above the signal line generates a long trade

(Buy) the crossing below the signal line generates a short entry OR

a long exit. (You can choose which).

As with all my products performance will improve if you take the

time to search through lots of markets and look for those with

favourable price action. This also applies to timeframes.

The

average trader will plot it on ES SP500 1 minute future chart and

expect to win. Of course the type of person is not going to win in

the long run as winning by definition requires work.

The forums are full of such

persons. They get good followings as they post a lot of content but

as traders, they would rather type unimformed opinions than put in

the work to scan for suitable

markets.

Those who talk do not know - Those who know do not

talk.

People who just rely on other forum users to tell them if a

product is good or not can never understand the recipe for success

is a very simple one....

TRADING TO WIN OVER THE LONG

RUN REQUIRES WORK

Video clip below shows

the Precision Probability Index above and below

strategy for MultiCharts

The zero line in this example is the

trigger that generates buy signals. In this example as it is a

generally trending up market, the signal is set to long only (Which

is often better)

You can of course set it to take short

trades by enabling short selling = true. This signal generates less

trades than the signal line strategy if the same periods are

entered.

This model is acting on pure probabilities and

buying then the odds are > 50% of a move up occuring. Exit long when

< 50% Very simple really.

Special features of Precision Probability Index

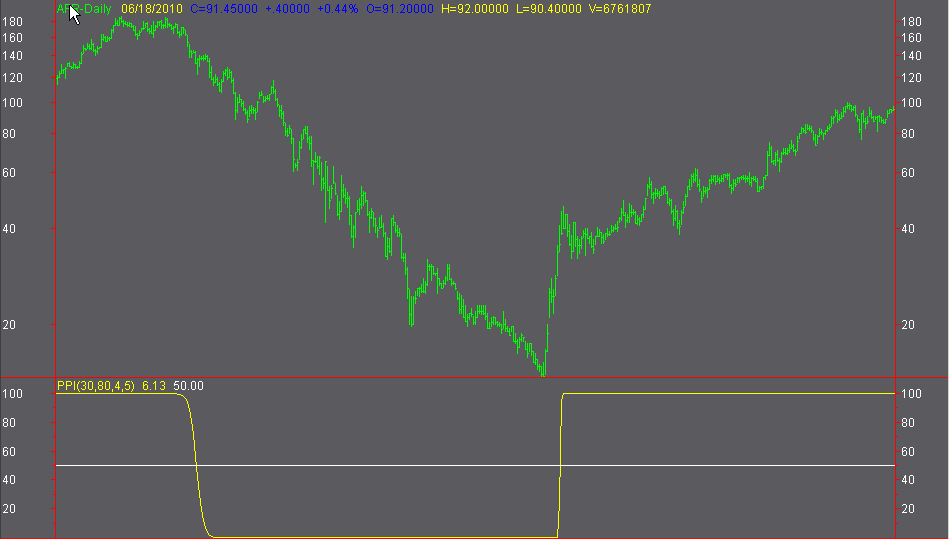

The

exaggeration factor, which as you would expect exaggerates the

truth, telling lies about reality.

You might wonder why one

would want to do this and the best way to explain it is to view the

screenshot below which has turned PPI into a digital signal

processing unit or "DSP"

The plot now only has two places to

visit, 0 and 100. The 0 means sell and the 100 means buy. A simple

way for a beginner to understand how to operate a trend following

system.

You can set the strategy and the indicator to

function in this manner by typing larger and larger values into the

exaggeration factor input, all the way up to 100 or 200 for example.

This product can bend and twist with you to suit whatever

abstruse or bizzare trading style you wish to implement. Yes

really, it is that versatile.

Other "accidental" discoveries of the PPI

indicator

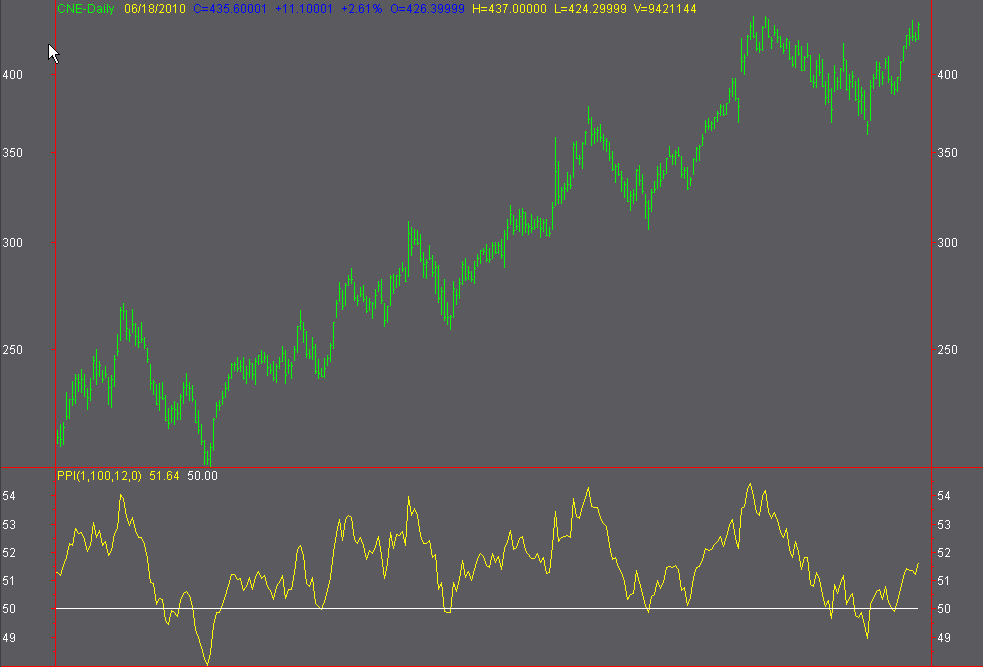

In the example below you can observe ( if you are

observant ) that there is a support level that forms approximately

around the 50 level of equilibrium that leads to the market price

bouncing up away from it each time it gets there.

You can

translate this phenomenon into traders who are accumulating stock

each time it becomes mildly oversold, they want to buy cheap but

they also want to keep the uptrend going up

thus preserving a

bullish sentiment for the market to see.

This price action

is generally caused by long term players in for a few years or if

you see it in intraday futures, you can still call them long term

players in for a few hours!

You wont see this all the time, but you will often

see it in choppy uptrends ( and choppy downtrends acting as

resistance )

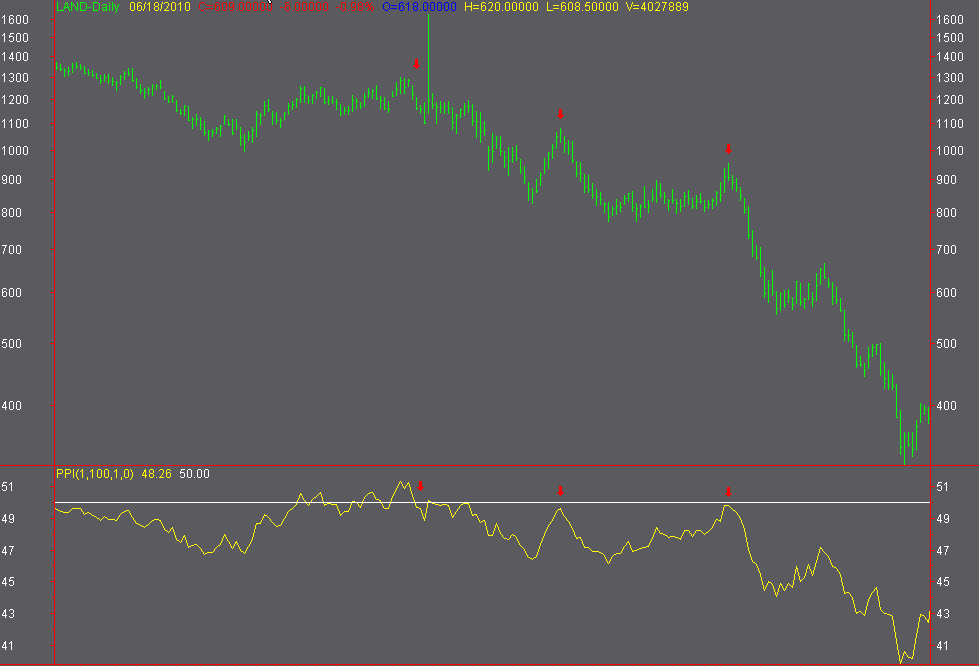

The shot below shows such a choppy down trend with the 50

equilibrium level acting as resistance.

You can sometimes observe

this effect in other indicators such as Demand Index

View license prices for

Precision Probability Index for MultiCharts

So now for the literature about how this gadget works

This product computes the probability of

one moving average being above another in x bars into the future.

The short period average would usually be about 2/3 of the slow

moving average. But please feel free to experiment.

If you

use lengths which are short such as short length 8 and slow length

15 you will see a lot of signals occuring around the 50 level as the

battle between bulls and bears occurs.

In the shot below this

irons out into longer lasting trades when a trend develops.

To reduce the number of tiny wins and tiny losses that occur at 50

fluctuations, I have build in a threshold which you can set to buy >

50.5 or 50.03 etc and sell < 49.8 or 49.99 etc.

This has the

effect of reducing whipsaw trades by delaying the entries slightly.

Shot below shows faster settings 8 and 15

Notice how close the line gets to 50 very

often then scroll down to the next image which uses the

threshold feature...

Please compare these two charts below which use a different threshold

setting.

The threshold iS ZERO in the first one which means it buys > 50

and shorts < 50.

The image under is using a threshold of

3, notice the difference?

Threshold changed below

to allow a "dead spot"

In the shot below as the yellow text

says the thresholds have been reset to buy above 53 and sellshort

below 47.

This reduces whipsaw trades at the expense of some

delay.

The bars future feature.

This is the number of bars into the

future that the plot will

calculate the probability of the short average being above the slow

average.

This is the least important feature for trading results but

is nice to punch in the numbers and know the exact chance of X being

above Y in 20 bars time.

Key points to remember:

Reducing the bars future values will increase the volatility of the

PPI plot

Increasing it will reduce the volatility of the

plot.

The plot will not change "shape" when altering the bars future

value and the crossing of 50 will be the same.

It is

suggested to use a small value between 2 and 5 etc.

A very important points below

If you are setting this up on a short

term time frame such as 1 minute or 20 tick chart the amount of

threshold you type must be MUCH SMALLER.

You will need to

include multiple decimal places such as buy above 50.03 and sell

below 49.95 etc to see the effect. In some cases three decimal

places will be needed.

Typing in large numbers

on short term time frames will result in zero trades occuring as the

mathematical probabilities will shift to a microscopic degree.

Also you need to use smaller threshold values with slower

lengths of PPI averages. In the shot below it is a fast setting of 8

and 15 which is posted on a daily chart with a threshold of 3

points

used.

If this setting was applied to long term PPI averages

like 20 and 28 the thresholds would need to be reduced to 1 or 2 or

thereabouts.

Using the readings

for a trade evaluation

In

the image below you can see the exact probabilities based on the

white moving average line (3 period) being above the yellow moving

average line (50 period) in 4 bars time.

From left to right

1st =

47.2%

2nd = 73.3%

3rd = 81.5%

For intra day use in day trading on minute and tick charts

Precision Probability Index uses

volatility to assist in measuring the true percentage probability of

a fast moving average being above a slower moving average.

When plotted on a short term intra day chart such as 20 ticks or 30

seconds or 5 minutes, there is naturally smaller volatility values

being passed to the algorithm.

TThe resulting output of the PPI indicator will be much

smaller in terms of the probability score. You will see numbers like

50.004 and 49.992 for example.

This will require you to

input smaller values into the above below strategy to see trades.

Some symbols have such low volatility that the indicator

will be unable to detect it and cannot produce a workable reading.

For the signal line strategy this is less important, but

with the above below strategy it is best to use longer timeframes >

5-10 minutes unless they are volatile.

This would apply to

tiny time frames on low volatility instruments.

Any questions

just ask.

On setting up

Start off with the indicator

exageration factor set to 0, the indicator short "smooth" set to 0 (

this is essential to get it to line up with the strategy )

and start off with a daily chart.

Gradually reduce time

frame and adjust settings so you can familiarize yourself with the

controls.

Remember that the lower the time

frame the lower the volatility and the lower the probability of

anything real happening.

This product is

also available as a combo trading system.

Check out the combo page here

View

license prices for Precision Probability Index for MultiCharts/a>

The help and advice of customers is valuable to me. Have a suggestion? Send it in!

About