How to compute optimal risk with calculator and examples

When the statistics are known to be consistent a formula for the optimal stake is easy to calculate

Pro traders know the importance of treating all trades with equal risk

percentages and not getting overly attached to their positions.

The amatuer may risk a bit more, such as the Russian roulette style of

risking 100% on a trade.

Over a longer time horizon the survival rate drops to zero. Just because

De Niro survived it doesn't mean everyone will. It would have been a dull

film if he died.

In the grand scheme of things the Pro trader knows his optimal risk

percentage and will divide it up so the sum of each trade never exceeds

it

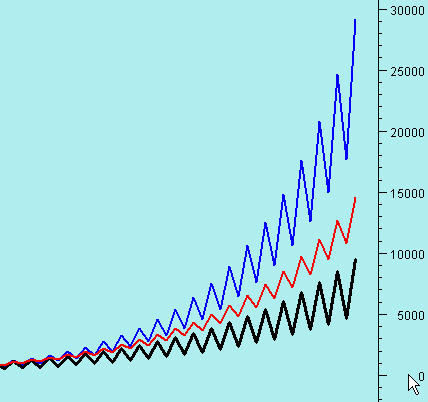

Image below shows the gains generated by three traders who did the same

identical trades at the same identical time:

Why are the outcomes so very different? The blue line is triple

the value of the black line?

The difference is caused only by one factor - Optimized trade sizing -

Take a long look

at the graph below

In

the table below you can find your optimal risk.

This is based on the statistics you

enter staying constant in the future.

Please be aware that figures derived from just a few trades will give you a

spurious output.

Better is to have hundreds of trades to generate the statistics you use.

Instructions: Type your

risk / reward ratio in the top box Type your

win percent into the second box ( using 0.48 for 48% ) Type the

number of open trades you run at once in the third box Press

Compute If you get a

red number you need to improve your statistics somewhat.

If you get a green number you can bring in the

green

If you have started to read this page then you already have

an edge. Risk / Reward ratio This is the size of your average winning

trade / the size of your average losing trade. A good trader would perhaps

have a risk reward ratio of between 1.8 to 2.5 times average losing trades. If

you have an average winning trade of = 2000 and an average losing trade of

800 then you can calculate 2000 / 800 = 2.5 You can use money values OR percent values

just as long as you don't mix them up. Thus if your average winning trade is

2.5% of your equity and your average losing trade is 1.2% of your equity you

can compute 2.5 / 1.2 = 2.08 Winning percent ratio This is simply the percentage of trades that

are winning. If you do 100 trades and 40 of them are winners that is 40% so type in 0.40

in the box What if the output number is negative? This is the scenario when your statistics

show a non profitable losing strategy. The optimal risk amount would be zero

as the pay-off rate is negative. If you have achieved a zero payoff then you

need to improve your system or trading style until you can get positive

reading from the formula. Consider a roulette wheel which has

ALWAYS got a negative payoff, which

means that the optimal bet is zero.

(Do not bet)

You can buy this formula together with details how to use it here .

This page is a very basic introduction to position sizing and optimal risk

If you want more advanced information there are two authors who are very

experienced in this area.

Mr Ed Thorp. He wrote a very detailed paper on this subject. A maths genius

with a crazy sense of humour and clarity of writing which is hard to beat.

From memory this book - article - pdf was called "The mathmatics of

gambling" and you can do well to study it carefully as it is superb.

Dr Van Tharp. (deceased) His book "SuperTrader" contains several methods of position

sizing and computing optimal risk.

Other methods described take into account the maximum drawdown

factors.

The amateur versus the Pro trader and how they differ

The

Pro will typically risk around 0.25% to 1.5% of the account balance on a

trade from entry price to stop.

Image from "The deer hunter"

Beginners also often neglect to use stop losses as they have no

expectation of their plan failing, often with catastrophic results

A

Pro trader might have an optimal risk percent of 32% and can have

thirty two trades running with 1% risk in each.

Introduction on how to calculate this essential formula and the statistics needed to compute it

Computing optimal trade risk is an essential formula

The statistics you need before doing the calculation.

What you need to compute optimal risk are the following statistics.

Calculate your optimal risk percent here

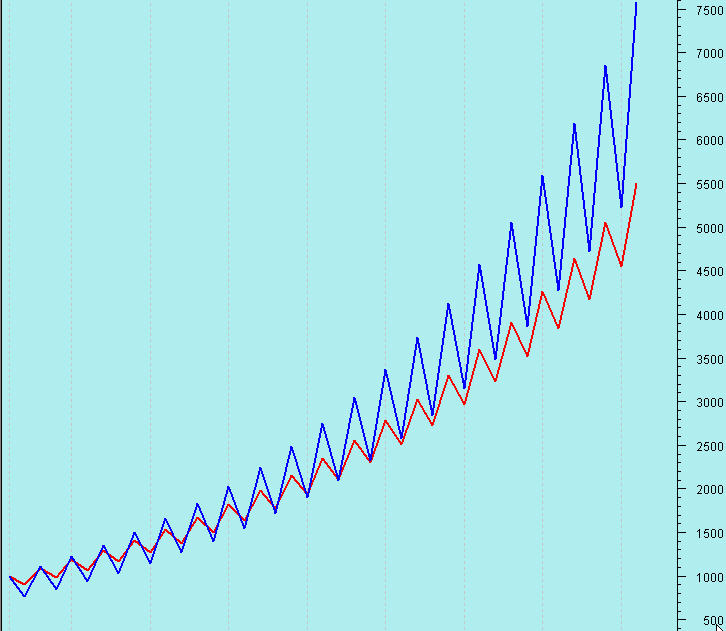

The chart below shows another

example of two traders and paradoxically the red line graph trader

had better statistics.

The blue line trader used optimal risk

to figure out the best trade size.

Trader blue = 50% win rate - 1.9 :1 risk reward ratio risked 23.3%

per trade

Trader red = 50% win rate - 2 :1 risk reward ratio risked 10% per

trade

and here is the point

If the red (better) trader

used position sizing he would have got 14,752 in equity which is

almost double of the blue trader and almost triple of his results.

It is simple to

replicate this experiement in an Excel sheet to prove it if you want

to reach a higher pinnacle of success.

Purchase an Excel sheet with the formula and a Word doc explaining how to use

After purchase the files will be sent

back to your PayPal email address

within 24 hours

$29.00

Other important points to note.

Depending on

trading styles and indeed trading system styles the risk reward

ratios and win percent ratios will differ wildly.

A trend

following system will usually have a lower winning trade percentage

compared to a rapid exit scalping strategy which might exit when an

"overbought" situation arises.

Typically a good trend

following strategy may have R-R of between 1.7:1 all the way up to

3.3:1 ( which is expectional ) and a win percent of 25-60%

In

comparison the scalping in and out system would have a much lower

risk reward ratio of about 1.4:1 and a win percent of 75% as the

scalping trader takes profits quickly.

Each system is

"correct" providing it is profitable AND suits the personality of

the person using it.

Relating to these pages you can practice

optimal risk use is the Trading IQ Game which generates a detailed report

showing your stats as above

Sign up and then log in to take full advantage of its features

then you can truly see how much difference it makes. Real market

data moving very fast!

Trading IQ Game

Or if you prefer to keep reading more

educational content the pages below are for you

You might also enjoy this crash calculator modelled

on 1987

And the AMAZING Future price

maximum and minimum price target

computer

Trading

Lessons in several parts for newbies and improvers

The lowest traffic page on my site is the page called "Correct answer"

so hopefully you can find it instead of the popular and often

visited page "Incorrect answer".

Solve this

chess puzzle if you are clever.

White to play mate in two

moves

Find the solution on

this page

Make good use of what

you learned so that my work is worthwhile.

The help and advice of customers is valuable to me. Have a suggestion? Send it in!

The contact page here has my email address and you can search the site

Return to the top of page (Keep

within the legal speed limit)

If you

like what you see, feel free to

SIGN UP to be notified of new products - articles - less

than 16 emails a year and zero spam

Precision Trading Systems was founded in 2006

providing high quality indicators and trading systems for a wide range of

markets and levels of experience. Supporting NinjaTrader, Tradestation and

MultiCharts, coming soon are TradingView and possibly MetaTrader

resumption.

Page revamped on August 2nd

2023 - New responsive page GA4 added canonical this. 5/5 html

baloon alighnment fixed and responsive

About