Pi-Osc was conceptualized by Precision Trading Systems to provide trade timing signals.

Precision Index Oscillator is a consensus type indicator which calls from a multitude of indicators

This indicator which has some powerful improvements and differences to industry standard oscillators.

At first glance to the untrained eye it would appear like another other oscillator, but when viewing it in juxtaposition

with other oscillators the true power of this excellent indicator begin to emerge.

Get a trial month Precision Index Oscillator "Pi-Osc" indicator for NinjaTrader 7 & 8 .....$75

The cost of the one month license is the same as it was in 2012- Longer license prices will have to increase soon.

Pi-Osc is a highly sophisticated concensus type indicator comprising of many different component signals.

A technical traders tool that measures everything from divergences to probabilites all blended into one simple to use product.

The buy and selling opportunities are highlighted by the moves away from + or - 3.14.

Simple to use for all levels of experience from beginner to expert and offers a unique edge in terms of precision.

Image below is Precision Index Oscillator on SP500 Futures 300 minute chart

How does the Precision Index Oscillator work?

The Pi-Osc indicator uses some very ingenious and logical factors in its calculations, some of these factors are found

within conventional oscillators and some are not.

The components

that go into computations are identified below.

Money

flow index provides a simple snapshot of how sold out or pumped up a stock or future

really is and when measured in three different time

frames gives a

slick consensus view of money flow.

Relative strength index (RSI)

still the No1 most popular indicator in use today as its power to identify

overbought

and oversold qualities in sideways markets is exceptional.

Its

poor performance in trends is greatly reduced when seamlessly integrated

with the PI-Osc algorithm.

Demand index, being one of the designers favourite indicators for

measuring the future direction caused by a large volume trade is

incorporated

here as well as its exceptional efficiency as a divergence indicator.

James Sibbet's creation provides an additional stellar incisive cutting accuracy to the Pi-Osc. Sibbets amazing creation is one of the only indicators

with true predictive qualites as a leading indicator.

Divergences. Pi-Osc measures

divergences which occur in five different time frames from two different

indicators,

realising that divergences are often spurious in their reliability, the designer only factors 4% of the total indicator

reading from these. Paradoxically the buy and sell zones have to have at least one observation of a divergence to trigger a signal.

Learn more about divergences and another product which uses them.

Volume is always a

factor that precedes a price change, as stock prices cannot move without a

real money value

being assigned to it either as a recent trade or a bid-offer order being placed. The designer's understanding of

volume

patterns is a very useful addition incorporated into the Pi-Osc indicators

unique conception.

Precision-Index-Oscillator on Crude oil futures

CL 300 min chart.

Momentum frequently decelerates prior to market turning points and PI-osc is monitoring several timeframes of smoothed momentum

samples in its calculations.

But unlike a conventional rate of change or momentum indicator the Pi-Osc indicator scores a neutral reading when momentum is rising or

falling fast, and a reading is only factored into the output

when momentum is reducing, thus indicating a higher probability of

success.

Probability is

another feature of this algorithm.

Although rarely used in industry standard oscillators, the designer has added a standard deviation (2.9) factor into this indicator as the more

usual 2 standard deviations used in Bollinger bands is just not reliable enough to bet hard earned cash on.

Normally distributed price sets have a 99.9% containment within 3.3 standard deviations, so when this is breached the Pi-Osc adds or deducts a

further value to its output number.

Stochastics have similar attributes to RSI

oscillators and have contributed a factor into PI-osc due to their smooth

and reliable ability to identify

buying and selling points on non trending

markets.

Price patterns.

Generally the industry standard oscillators just use the closing price to

calculate their values, and although some indicators

such as the stochastic use the high and low in their mathematics, few oscillators are actually programmed to respond to unique candlestick chart

set ups.

PI-osc is setting the standard with its intelligent programming to recognise when the current chart pattern is shouting BUY BUY BUY! Several of

the more reliable

patterns are factored into the algorithm.

When all the maths is done, Pi-Osc does an

exceptional job of determining true buying and selling points.

Basically the trading interpretation is made very simple for you, as the buy and sell zones are so logically determined, not by one factor but from a large consensus "vote" from

more than one different computation.

The benefits of this indicator are that it saves

valuable time in "confirming technical analysis signals" and all trades

know time is precious as

large price changes can be missed in seconds while checking other confirming factors. It takes the hard work out of it, and lets your

computer do the brain work.

Ideally this indicator is best as an entry

signal, and exits are best done with a trailing stop which has a logical

trend following exit, as its quite rare that the Pi-Osc will run right to

the other extreme and issue a reverse signal.

Precision Index Oscillator can often pinpoint tops and bottoms very precisely.

This indicator was first designed in times when markets were less volatile than they are now and since then the

markets have grown enourmously more volatile particularly during intraday swings in futures.

Pi-Osc shown in this video is used in combination with PLA Dynamical GOLD to confirm the new uptrend.

Combos are expensive and are bespoke for the different requirements of each client. Only for long standing clients.

This takes partial exits on various targets and uses a trailing stop. Ask for details if you want one made for you.

Precision Index Oscillator has now got a new rule as a result of the gradual rise in market volatility.

Apart from the other well known main rules to wait for the bounce away from Pi and trade in the direction of the major trend, the new rule is to

experiment to find the best historical timeframe.

In the old days it would fire up very nicely on a 10 minute chart of most things, and still does (sometimes) but the

futures markets now go way out of the old extremeties in terms of deviations from the norm.

So it is essential to know what the market volatility is capable of on each instrument.

The point being made here is that using this on very short term time frames is not as safe as used to be.

Institutions enjoy working together to drive the prices into areas where most traders did not expect them to go,

taking out all the stops and getting a better price for themselves.

So the first task after ordering this product is to create multiple minute chart settings in your NinjaTrader platform

and then click through them and there you will find hopefully find the holy grail, just like finding the best guitar,

amplifier and effects pedal settings for creating your own personalized type of music, finding the best timeframe to use you Pi-Osc is the

essential work.

The holy grail usually turns out to be nothing more complex than a stop watch.

If during quiet markets the best setting turns out to be 93 seconds or 49 minutes on a volatile market or a 940 minute chart on a very volatile market then so be it.

Does it matter? All that matters is YOU find the way to get to the holy grail from this product.

Precision Index Oscillator has eight rules

1. Trade in the direction of the major trend

2. Find the time frame that has worked best in historical testing ( This can be a different setting for each market )

3. ALWAYS use a stop loss

4. Wait for the bounce away from Pi

5. Wait for the bounce away from Pi

6 Wait for the bounce away from Pi

7 Wait for the bounce away from Pi

8. Remember the other seven rules.

Precision Index Oscillator clarification of rules 3 to 7

This indicator can stay locked at the extreme level for many bars, days, minutes, tick or hours etc.

Taking the signal before the bounce comes is like the well known phrase "catching the falling knife".

As Ed Seykota puts it in his usual amusing style, the problem with catching falling knives is that there are more knives than we have fingers. He is referring to a market sell off rather than a sell off in one market.

When everything is crashing and we buy all of the crashing things at once, yes you guessed it: A painful day for the fingers!

The shot below is Pi-Osc on 15 minute Dax futures.

Notice how violently the price does an 80- 90 point jump up and down.

Precision Index Oscillator indicator logic explained in a simple video clip

This indicator was designed to help YOU be the wise guy in the market.

Precision Index Oscillator markets and their suitability.

Stocks, futures, bonds (real time and end of day)

Forex: Pi-Osc will perform on forex but as forex does not print volume in the same way the above do, performance can be less than optimal as less information is being given to Pi-Osc.

Forex futures: These instruments do have reported volume so Pi-Osc will perform normally.

Chart below: 2 hour chart of GBPUSD and a good buy signal followed by two sell signals which didn't go far.

Precision Index Oscillator can be used in NinjaTrader market analyser and you can follow the same for other indicators too

Open

market analyser and populate it will a list of stocks such as the

Dow Jones 30 or Nasqaq 100 ( SP500 is a bit much to begin with )

Delete all the columns apart from last price.

Click

columns and choose indicator -Pi-Osc

The important

part

Set to daily 1

Plot 0

Days

back 300

calculate on bar close

bars to reference to

infinite

If you want colour coding shades

Set max

background to a up colour like blue

min background to a down

colour like red

click apply..........wait a while for

everything to populate and the button will cease being grey, then

click ok when it allows you

The list will populate with Pi

values ( Screenshot below, just copy the settings for daily data)

-

Pi-Osc and other chart types in for NinjaTrader 7 & 8

This indicator works on any chart type in the NinjaTrader platform.

However please note there is NO ADVANTAGE to using delayed box sized charts such as Renko, Kagi and point and

figure as they remove detail from the information Pi-Osc receives.

Adding extra filters to a complex filter is not required so my preference is the simple minute-day-week type.

Using tick charts gives the full information to Pi-Osc but is more resource hungry as there are no "bin sizes" that are

pre-cached into the 1 minute bins when using time based charts.

This means all things have to be calculated on the fly which means slower loading times if using a lot of ticks over a

long period.

If you like using tick charts then you can start off by finding the best setting for your style and take a screen shot, then replicate that frequency in a tick chart.

IMPORTANT: Ensure Precision Index Oscillator has enough data to use.

This is described as IMPORTANT because once I got a complaint from a trader who was using the saw tooth plot to

take trades.

The image below shows the saw tooth plot on the far left is used to highlight that the indicator does not have enough data loaded.

It is normal to see this at the start of the data but if you see it on the far right of the data you must load more bars

or it wont be able to compute any values in the NinjaTrader platform.

| FAQ for dummies | Response |

|---|---|

| Question: Does Pi work on Renko bars? Answer: Yes, it works on any chart in the NinjaTrader platform as is stated above. |

|

|

Question: I see it costs $75 for a one month trial, but what happens when it expires? Do I have obligations to renew? I am a bit worried about this please advise Answer: The are two possibilites. 1. Don Corleone visits you and you will wake up with a horses head in your bed. 2. The Pi-Osc will stop working. More likely that it is No2. |

|

|

Question: I have not received my indicator yet and ordered it 45 minutes ago. Why is this? Answer: You did not include your machine id number in the Paypal payment page. |

|

|

Question: Your FAQ is funny! Did you ever think of offering a prize for the most stupid question? Answer: My research shows a bit of humour helps to encourage careful reading and avoids having to ask me something which is already written clearly on the site. I like your idea, and might do an email shot which will add an extra free month onto an existing license for the funniest silly question. Even my dog can read, here he is studying Elliot wave theory although he finds it confusing. See my dog Fletcher trading with Elliot wave theory (old page) |

|

|

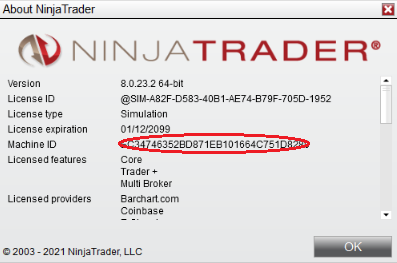

Question: I see I need to add a machine id number when I order. Where is it located? Answer: Open NinjaTrader 8 and click on help and about. The machine id number is located on the 5th line. If you are still using NinjaTrader 7 its on the 3rd line. Be sure to choose the correct NinjaTrader version in the drop down menu on the payment page. |

|

|

Question: I trade mostly on the 1 minute chart for the currencies 6E & 6A and was wondering if your indicator is practical and effective to use on a 1 minute time frame? I see most of the screenshots are 10 minutes and up Answer: I may be talking myself out of a sale here, but I know of no system that is profitable in a 1 minute time frame over an extended period. Mostly the vendors of these " fantastic day trading models " are scammers who know people are attracted to the excitement of high speed trading, and milk it accordingly, please understand there is a big difference between them and me. And... Send me the code for a strategy that is consistently profitable over the last 3 years of SP500 futures that samples data using a 1 minute chart and you can have a free 10 year license for Pi-Osc on NinjaTrader 8. |

|

|

Question: Do this indicator work on Kagi charts? Answer: Yes, and it is clearly stated above. |

|

|

Question: I have 8 computers here that I use. As they are all my own computers I want you to set up 8 licenses for me for the same price. If you can do this for me I will subscribe immediately. I tell you in all honesty that they are mine and I am not ordering on behalf of my friends using them. Answer: See this video clip |

|

|

Question: A lot of trading indicator vendors are not honest. How can I trust you and your products? Answer: You can see my Complaints-Testimonials-Comments here You can see a multi month thread on big mikes forum now called futures.io entirely devoted to this Pi-Osc product. Google it. The pie is given for not researching before asking. Cowboys don't last in this business but PTS has been here since 2006 - I was asked to port products to NinjaTrader in 2011 and did it in 2012. |

|

|

Roger Here are a couple of charts. I have just three things to say WINNER WINNER WINNER and its giving better signals than the Tradestation version. I am like a kid in a candy store. Regards M Answer: Probably the better signals are a result of being connected to the unfiltered data provider Kinetick rather than any short-comings in Tradestation. View the happy Pie customer screenshots. |

|

|

Question: Does your pie indicator repaint?? Answer: No Re-painting is the same as pretending it didn't happen... Again this concept is to help the cowboys sell items to fools. Does the losing trade in the video above disappear? |

|

|

Question: Does your pie indicator work in NinjaTrader market analyser?? Answer: Yes, scroll up |

|

To place emphasis on the importance to the Pi-Osc rules, these are repeated below

1. Trade in the direction of the major trend

2. Find the time frame that has worked best in historical testing ( This can be a different setting for each market )

3. ALWAYS use a stop loss

4. Wait for the bounce away from Pi

5. Wait for the bounce away from Pi

6 Wait for the bounce away from Pi

7 Wait for the bounce away from Pi

8. Remember the other seven rules.

-----------------------------------------:

Like what you see? Sign up to get notified of new products when released

Get a trial month Precision Index Oscillator "Pi-Osc" indicator for NinjaTrader 7 & 8 .....$75

The one month license cost is the same as it was in 2012 - Price of longer licenses have to increase soon

Here is a full list of other products available for NinjaTrader

A Testimonial from Precision Trading Systems

Precision Trading Systems would like to suggest

NinjaTrader 8 as a platform for trader of all levels of expertise.

The first great thing about it is that you can get a full version

completely free of charge so you can try it out. If you wish to hook up to

a live Kinetick data feed you can do so at a later date for very

reasonable cost click the links below for more information.

It has a

lot of useful features including automated trading, SuperDOM single click

order entry and amendment. The charting package is excellent in particular

the quality of the candlestick charts is outstanding. For those with

programming knowledge there is a powerful language which can be used to

create your own complex add on indicators and systems. It is very similar

to C# and has the look and feel of a full blown programming package.

A very notable quality from my point of view is the blisteringly fast

speed at which this language computes indicator values.

This is very

noticeable for me as some of my systems contain many many pages of highly

complex number crunching algorithms and when first plotting the indicator

on the chart it just zaps into place instantly. Obviously the programming

behind the scenes of NinjaTrader platform is very efficient.

This

factor is a prime benefit to any trader who needs high speed execution and

computation.

To my knowledge there are over 100 other vendors of add on

trading software to choose from. You can back test systems to ascertain

performance and the help knowledge data base and user forum is very

comprehensive.

Thanks for viewing this page, I hope it was helpful.

The contact page here has my email address and you can search the site

If you

like what you see, feel free to

SIGN UP to be notified of new products - articles -

less

than 16 emails a year and ZERO spam Precision Trading Systems was founded in 2006

providing high quality indicators and trading systems for a wide range of

markets and levels of experience. Supporting NinjaTrader, Tradestation. MultiCharts, TradingView,

MetaTrader 4 and 5

The help and advice of customers is valuable to me. Have a suggestion? Send it in!

About