The Tri-Spectral Forecast indicator and drawing tool for NinjaTrader 8

Please visit the product guide if you require this

tool for a different trading platform.

The

contact page here has my email address and you can search the site

If you

like what you see, feel free to

SIGN UP to be notified of new products - articles - less

than 16 emails a year and ZERO spam

Precision Trading Systems was founded in 2006

providing high quality indicators and trading systems for a wide range of

markets and levels of experience. Supporting MultiCharts - NinjaTrader - Tradestation- TradingView -

MetaTrader 4 and 5 - Who do you need next?

Page Created June 19th 2023 -

Updated redirect index.htm Feb 9th 2024 - New responsive page GA4 added canonical this. 5/5 html baloon

Cookie notice added

The Tri-Spectral forecast indicator displays historic seasonal analysis in a rapid and precise manner giving you a simple indication of when a cycle pattern exists

This indicator for NinjaTrader 8 saves a huge amount of time when performing annual cycle analysis research in of markets in a fully configurable format

Indroduction and concepts of the Tri-Spectral

Forecast tool for NinjaTrader 8

The problem of making decisions is

one that faces traders every time we look at the screen. Should we

buy or should we sell or should we avoid?

Sometimes there

might be room on your account for five long trades but there are

nine promising markets staring you in the face.

How to

screen and filter these out to increase the probability of winning?

The solution to improving your

probability of getting these difficult choices made is right here

Introducing the

Tri-Spectral Forecast Tool: Uncover Powerful Insights for your

Trading by analyzing historical data, this tool provides valuable

insights into future price movements.

With a simple and

intuitive interface, the Tri-Spectral Forecast tool takes today's

date, delves back 251 bars to examine last year's market behavior,

and projects it into the future.

This easy-to-interpret

visual representation offers a wealth of information.

By

incorporating this tool into your trading strategy, you gain a

significant advantage over your peers.

It helps prevent costly

trading mistakes and validates profitable opportunities. For

instance, if a friend considers buying Apple stock at the end of

August, you can utilize the cyclical evidence

from historical

analysis to guide them towards more informed decisions.

Designed and now available specifically for NinjaTrader 8, this

forecasting tool saves you from potential errors and guides you

towards more successful trades.

Utilize the Tri-Spectral Forecast

tool to confirm your trades and gain insights from firm cycles, such

as director sales patterns following annual company results

announcements.

Unlock the power of the Tri-Spectral Forecast

tool today and take your trading to new heights. Make informed

decisions, trade with confidence, and maximize your potential for

success.

Lets

get started, how it works and the simple interpretation

After adding the drawing tool to the Apple stock chart below,

very clearly and without any counting, jotting notes or maths it can

easily be seen there is a clear cyclical history of a rising

market

from this time of year going forward.

The yellow plot is

last year (drawn on the chart and plotted into the future) by the

number of "future" bars you choose.

The white plot is two years

ago and red is three years ago.

This

forecasting tool for NinjaTrader 8 can save a lot of errors as

certainly some traders would be looking to short Apple as it nears

resistance, the forecast below might change their mind.

Using this price forecasting tool to confirm trades solves the

problems. In some cases where there is concrete evidence of a

solid and predicatable cycle such as director sales after

announcing the company

results, a lot of your previously unseen opportunites are revealed

and your time is saved.

The Tri-Spectral forecast tool also reveals notable sell-offs

in Apple occurring in late August and early September. Now the planning of

trade entries and exits becomes much clearer.

Brief tutorial video from Labour day observations on Sept 2nd 2024 -

Features PayPal holdings, 3M, Nike, Goldman Sachs, etc

How to set up your Tri-Spectral

Forecast tool on your NinjaTrader 8 platform.

In a typical year of a stock price there are approximately 251 bars of data

and a crypto currencey has 365 bars, the difference is that the

cryptos are trading at the weekends.

When analysising a daily stock or future with this

price forecasting tool for NinjaTrader 8 the settings

would be 251, 502 and 753 for the settings of Back1, Back2, Back3.

If using it on crypto currencey such as Bitcoin BTC these are set to 365, 730 and 1095

as these products trade 24/7 with no missing bars each weekend.

Once these values have been inputted, the next step is to input how

many bars into the future to plot. The chart example below uses 70

bars.

It reads the last years change in percentage from the

current bar number -251 to calculate what happened last year on the

same date going forward 70 bars and plots it into the future.

Delightfully simple in its concept when one observes three

years all projecting in the same direction, one can see there is

possibly a cycle in action on the market.

On the same theme

as above, if the three plots are not going in the same direction and

there is no "Covid crash" or similar in the history then it will demonstrate the lack

of an annual cycle.

To make things even

more clear the date of the last three years analysed are highlighted

in the colour you choose which matches the colour of the projection

lines in the NinjaTrader 8 plot.

In character, in manner, in style, in all things, the supreme

excellence is simplicity.

Quote by Henry Longfellow.

If you are interested to see how this cycle pattern below runs over the next

few of weeks the name of the stock is in the link in the

email that is sent out after

SIGN UP

The image above is not a trade recommendation to buy or sell or

hold or stay out.

Backbars feature (not used in

this version)

This is set to 0 by default ( as in the chart above and below ) this is just a reserve input for future use.

The chart below of Tesla also indicates

some evidence that an annual cycle is

present. Although this time it is more varied in its magnitudes it

still clearly shows an upward tendancy.

Ignored years feature

(Values between 0 and 3)

If there is a crash or extreme market anomoly which has

"dirtied the data" over the last few years. It can be ignored by

this feature.

Example: If the Covid crash was 2 years ago

you can set ignored years to 2 and the plot and forecast would

vanish.

The point is that this type of extreme market event is not

going to give a valid cyclical projection just as a Tsunami destroys

the observation of the seventh wave being the biggest.

The screenshot below

shows another positive annual cycle for the last three years on

Microsoft stock.

It is also clearly tells you that

considering taking

some partial profits around $410 might be something to add to the

planning of trades.

By now

the solution to the problems are becoming clear.

After

your purchase there will shortly be some optional add on upgrades to this

product as there are a lot of potential uses for it that I want to

test out.

The shot below of GLD (Gold) has it future set to 80 so the

plot has more reach into the future showing us to be very cautious.

This is a great example of what is discovered by using the

Tri-Spectral Forecast tool- CLARITY OF DECISIONS.

When your trading friend tells you of a plan to

short gold, you can casually mention that there is no cyclical

confluence evidence for this time of year. It is just random.

You would be right to say that. The red plot is up, the

white plot is down to sideways and the yellow plot is sharply down.

Indeed the future of gold can only be seen as volatile and chaotic

based on this evidence.

Options traders on the other hand may enjoy

buying into a near month strangle position which is a long put and a long call,

designed to capture a big move in either direction.

As the premium

cost is low, then theory is that the gains on the puts will be

greater than the loss of the calls and vice versa if it goes the

other way.

They could quite reasonable see the evidence for a big move in either

direction.

Looking

for annual cycles in Gold futures during June leads to the discovery

that there arent any.

All these evidences can be useful to

avoid making bad trading decisions as the chart clearly shows this

time of year can lead to a big drop in Gold or a big rise in Gold,

or a sideways non event in Gold.

Some

real and genuine examples of annual cycles that you will find with

the Tri-Spectral Forecast tool in stocks

The directors selling some of their

stocks. This is a very real opportunity

if the trade is carefully researched in advance.

Company

directors ( in some companies ) are often not allowed to sell any stock until after the

year end or quarterly results are announced.

This is often the exact

same date each year and the news might show excellent results followed by

a brief and large move up, and often within the space of just a few

minutes the price will

start selling off very hard with a key type

reversal bar.

Moves like this take the public by surprise.

You on the other hand will be ready for it having seen the

projections clearly in advance.

This director

selling is often enough to completely reverse an uptrend as they are

the

big shareholders in the game to make money, likely they will be the

ones who buy back stock at a lower

price on another predictable cycle date

which is caused by "date of trading rules for directors".

Seasonal trends

in stocks can be related to the "Christmas rally" where shops have

booming profits in the run up to Christmas, there are seasonal

trends in the form of holidays, weather,

temperature or regular

annual events.

Dividend Payments: Dividend-paying companies

typically have specific dates for dividend distributions, which can

cause predictable cycles around those dates.

Annual Shareholder

Meetings: Companies hold annual shareholder meetings on fixed dates,

which can generate interest and potentially affect stock prices.

Product Launches: The introduction of new products or services

by a company on specific dates can create anticipation and impact

stock performance.

Industry Conferences: Significant industry

conferences or events held annually can drive attention to specific

stocks or sectors during those periods.

Regulatory Filings:

Filing deadlines for regulatory reports, such as 10-K or 10-Q

filings, can create patterns in stock movement as investors react to

the disclosed information.

Index Rebalancing: When stocks are

added or removed from prominent market indices, it can influence

trading activity and stock prices around the rebalancing dates as

institutions have to

buy these stocks for pension funds etc, this

method requires care however as being demoted or promoted does not

happen every year.

Options Expiration: Expiration dates for

options contracts can lead to increased trading volume and potential

price movements in the underlying stocks.

Seasonal Trends: Some

industries or stocks may have seasonal patterns influenced by

factors like holidays, weather, or specific events.

Economic

Data Releases: Key economic indicators or reports, such as

employment data or GDP figures, released on specific dates can

impact overall market sentiment and individual stock performance.

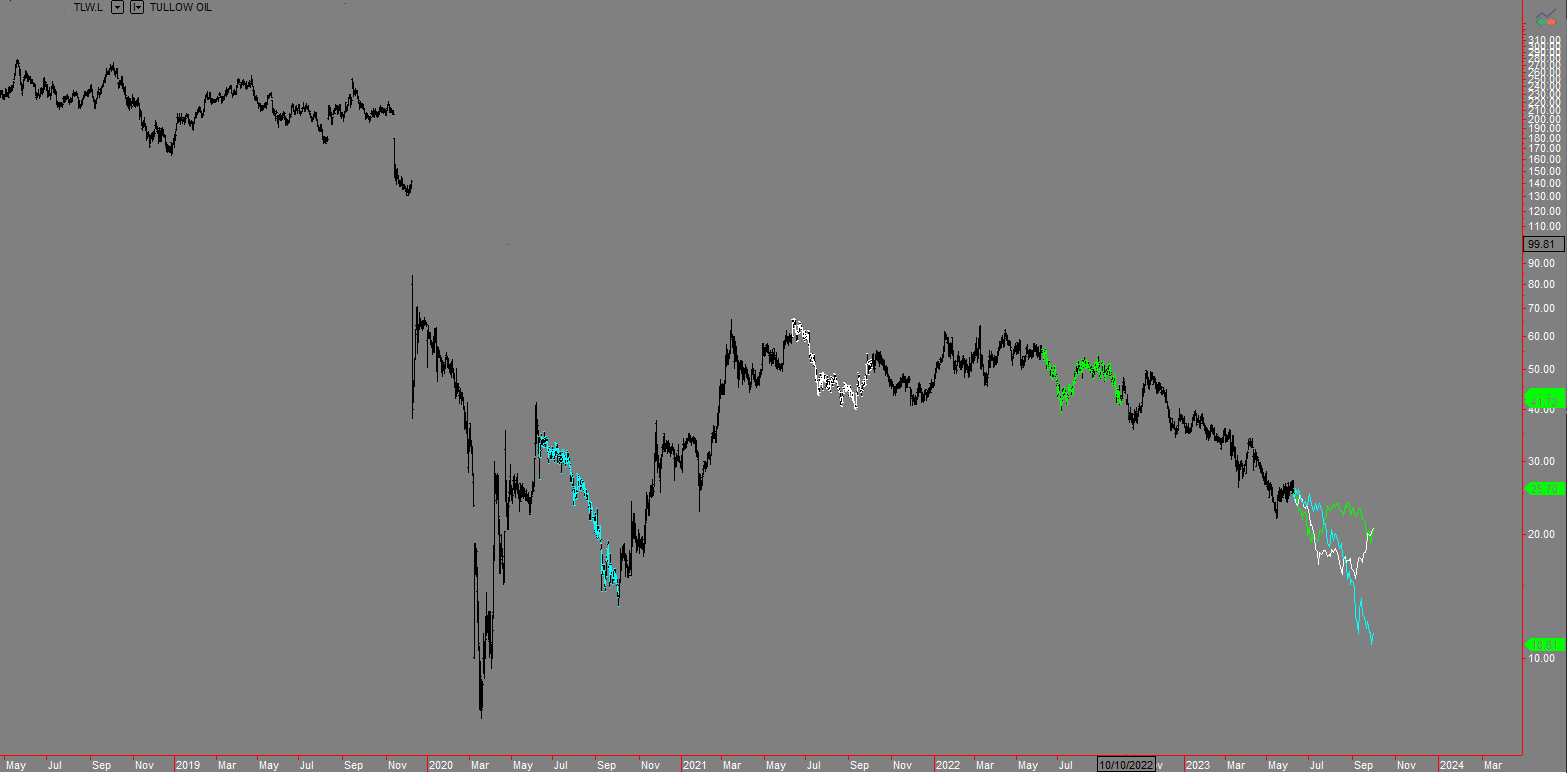

The chart below of Tullow oil PLC shows three plots going

in the same direction which indicates some evidence that an annual

cycle is present.

This time it is bearish, possibly resulting

from lower oil demand during mild weather.

It can be clearly

seen that the cyan plot is less trustworthy than the white and green

plots simply because of the time it occurred.

Basis of this it would be

very wrong to assume a drop down to 10.81 is a serious possibility

rather than a very remote one.

The ease of determination of

which year is projecting which outcome shows clearly that the cyan

plot, is coming out of the back of the Covid crash and the oil

storage crisis.

With the distortion cababilities of past crashes causing

confusing cycle readings, this is a good example of where you might

engage Ignored years =3.

The beauty of the Tri-Spectral forecast is that it

gives a clear and realistic sense of what to expect from the future,

and this expectation is based on real historical data.

Similar to

predicting when the Swifts and Swallows will arrive in the UK after

spending the winter in Africa.

Typically they arrive at their

earliest in late March to early April, but in colder years they can

come as late as the latter part of May or the early part of June.

They are a good example of a repeating cycle which is very valid and

robust.

With careful use this

product

can transform an average trader into a better than average

trader as it offers a very simple method of forecasting the future

and filtering trades.

Important technical

points to be considered when using the Tri-Spectral forecast

Three years is the default amount loaded,

but you can see six years or nine years if you follow the guide below.

How to add more years

If a second version of this indicator is added with longer

Back1, Back2, Back3 values then it is simple to see six plots or

even nine plots if you have enough data loaded.

Doing this will add more

crudentials to the validity of the observed results. When doing this

on stocks the values of 1004 (251 days x 4) 1255 ( 251 x 5) and 1506

can be used.

If using on a crypto currency then you can use 365 x 4

= 1460 for Back1 and 365 x 5 = 1825 for Back 2 and 365 x 6 = 2190

for Back3.

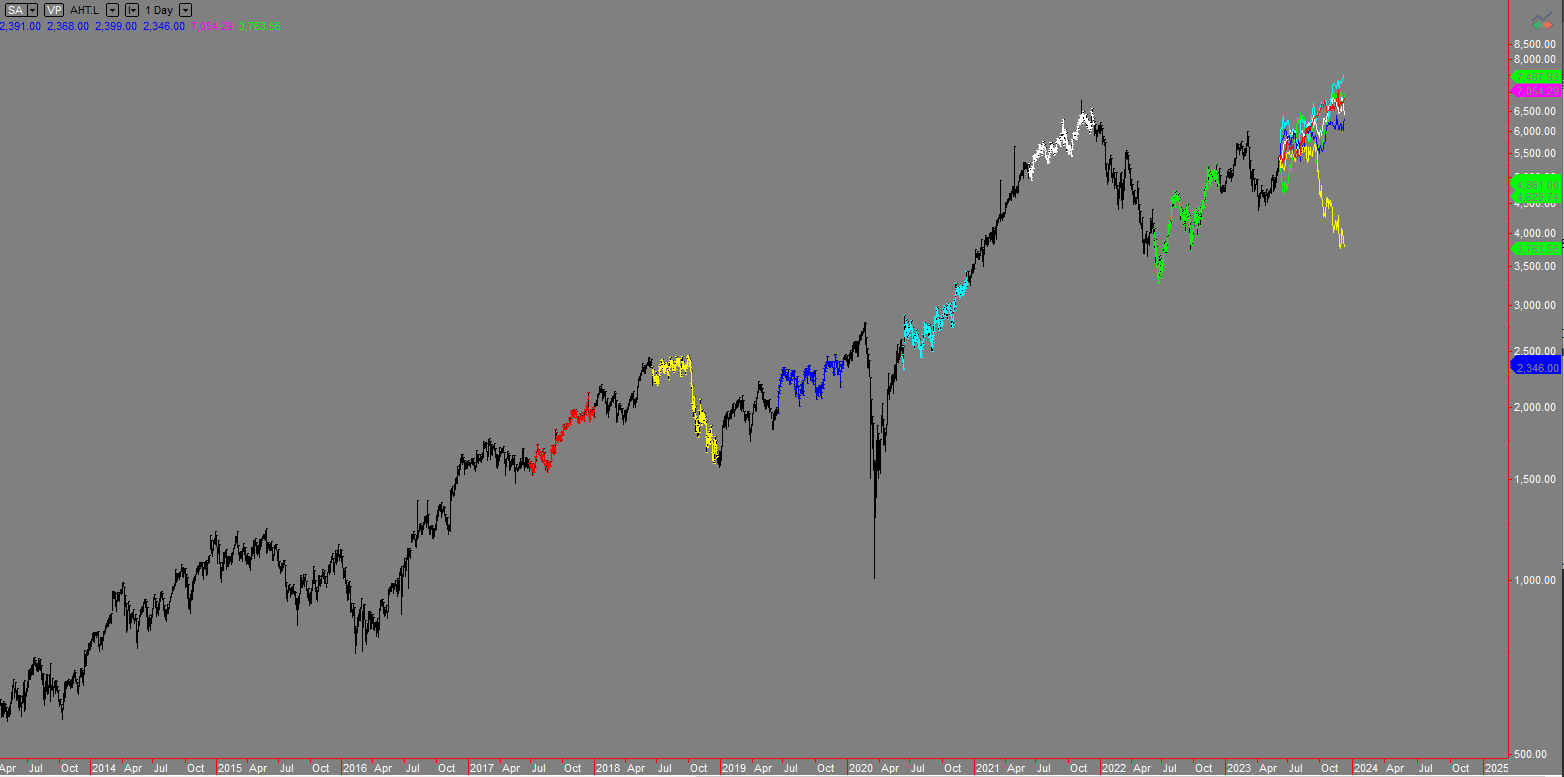

This powerful example below clearly shows you at a glance

in a matter of seconds,

that Ashtead group PLC in five out of the six years over the next 130 bars were higher

and only the yellow year of 2018 was down.

This method of

technical analysis speaks a very clear message indeed.

Chart types for the Tri-Spectral

forecast

This product works on daily charts of the types, Line,

Candlesticks, Bars of HLC, OHLC but other types of chart will cause

invalid readings to the plots due to not being one bar per day.

If this product is used on minute or hourly

charts the data will make no sense as it looks back a number of

bars, instead of using the date.

Margin width to the right side of the last price

There is a setting called

right side margin in

NinjaTrader 8 which you can locate as follows. Right click on the chart

background > Properties > Right side margin.

After

loading the indicator you can drag the chart over to see more of the

plot if needed.

Set this

value larger until you can see the entire future plot, this will

vary depending on the future setting you have used. Once it is set

you can select different charts and it will automatically use the

correct same settings.

Please note this varies a lot based on how much zoomed in or out the

chart is and smaller numbers can be used when zoomed out than when

zoomed in.

Annual cycles which are found in

commodities are shown below

Crop Planting and Harvesting: Agricultural commodities such as

corn, wheat, and soybeans have specific planting and harvesting

seasons, which can create cyclical patterns in supply and demand.

Weather Patterns: Weather events, such as hurricanes, droughts,

or seasonal rainfall, can impact commodity prices and create

"fairly" predictable cycles (but not exact as with the Swallows)

OPEC Meetings: For oil and petroleum-related commodities, OPEC

(Organization of the Petroleum Exporting Countries) meetings and

decisions on production quotas can influence prices.

Inventory Reports: Regular reports on inventory levels, such as the

weekly crude oil inventory report in the United States, can affect

commodity prices.

Mining Production Reports: For metals and

minerals, periodic reports on mining production and output can

impact supply and prices.

Seasonal Demand: Certain

commodities, like natural gas for heating or gasoline for summer

travel, experience seasonal fluctuations in demand that can affect

prices.

Global Economic Events: Economic indicators, such as

GDP growth, interest rate decisions, or geopolitical events, can

impact commodity prices worldwide.

Commodity Futures Expiration: Expiration dates of commodity futures

contracts can lead to increased trading activity and potential price

volatility.

Maximum settings and troubleshooting.

Backbars setting = 0-1 ( not used in this

version so just leave it as 0 )

Maximum future setting = 200

Maximum back

setting = 150

The other values back1, back2 and back3 have to

be inputted with care so that back2 is double the value used in

back1, and back3 is triple the value used in back1.

Date of the previous year highlighting is not

the exact date of today?

This is because of irregular distribution of weekends and

leap years. Another reason for this could be due to looking at

charts on Saturday or Sunday.

You can adjust the Back1, Back2, Back3 by up to + or - 3

to line them up perfectly in some years but may only get them within

2 bars of the right date.

The reason is simply because Jan

1st is not Monday by default, if it was then it would be a simple

job for the programming.

Once set up, save as default and it

will be as close to on the ball as possible for the whole year.

For this product there is a members only offer to get discounted trials

on other PTS products, follow the link below for details.

The help and advice of members is valuable to me. Have a suggestion? Send it in!

~ About ~