Micro-futures v

regular futures, what you need to know - Micro Futures Available

via NinjaTrader Brokerage

NOTE .....If actively long in

one index contract then cannot enter long on another index

future, only short thus keeping market neutral AND not adding to

market risk

|

Dax 40 on Eurex exchange in Frankfurt

fully electronic

FDAX

Standard Dax futures = 25 Euros a point (tick size = 0.5)

FDXM Mini Dax futures = 5 Euros a point (tick size = 1 point)

FDXS Micro Dax futures = 1 Euro a point (tick size = 1 point)

Opening 00.10 GMT

Closing 21.00 GMT

Trading begins after a pre-trading period (typically starting at

00:00 GMT) and includes a brief closing auction at 21:00 GMT.

These hours apply Monday through Friday, with closures on

major German holidays (e.g., Christmas, New Year’s Day).

|

Micro E-mini S&P 500 Futures

(MES)

Underlying Index: S&P 500

Contract

Size: 1/10th of the E-mini S&P 500 ($5 per point)

Tick

Size: 0.25 index points

Tick Value: $1.25

Purpose: Access to the broad U.S. stock market at a reduced cost

|

Micro E-mini Nasdaq-100 Futures

(MNQ)

Underlying Index: Nasdaq-100

Contract Size: 1/10th of the E-mini Nasdaq-100 ($2 per point)

Tick Size: 0.25 index points

Tick Value: $0.50

Purpose: Exposure to tech-heavy U.S. stocks with high

volatility.

|

Micro E-mini Dow Futures (MYM)

Underlying Index: Dow Jones Industrial Average

Contract Size: 1/10th of the E-mini Dow ($0.50 per

point)

Tick Size: 1 index point

Tick Value:

$0.50

Purpose: Trading the 30 major U.S. industrial

companies.

|

Micro E-mini Russell 2000 Futures

(M2K)

Underlying Index: Russell 2000

Contract Size: 1/10th of the E-mini Russell 2000 ($5 per point)

Tick Size: 0.10 index points

Tick Value: $0.50

Purpose: Access to small-cap U.S. stocks.

|

Micro Crude Oil Futures (MCL)

Underlying Asset: WTI Crude Oil

Contract

Size: 100 barrels (1/10th of standard Crude Oil futures)

Tick Size: 0.01 per barrel

Tick Value: $1.00

Purpose: Trading the energy market with lower capital

requirements.

|

Micro Gold Futures (MGC)

Underlying Asset: Gold

Contract Size: 10 troy ounces

(1/10th of standard Gold futures)

Tick Size: 0.10 per

troy ounce

Tick Value: $1.00

Purpose: Hedging or

speculating on gold prices.

|

Micro Silver Futures (SIL)

Underlying Asset: Silver

Contract Size: 1,000

troy ounces (1/5th of standard Silver futures)

Tick

Size: 0.005 per troy ounce

Tick Value: $5.00

Purpose: Exposure to silver price movements.

|

Micro Bitcoin Futures (MBT)

Underlying Asset: Bitcoin

Contract Size:

0.10 Bitcoin (1/10th of standard Bitcoin futures)

Tick

Size: 5 index points

Tick Value: $0.50

Purpose:

Trading cryptocurrency volatility in a regulated market.

|

Micro Ether Futures (MET)

Underlying Asset: Ethereum

Contract Size: 0.10

Ether (1/10th of standard Ether futures)

Tick Size: 0.50

index points

Tick Value: $0.05

Purpose:

Speculating on Ethereum price changes.

|

Micro 10-Year U.S. Treasury Note

Futures (M10Y)

Underlying Asset: 10-Year U.S.

Treasury Note

Contract Size: $10 per point (1/10th of

standard 10-Year Note futures)

Tick Size: 1/64th of a

point

Tick Value: $1.5625

Purpose: Trading

interest rate movements with lower exposure.

|

Micro SMI Futures (FSMI Micro)

FSMS

Underlying Index: SMI (Swiss Market Index, 20

major Swiss companies)

Contract Size: 1 CHF per index

point

Tick Size: 1 point

Tick Value: 1 CHF

Launch Date: April 19, 2021

Availability on

NinjaTrader: Yes

Notes: Tracks Swiss blue-chip firms

(e.g., Nestlé, Roche). Less traded than FDXS or FESX, making it

somewhat "rarer" in terms of retail focus.

|

Micro EURO STOXX 50 Futures (FESX

Micro) FSXE

Underlying Index: EURO STOXX 50 (50

major Eurozone companies)

Contract Size: €1 per index

point

Tick Size: 1 point

Tick Value: €1

Launch Date: April 19, 2021

Availability on NinjaTrader:

Yes

Notes: Covers major Eurozone stocks (e.g., LVMH,

SAP). Popular and liquid, not rare.

|

Micro STOXX Europe 600 Futures (F600

Micro)

Underlying Index: STOXX Europe 600 (600

companies across 17 European countries)

Contract Size:

€1 per index point

Tick Size: 0.5 points

Tick

Value: €0.50

Launch Date: October 18, 2021

Availability on NinjaTrader: Yes (though less prominently

featured)

Notes: Broader European exposure than EURO

STOXX 50. Lower liquidity and awareness make it a "rare" micro

contract relative to FDXS or FESX.

|

Micro MSCI Europe Index Futures

Underlying Index: MSCI Europe (large- and mid-cap

stocks across 15 European countries)

Contract Size: €1

per index point

Tick Size: 0.05 points

Tick

Value: €0.05

Launch Date: Part of Eurex’s MSCI micro

suite expansion (circa 2021-2022)

Availability on

NinjaTrader: Likely yes (Eurex MSCI futures are supported,

though not heavily advertised)

Notes: Niche due to its

focus on a specific MSCI benchmark. Low retail volume qualifies

it as "rare."

|

Micro MSCI World Index Futures

Underlying Index: MSCI World (large- and mid-cap

stocks across 23 developed markets globally)

Contract

Size: $1 per index point

Tick Size: 0.05 points

Tick Value: $0.05

Launch Date: Part of Eurex’s MSCI

micro suite

Availability on NinjaTrader: Likely yes

(similar to MSCI Europe)

Notes: Unique for its global

scope (including U.S., Japan, etc.). Very low visibility among

retail traders, making it "rare."

|

Micro MSCI USA Index Futures

Underlying Index: MSCI USA (U.S. large- and mid-cap

stocks)

Contract Size: $1 per index point

Tick

Size: 0.05 points

Tick Value: $0.05

Launch Date:

Part of Eurex’s MSCI micro suite

Availability on

NinjaTrader: Likely yes

Notes: Competes with CME’s MES

but offers a different index flavor. Rarely traded by retail,

thus "rare."

|

Micro MSCI Emerging Markets Index

Futures

Underlying Index: MSCI Emerging

Markets (stocks from 24 emerging economies)

Contract

Size: $1 per index point

Tick Size: 0.05 points

Tick Value: $0.05

Launch Date: Part of Eurex’s MSCI

micro suite

Availability on NinjaTrader: Likely yes

Notes: Exposure to markets like China, India, Brazil.

Extremely niche and low-volume, a "rare" gem.

|

Micro AUD/USD Futures (M6A)

Underlying: Australian Dollar vs. U.S. Dollar

Contract Size: 10,000 AUD (1/10th of standard AUD/USD

futures at 100,000 AUD)

Tick Size: 0.0001 USD per AUD

Tick Value: $1.00 |

Micro EUR/USD Futures (M6E)

Underlying: Euro vs. U.S. Dollar

Contract

Size: 12,500 EUR (1/10th of standard EUR/USD futures at 125,000

EUR)

Tick Size: 0.0001 USD per EUR

Tick Value:

$1.25

|

Micro GBP/USD Futures (M6B)

Underlying: British Pound vs. U.S. Dollar

Contract Size: 6,250 GBP (1/10th of standard GBP/USD futures at

62,500 GBP)

Tick Size: 0.0001 USD per GBP

Tick

Value: $0.625

Key Points:

Launch Date: These micro

forex futures (M6A, M6E, M6B) were launched by the CME on May 3,

2021, to target retail traders seeking lower-cost forex

exposure.

|

Micro Palladium Futures (MPA)

Ticker: MPA

Underlying: Palladium

Contract Size: 10 troy ounces (1/10th of standard PA futures

at 100 oz).

Tick Size: 0.50 USD per troy ounce.

Tick Value: $5.00.

Launch Date: June 27, 2022.

Availability on NT: Yes, though less liquid than gold or silver,

it’s supported.

|

Micro Platinum Futures (MPL)

Ticker: MPL

Underlying: Platinum

Contract Size: 10 troy ounces (1/5th of standard PL futures at

50 oz).

Tick Size: 0.10 USD per troy ounce.

Tick

Value: $1.00.

Launch Date: June 27, 2022.

Availability on NT: Yes, another niche but tradable option.

|

Micro Corn Futures (YC)

Ticker: YC

Underlying: Corn

Contract

Size: 100 bushels (1/10th of standard ZC at 5,000 bushels).

Tick Size: 0.125 cents per bushel.

Tick Value:

$0.125.

Availability on NT: Yes, seen in active

positions on X posts. |

Micro Soybean Futures (YK)

Ticker: YK

Underlying: Soybeans

Contract Size: 100 bushels (1/10th of standard ZS at 5,000

bushels).

Tick Size: 0.125 cents per bushel.

Tick Value: $0.125.

Availability on NT: Yes.

|

Micro Wheat Futures (YW)

Ticker: YW

Underlying: Wheat

Contract Size:

100 bushels (1/10th of standard ZW at 5,000 bushels).

Tick Size: 0.125 cents per bushel.

Tick Value: $0.125.

Availability on NT: Yes

|

Micro Copper Futures (MHG)

Ticker: MHG

Point

Sizes (Tick Sizes)

Tick Size: 0.0005 USD per pound

Underlying: High Grade Copper (COMEX HG futures benchmark).

Contract Size: 2,500 pounds (1/10th of the standard HG

futures at 25,000 pounds).

Example: At $4.00 per pound, notional value = 2,500

× $4.00 = $10,000 USD.

Settlement: Financially settled

(cash-settled based on the HG futures price at expiration, no

physical delivery).

Expiration: Monthly contracts,

typically expiring on the third-to-last business day of the

contract month (e.g., March 27, 2025, for “H” contract).

Exchange Notes

Exchange: CME Group (COMEX division).

Purpose: Offers retail traders and smaller investors exposure to

copper prices (an industrial metal tied to construction,

electronics, and global growth) with lower capital requirements

than standard HG futures.

Launch Date: May 2, 2022.

Liquidity: Growing, with over 12,000 contracts traded daily

by April 2024 (per Reuters), though less liquid than micro gold

(MGC) or crude oil (MCL).

Trading Platform: Accessible

via NinjaTrader Brokerage with a CME futures account and

real-time COMEX data subscription (e.g., through Kinetick or

CME’s data feed).

Opening and Closing Times (GMT)

Trading Hours: Nearly 24 hours a day, 5 days a week:

Opening

Time: Sunday 23:00 GMT (6:00 PM EST).

Closing Time:

Friday 22:00 GMT (5:00 PM EST).

Daily Break: 22:00 GMT

to 23:00 GMT (5:00 PM EST to 6:00 PM EST), a 1-hour halt each

trading day.

Notes on Times:

These hours align with

CME’s Globex electronic trading schedule for metals futures.

As of March 1, 2025, GMT is in use (not BST or daylight

saving adjustments yet—those typically start late March). EST

(Eastern Standard Time, UTC-5) is the CME’s base timezone, so

GMT (UTC+0) reflects a 5-hour offset.

Trading is

continuous except for the daily break and major U.S. holidays

(e.g., Thanksgiving, Christmas).

Additional Details

Contract Months: Available for all 12 months (January to

December), with symbols like MHGH5 (March 2025), MHGJ5 (April

2025), etc., following CME’s month codes (F, G, H, J, K, M, N,

Q, U, V, X, Z).

Margins on NinjaTrader:

Intraday: As

low as $50-$100 (varies by volatility and NinjaTrader’s clearing

firm).

Initial (overnight): Around $500-$1,000, per CME

requirements (exact figures depend on current market

conditions).

Purpose: Ideal for hedging or speculating on

copper prices with a smaller notional value than the standard HG

contract ($100,000+ at $4.00/pound).

|

|

exposure

|

|

exposure |

|

exposure |

|

exposure |

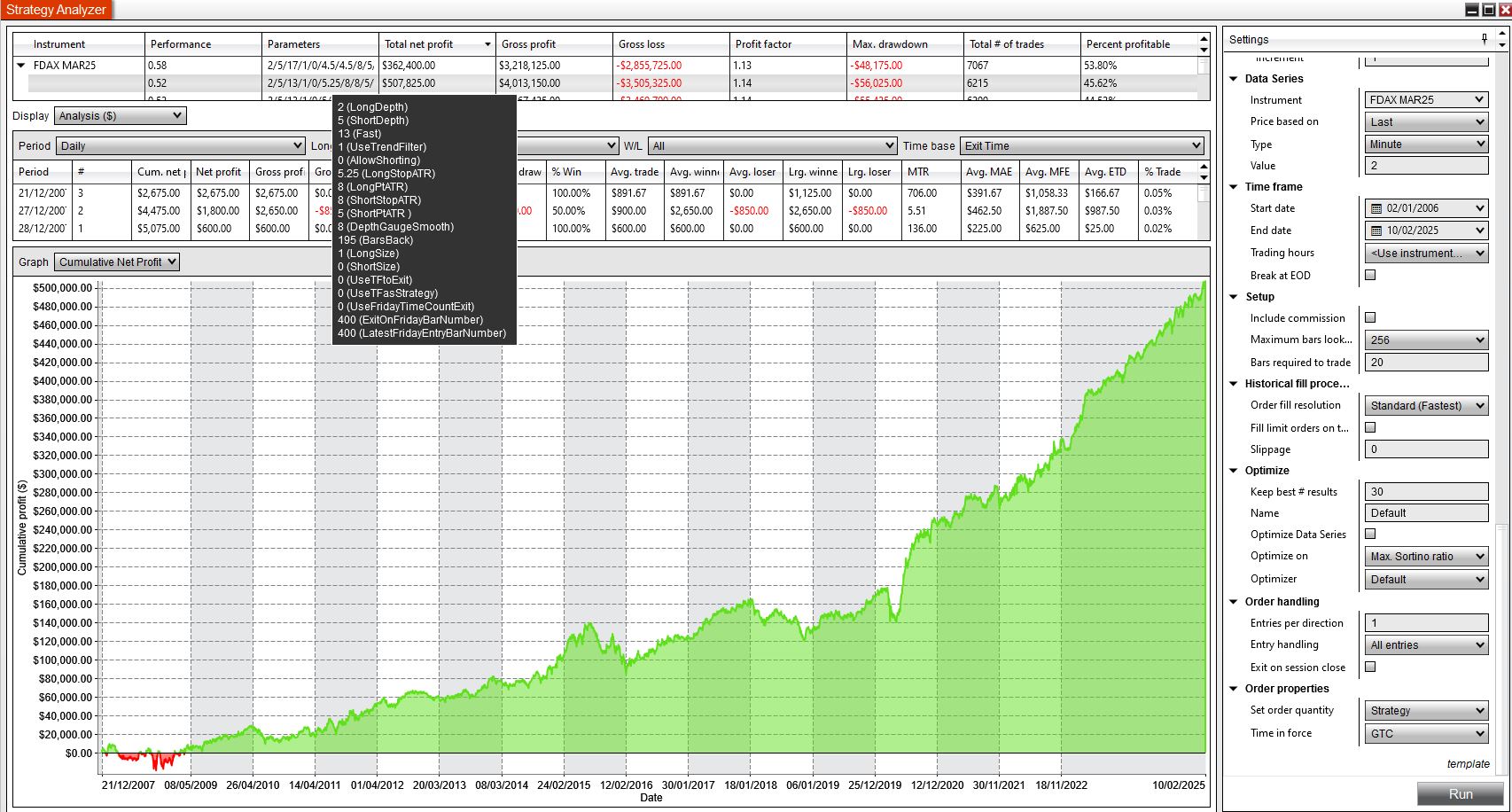

This did well in

the last few years but a bit bumpy in previous years

|

|

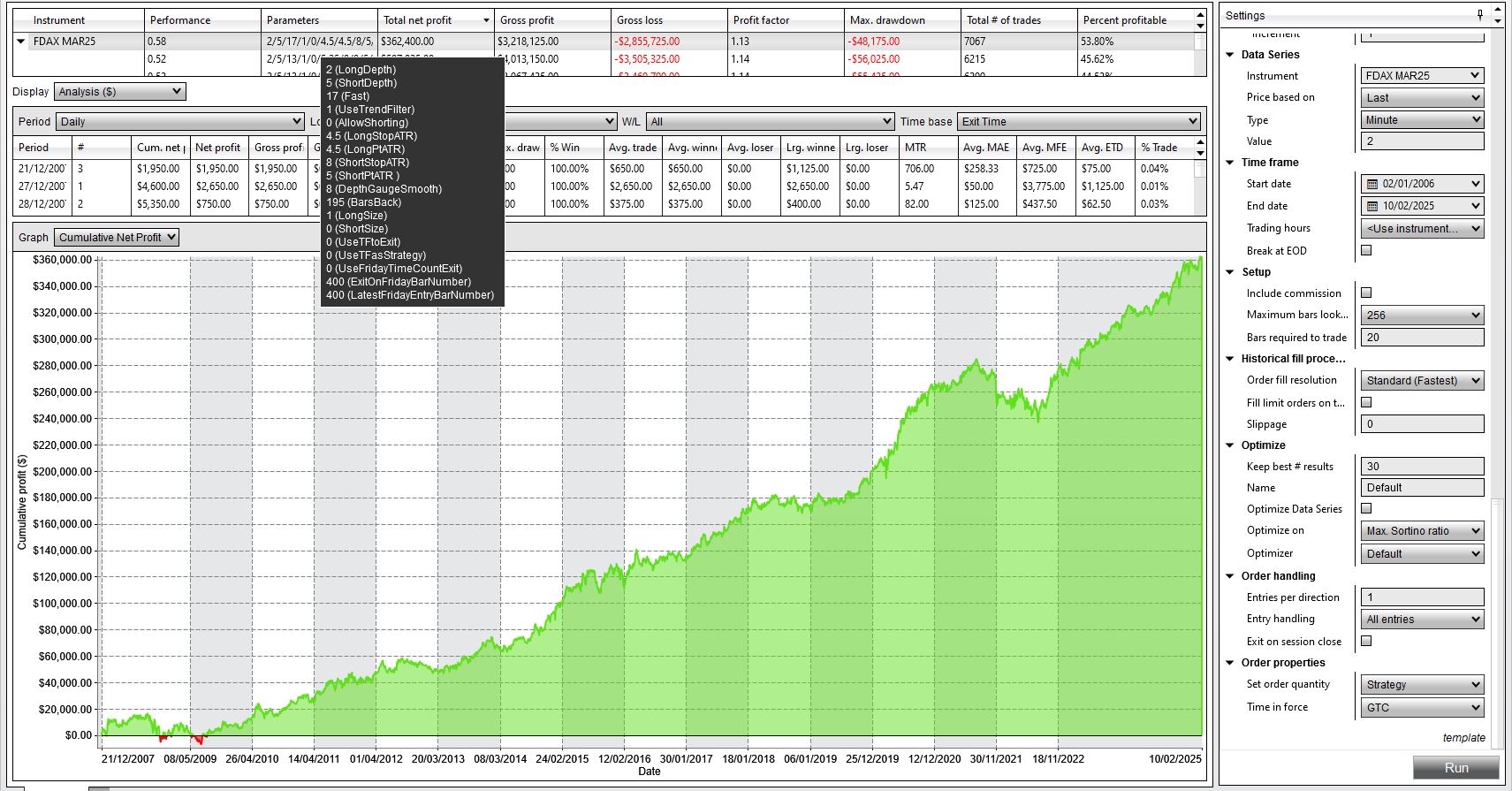

I Like the

shape of this best and

it is still long only...

|

|

Follow the

Rare-Golem-H strategy...........

With long and short

fixed the long variables and fast to 18.

Got 0.59 sortino

with these and $444,000 on 1 contract long and short 60k short

profit

Long depth 2

Short depth 11 or 7

Fast fixed

at 18

Long stop fixed at 5.25

Long targ fixed at 4.2

Short stop 7 or 6

Short targ 3

use TF fixed at 1

DG

Smooth fixed at 8

all overnight filters OFF ( friday exit

cost lots of profit )

444k in one, and 482k in other.

|

|

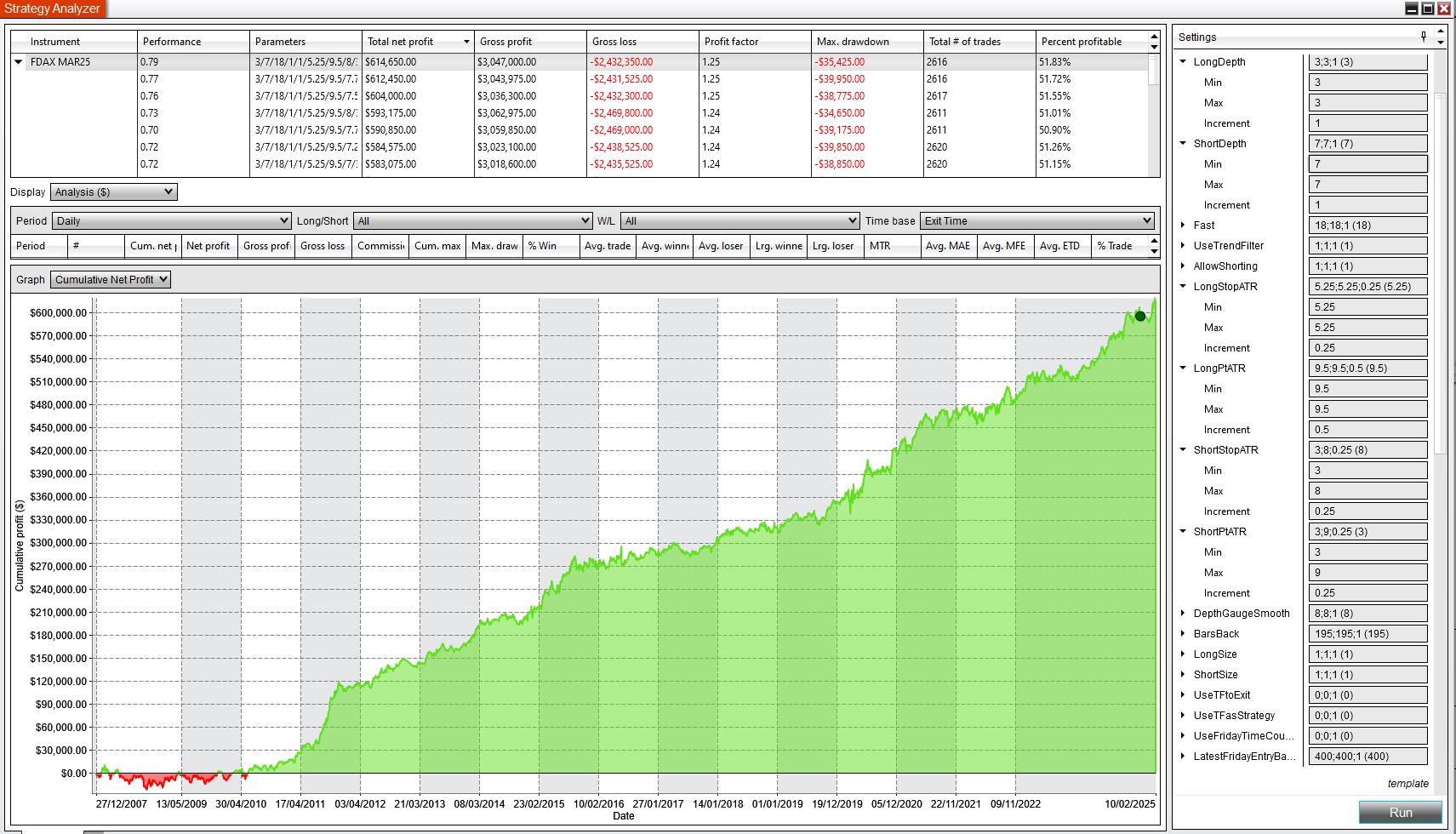

I would be

happy to run this one, Dax M6 report below with 0.79 Sortino....

Subscribe to PTS

YouTube

channel, then email me and I will tell you.

|

|

|

|

|

|

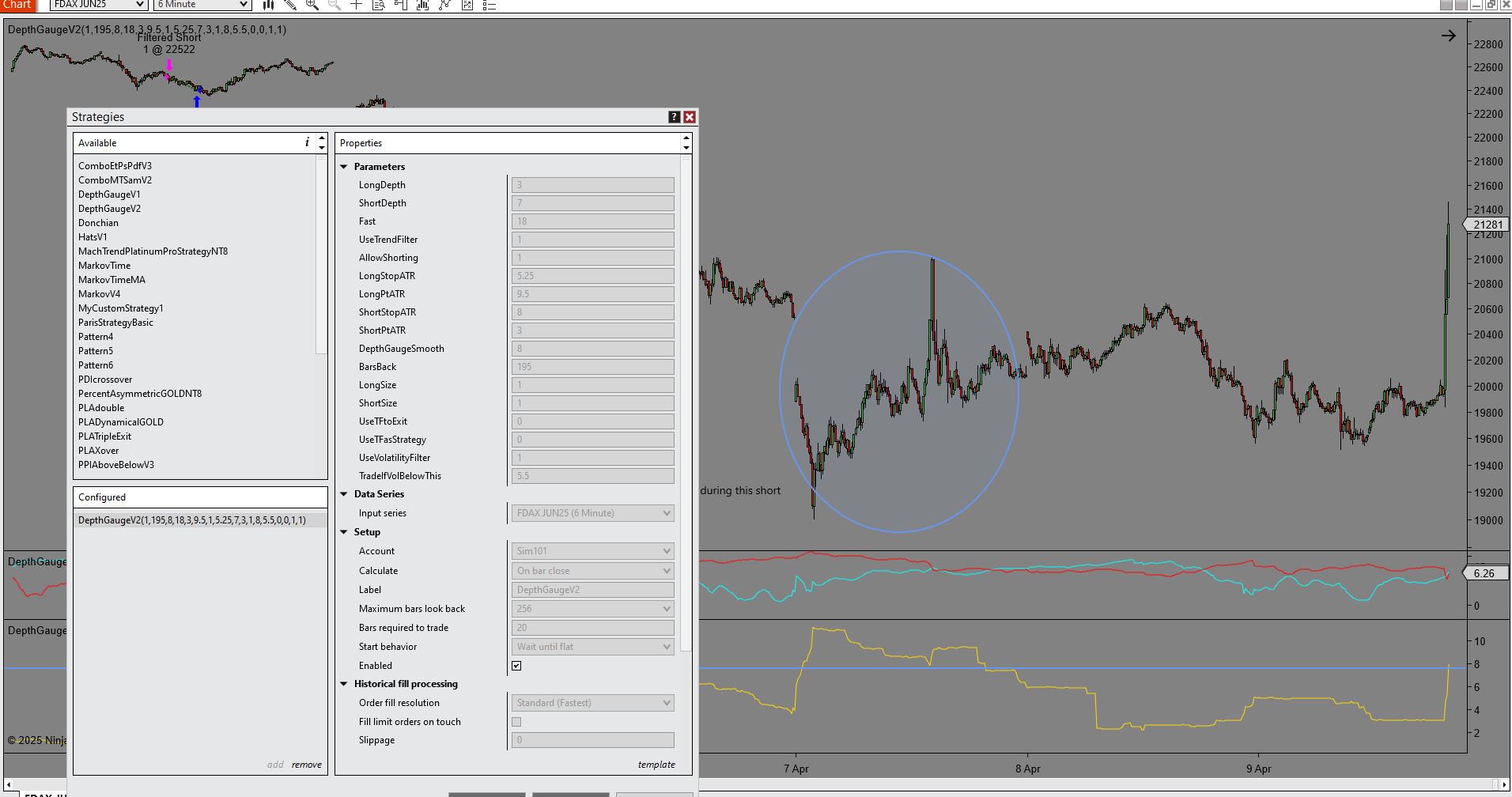

The above Depth Gauge strategy while

impressive led to a large losing short trade shown in image

below, April 7th 2025.

A solution was found in the addition of a

volatility filter to prevent any trades occuring when volatility

was too high as it was during the tarriff arguements.

Unfiltered results (vf set to trade if less than 20%, meaning it

wont stop any trades

Long Profit $456,125 Short Profit

$18,3525 over 2818 trades...

NEXT Depth Gauge VOLATILITY

FILTER USED in a coarse test from 1% to 12% noting a new weapon

could be found as low volatility would mean smaller losses (and

winners)

12% setting knocked out one trade ( the very

same one shown below)

11% down to 4% knocked out more

trades and seemed to smooth EC a bit.

VERDICT. Test the

variants of percentage vf from 3% to 13% until a comfortable

setting is found. (Suggest 5-8% is good)

It is not a bad thing the shut down

during high volatiliy and it does not actually shut down, merely

waits until threshold on the indicator is less than x ...have a

play with it.

|

|

With filter VF set to 5.5% it removed the

Trump tarriff trade and that alone...clever eh

|

|

|