Ed Seykota created this formula, I am just writing about it as its very cool.

Video

below shows the Precision Probability Index trading system which

achieves a good lake ratio. Shown here with speeded up

data

This formula was I believe first created by Mr Ed Seykota a great trader with a razor sharp mind. Featured in the highly regarded book Market Wizards volume 1

Indroduction and concepts of the lake ratio

The lake ratio is a simple to

understand ratio for use in measuring performances of trading

systems and indeed the trading account of a trader or fund manager.

This is based on the equity curve generated by the trader or

the system. In recent times it has become more popular as a tool of

institutions for use in measuring traders risk profiles v profits.

Simplicity = Beauty

You can find out your own personal

lake ratio value by trading a few sessions of the Trading IQ Game

and then viewing the trade report at the end of the session ( you

must be logged in to receive the trade report )

The three

main areas which are used to make the measurement calculation are

Growth rate of account

Depth of draw down of that account

( the greater the percentage of draw down the deeper is the water )

Time that the account is underwater ( the longer the duration of

the draw down the wider the water )

The ideal lake ratio

which all fund managers seek to achieve is the improbable 0.00 and

the higher the number measured the worse the performance.

Here

are some examples

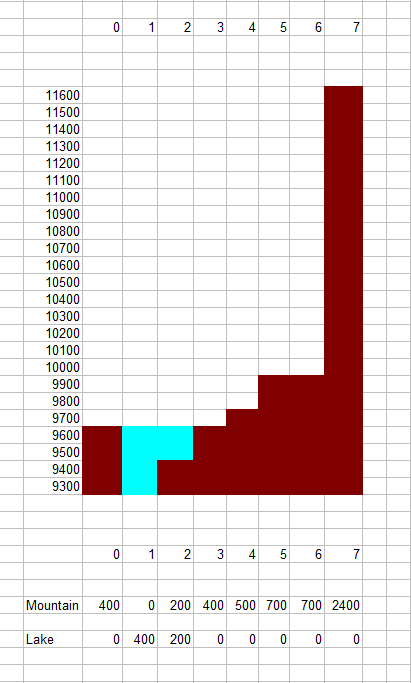

Example No1

In the example below we

can see the red area represents the growth of the account and this

is referred to as "mountain area" when all the cubes of the mountain

area are added up we get 4900

The lake area is counted by

adding up the area of the blue area using the right column to note

the balance of the account

Thus lake area = 600

The to get

the lake ratio we simply take the lake volume divided by mountain

volume

600 / 4900

Lake ratio = 0.1224 ( very good )

Lake ratio formula = lake divided by mountain.

Calculating

area of each is best done by sampling each bar or day or which ever

frequency of data is used.

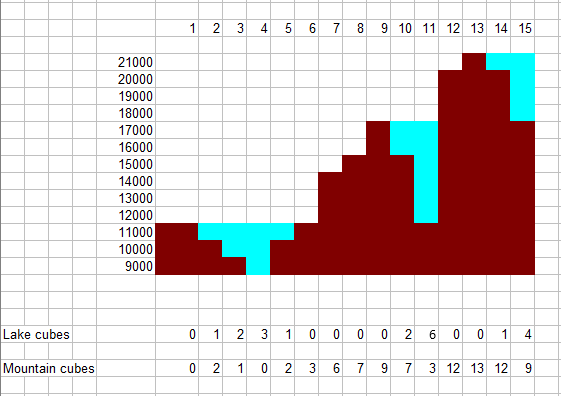

Example No2

In the example below we can see the red area represents the growth

of the account and this is referred to as "mountain area" when all

the cubes of the mountain area are added up we get

Mountain area

= 86

The lake area is counted by adding up the area of the

blue area using the right column to note the balance of the account

Thus lake area = 20

The to get the lake ratio we simply do

lake divided by mountain

20 / 86

Lake ratio = 0.2325 (

good )

For calculation purposes the extreme low of the equity

curve is taken as the base level for measurment and the extreme peak

of the mountain is taken as the high value to measure down from to

get the depth of the water. This procedure runs on a bar by bar

basis so it the highest peak that has occured "to date" if reading

the data from left to right.

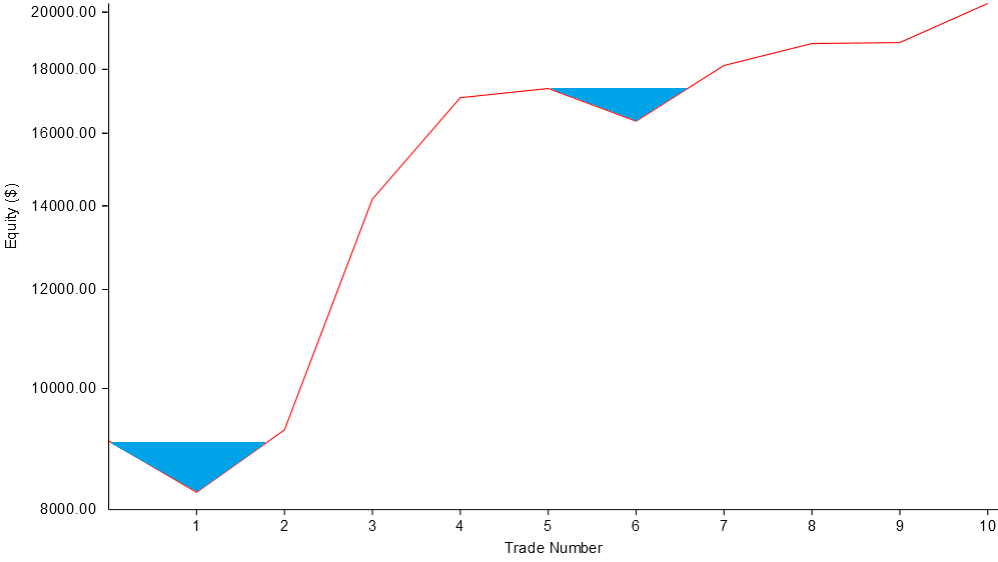

Example No3

In the example below we can see the actual

equity curve of a participant in the Trading IQ Game who achieved an

excellent lake ratio of 0.020 which is lower and much better than

those above.

This metric is used by myself to help me select

traders with strong promise and ability to produce good profits with

low draw downs and short underwater periods.

Lake ratio =

0.020 ( very very good )

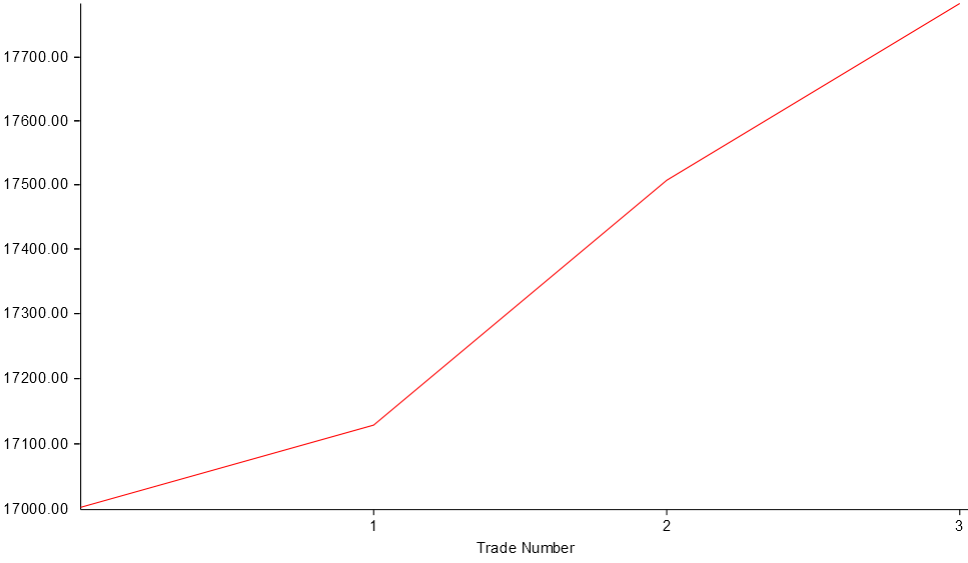

Example No4

In the example below we can see the actual

equity curve of a participant in the Trading IQ Game who achieved

the dream and got a perfect lake ratio of 0.00 which simply means if

you pour

water on the equity curve ( mountain ) then it will not

settle as their are no lakes for it to collect.

This metric

is used by myself to help me select traders with high ability to

produce good profits with low draw downs and short underwater

periods.

Obviously there were only four trades to create this

chart, and having months of trades without ever registering a losing

trade is virtually impossible, but one can understand what fund

managers look for when selecting traders to grow their trade

accounts up.

Lake ratio = 0.00 ( statistically

improbable over a long time duration as it requires no losing trades

)

The

original lake ratio article by Ed Seykota is found here (

Some distance down the page )

These pages below will

also appeal to those who enjoy ratios, statistics and calculations.

Price target

computer (

Predicts exact maximum high and low )

Computing optimal risk

( Same method as the Las Vegas card counter Ed Thorp )

1987 crash calculator ( Calculate your

loss or profit if the 1987 crash happens again )

How to test a trading

system ( Video simulation and maths )

Beginners guide to trading part one (

Six parts )

Hedging a portfolio with

traded options

View

the Product guide for all platforms supported

The contact page here has my email address and you can search the site

If you

like what you see, feel free to

SIGN UP to be notified of new products - articles - less

than 10 emails a year and zero spam

Precision Trading Systems was founded in 2006

providing high quality indicators and trading systems for a wide range of

markets and levels of experience. Supporting NinjaTrader, Tradestation and

MultiCharts.

Page Created June 22nd 2023 - New responsive page GA4 added canonical this. 5/5 html baloon

Cookie notice added Video resize nicely

About