Provided by Precision Trading Systems for MultiCharts and Tradestation

The many uses of the Volume flow indicator VFI clearly displayed in chart examples

1. When VFI is above zero this denotes a

bullish condition. (Trend definition)

2.

When VFI is below zero this denotes a bearish condition. (Trend

definition)

3. As a divergences

indicator,It can be in the usual way as one would use other oscillators

such as Demand Index or Money Flow MFI and Qstick indicators

4. One use not highlighted by most texts is the

use of "V" formations in VFI which when highly correlated with the price

of flag up the trend turning points

in a timely manner. These observations

are best when a dramatic rise of fall in the price and the VFI precede the

V formation.

5. Topping and bottoming

patterns such as head and shoulders and double tops which form in the VFI

often herald a trend reversal in the underlying

instrument before it shows

in the actual price. Pleas see images below.

6.

Rumour has it that Mr Katsanos made $700,000 in a single day from a signal

generated by the volume flow indicator.

7.

As an overbought or oversold oscillator in the same way as RSI

would be used.

8. IMPORTANT NOTE When an

extreme high reading ( overbought ) is observed on the VFI it can often be

an early warning to herald a major uptrend is

starting and traders

entering short on these readings must exercise extreme caution.

9. Obviously the same applies vice versa when

extreme oversold readings occur.

Designer of the Volume Flow Indicator or VFI

Markos Katsanos: (Genius)

Introduction

Mr Katsanos graduated in structural engineering and holds an honours degree in civil engineering. He is a member of the Technical Securities AnalystsAssociation of San Fransico known as ( TSAAF) He began applying his logical commonsense engineering background to the stock market around 1987.

His superbly designed indicator known as the VFI Volume Flow Indicator, is probably in my opinion his finest piece of work.

This indicator is always

going to be high on my list of essential tools in the traders toolbox.

Versatile in its uses, simple to understand and

more reliable than some other inferior volume indicators.

Example 1: Below VFI Flagged up two nice head and

shoulders bottoms which called the moves up very early.

-

See the video prediction that Bitcoin would reach 111,965 that came true then sold off

-

This new product uses Demand Index to project the next 30 bars of price actionFeel free to check the next 30 bars were projected correctly (even on Etherium and Bitcoin)

|

-

|

Using this right handed mug will remind you to trade correctly according to the guidelines for Precision Trading Systems. The PTS shop is open 24 / 7 and items are shipped in a rapid time. See the range of T-Shirts - Badges - Hoodies - Mugs - Baseball caps etc If you are a left handed person this cup is not suitable for you as you won't see the logo. Check out the shop ( opens in new tab ) THIS CUP IS GUARANTEED TO MAKE YOU A BETTER TRADER ( and stop you being a mug ) |

|

-

|

Good things can be done with other volume derived indicators such as Demand Index which the Precision Divergence Finder (lower plot) uses. It measures multiple instances of DI lengths and check for divergences that will issue buy signals. Trades get triggered when PS goes into long mode if within "N bars" of the divergence occuring: Upper plot is the Precision Stop Indicator Bespoke combo strategies made for the requirements of each client - Ask for more details if you have strategy you want designed. |

|

|

Volume flow indicator

Example 2: Below VFI crosses zero with conviction, and forewarned the fast move up which occurred a few bars later

Volume flow indicator break out

Example 3: Below VFI gave four nice "V" Patterns

which called the trend turning points very precisely

Joke for newlyweds. |

|

Volume flow indicator as trend indication

Example 4: Below Crossing zero called the trend well, by staying under zero its kept the traders out of bad trades

Volume flow indicator zero line crossing

Example 5: Below VFI Length 8 with no smoothing

functions nicely as an overbought oversold oscillator in the same context

as an RSI would be used. +5 indicated overbought and -5

indicated oversold in this example.

You can read more about Volume flow on Markos Katsanos's own website

mkatsanos.com

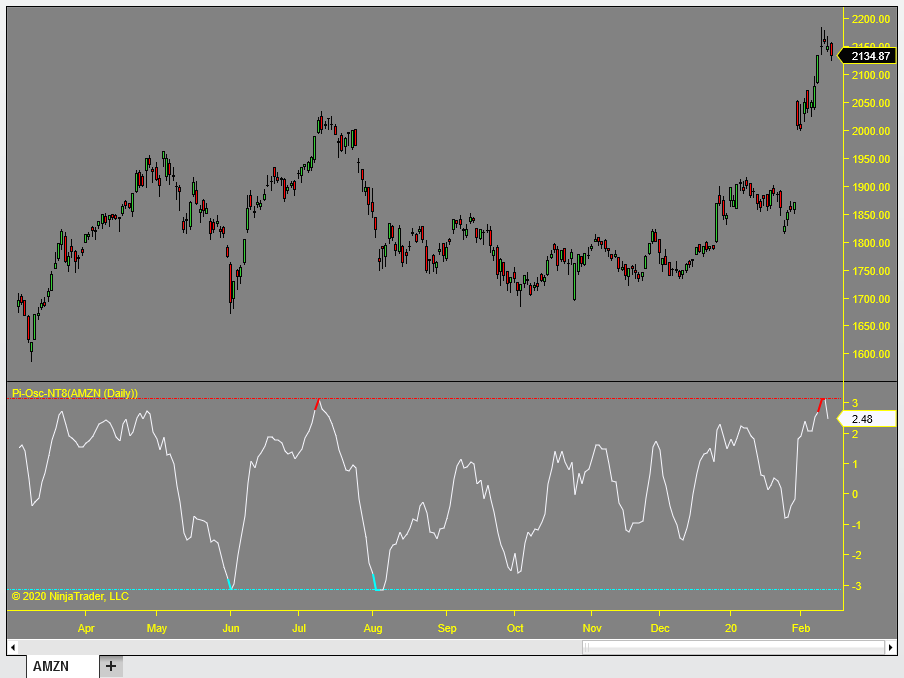

The Precision Index Oscillator below generates buy and sell signals when bouncing away from Pi (+ or - 3.14)

Pi-Osc often finds tops and bottoms with pinpoint accuracy

Pi-Osc trials are now available for TradingView learn more

Pi-Osc below shown on Amazon, it also works nicely on crypto currencies.

Pi-Osc for NinjaTrader learn more

Pi-Osc for Tradestation learn more

Pi-Osc for MultiCharts learn more

Pi-Osc for TradingView learn more

The help and advice of customers is valuable to me. Have a suggestion? Send it in!

The contact page here has my email address and you can search the site

If you like what you see, feel free to SIGN UP to be notified of new products - articles -

less than 19 emails a year and ZERO spam ZERO hard selling

About

Precision Trading Systems was founded in 2006 providing high quality indicators and trading systems for a wide range of markets and levels of experience.

Supporting NinjaTrader, Tradestation. MultiCharts, TradingView, MetaTrader 4 and MetaTrader 5

Admin notes

Page updated Dec 26th with "lazy load" images,

shop and mobile friendly and new

GA4 codes.