PPI was designed by Precision Trading Systems to compute the exact probabilities of trend going to Y-price by X-Time

Precision Probability Index is a simple to use indicator which computes the odds of a trend continuing or not

The Gold Version comes with two types of strategy

and an indicator for advanced users

Signal line crossing strategy ( Generates trade

on the crossing of the signal line on the main plot )

WATCH PPI VIDEO HERE

Level cross over strategy ( Generates trades on the cross of the level of

probability you specified ( default is the crossing of 50% )

Methods of usage

The indicator can be used as a confirmation tool

to enhance your own strategies profitability

Know

exactly what the odds are of the market rising or falling

Observe the crossing of the signal line on the main plot to warn when the

probabilities are moving

As a risk calculation aid

to know the odds of your trade going in your favor in X number of bars

into the future

With a distorted exaggeration

factor one can use it as a binary trend indicator ( Ranging from 0 to 100

)

An excellent divergence indicator giving

reliable signals

Explanation of how it works

The indicator computes the exact mathematic

probability in percentage terms of a slow moving average being above a

faster moving average in a certain period into the future. This produces a

sinusoidal plot as shown in the photos.

The settings used allow incredible versatility of

uses. A smoother is provided on the main plot which irons out the false

and useless wiggles and this is user adjustable of course.

There is a signal line which can be shown or

hidden depending on preference and useful trade signals can be generated

when the main plot crosses above or below the signal line plot.

Other signals can be generated by the cross above

or below 50%. Here also this is configurable to compensate for bullish or

bearish technical set ups. The default value is 50% but you can set it to

buy above 51% or 50.0002% and sell below 51% or 50.0002%.

Dead spots are can be created simply by leaving a

gap between the buy above input and the sell below input. EG Buy above =

50.04% sell below = 49.96% gives a symmetrical Long-Short strategy with a

dead spot of 0.08 wide. The concept of this dead spot feature is designed

to reduce over trading at points of near equilibrium market conditions.

You can skew the dead spot to any level you wish,

for example if you are bullish of the market you might like to buy sooner

and sell later, so you can find the mid point of 49% and set buy above to

49.02% and sell below to 48.98%. Huge flexibility can result from doing

this.

In addition there

is also an exaggeration factor which distorts the volatility component of

the model to allow exaggerated readings, the reason for this is to enable

Precision Probability Index to function as a binary trend indicator, or as

an accurate probabilistic computer, and various mutation in between these.

Precision Probability

Index GOLD comes with two strategies.

1. The crossing of the signal

line strategy

2. The above below zero strategy.

This product has been tested by NinjaTrader staff and has passed their testing procedures

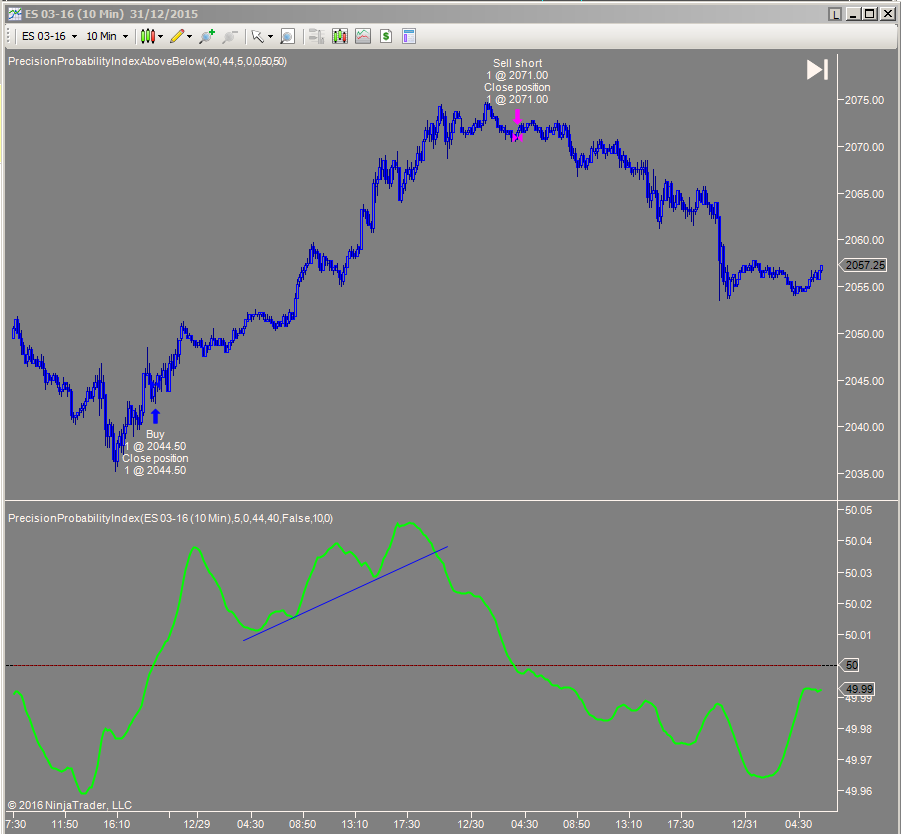

Chart below PPI trading on the E-mini SP500 Futures in a 10 minute time frame chart

Precision Probability Index is used to trade on the

crossing of the 50% line (The 50% line can be adjusted up or down to

factor in up or down trend biases)

Notice the

additional bonus observation of a bearish divergence that validates the sell signal which occurs

afterwards

Video showing how to use Precision Probability Index in NinjaTrader

The 20 tick time frame is used to demonstrate in a fast and fun way. In actual trading use it is suggested to use a slower time frame.

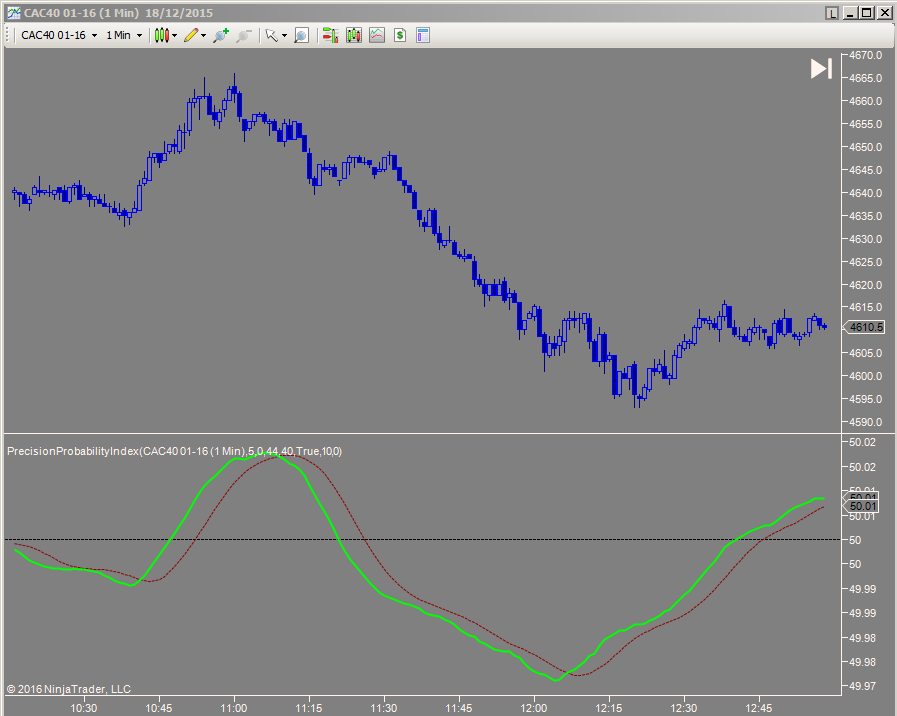

Precision-Probability Index on Cac 40 futures using a 1 minute chart.

Chart below: CL 2 Renko bars

Precision Probability Index works on any chart

type in the Ninja Trader platform, includin the Renko type below.

Here you can see the "above below strategy"

giving timely trades on the CL light crude oil futures as the buying

pressure alters the probability

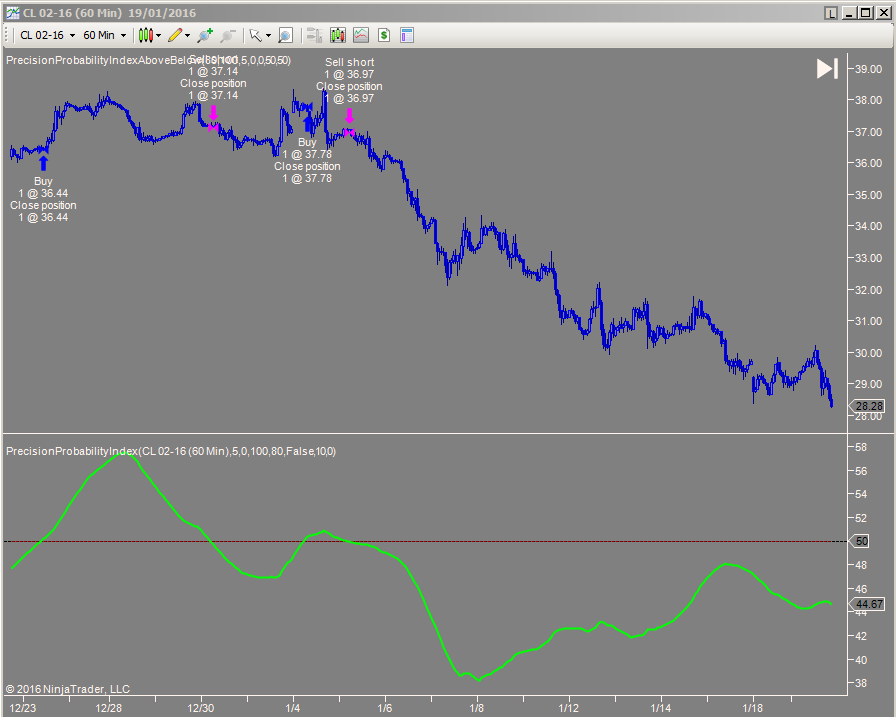

Precision Probability Index shown below on 1 hour chart of CL Crude oil futures.

This indicator was designed to help YOU be the wise guy in the market.

Chart below: CL Futures 60 minutes ( USA Crude oil futures )

Precision Probability Index is used to trade on the crossing of the 50%

line

Notice how well the strategy stays short during the volatile

downtrend when many other strategies would be shaken out.

These little differences in trading strategy performance give enhanced

performance to investors over the long run, the dealing costs are reduced

and the financial ratios such as risk-reward, calmar and the lake ratio

also improve.

Whilst the indicator plot may resemble demand index or relative

strength index or money flow index, the trained eye can differentiate

between them.

Precision Index Oscillator markets and their suitability.

Stocks, futures, bonds (real time and end of day)

Forex: Pi-Osc will perform on forex but as forex does not print volume in the same way the above do, performance can be less than optimal as less information is being given to Pi-Osc.

Forex futures: These instruments do have reported volume so Pi-Osc will perform normally.

Chart below: Daily chart of Burberry PLC with a nice buy signal and a double pi top which didn't go far.

Precision Index Oscillator chart

types in for Tradestation

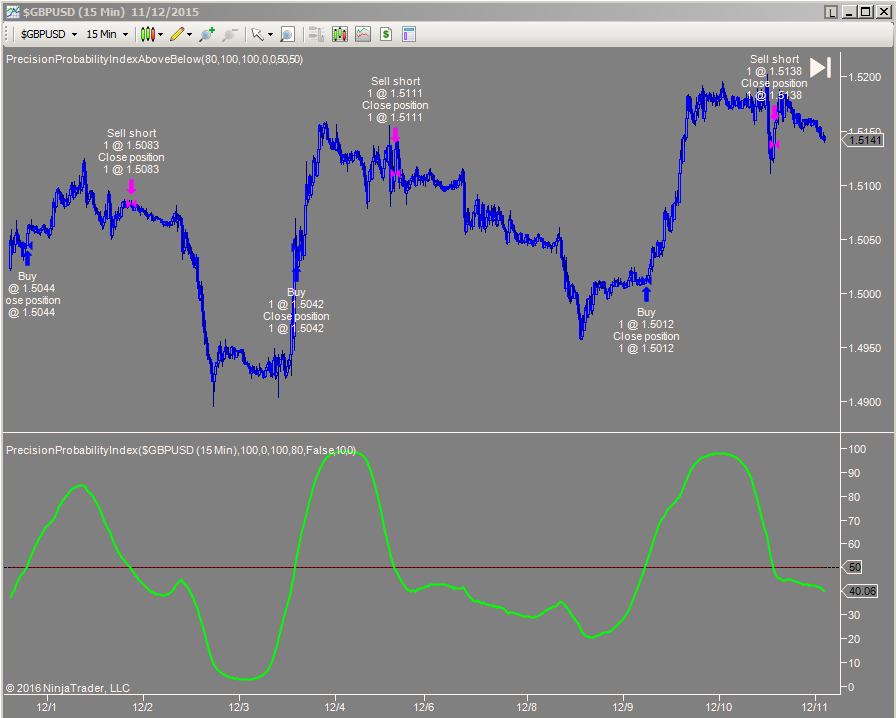

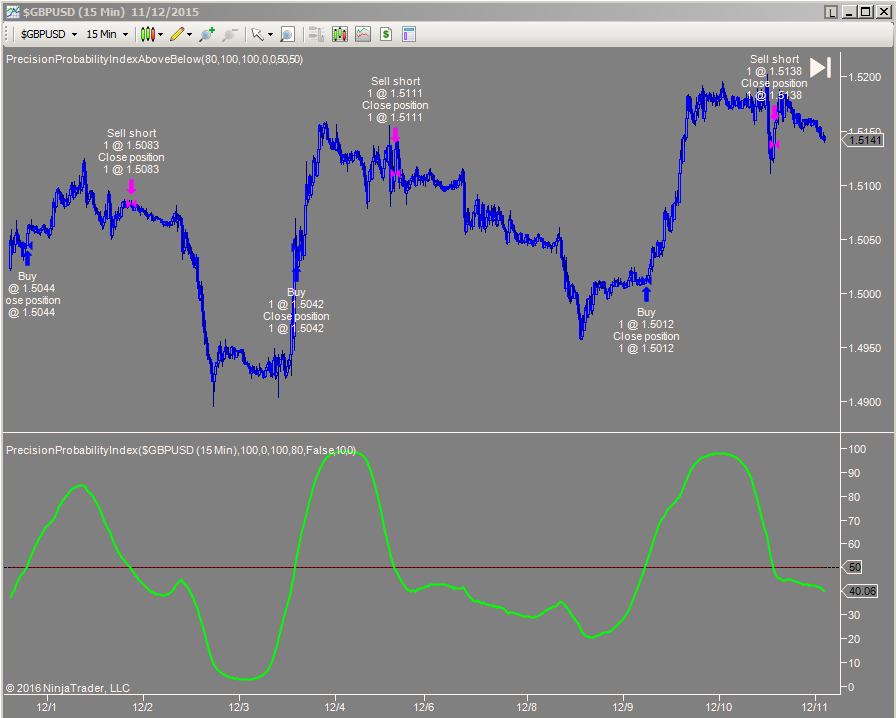

Chart below: GBP-USD 15 Minutes

Precision Probability Index is used

to trade on the crossing of the 50% line

The slow average is set to

100 and the fast average is set to 80 and Bars futures = 100, Here the

stock market trend predictors often find difficulties as forex is ofter

much harder to use in trend following methodologies. PPI makes perfect

sense out of the patterns and oscillations that occur in the English pound

versus the US Dollar, Event analysis performed using the mass index or

speculative sentiment index show the supply demand of the consumer are an

average indication of reality when compared to the Precision Probability

index when set up correctly.

Precision Probability Index can be used on Forex, futures, stocks, indices, bonds etc.

View license prices

for PPI

Precision Probability Index is used to trade on the crossing of the 50% line

The slow average is set to 100 and the fast average is set to 80 and Bars futures = 100, Here the stock market trend predictors often find difficulties as forex is ofter much harder to use in trend following methodologies. PPI makes perfect sense out of the patterns and oscillations that occur in the English pound versus the US Dollar, Event analysis performed using the mass index or speculative sentiment index show the supply demand of the consumer are an average indication of reality when compared to the Precision Probability index when set up correctly.

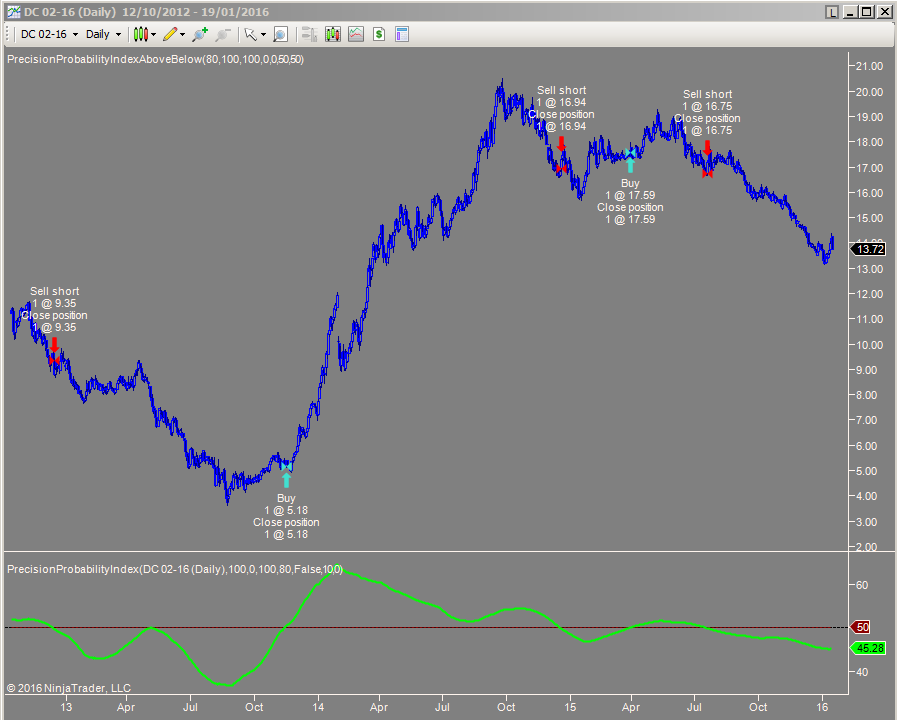

Chart below: DC Milk futures Daily chart

Precision Probability

Index stays long from 5.30 to 16.45 in a signal trade

Did you

notice the bearish divergence that occurs before the sell signal? This

indicator is comparable to the demand index indicator when it comes to

finding selling and buying pressure imbalances in the stock-market.

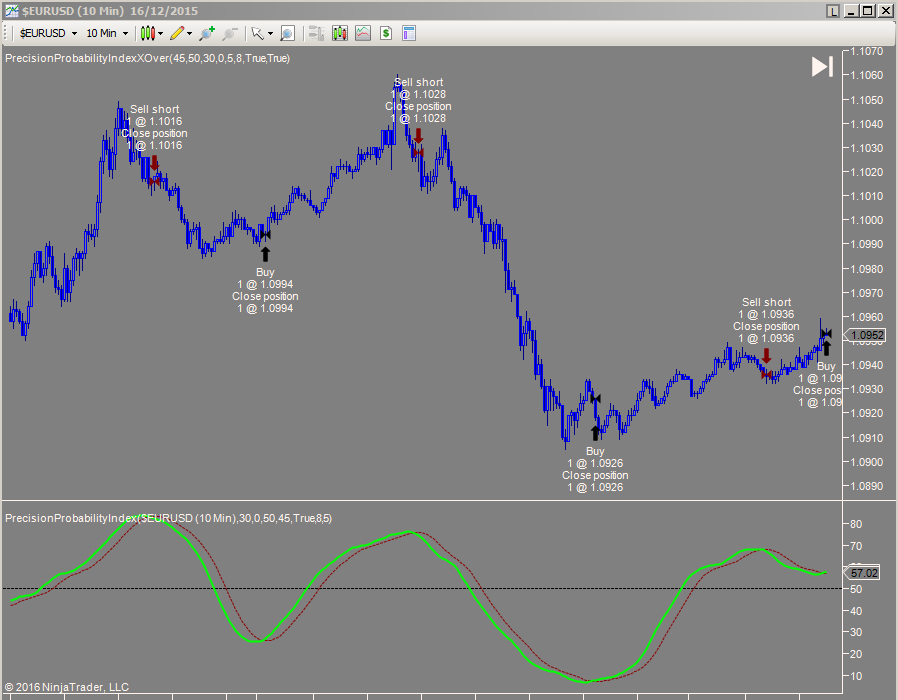

Chart below: EUR-USD 10 Minutes

Precision Probability Index is used to trade on

the crossing of the signal line

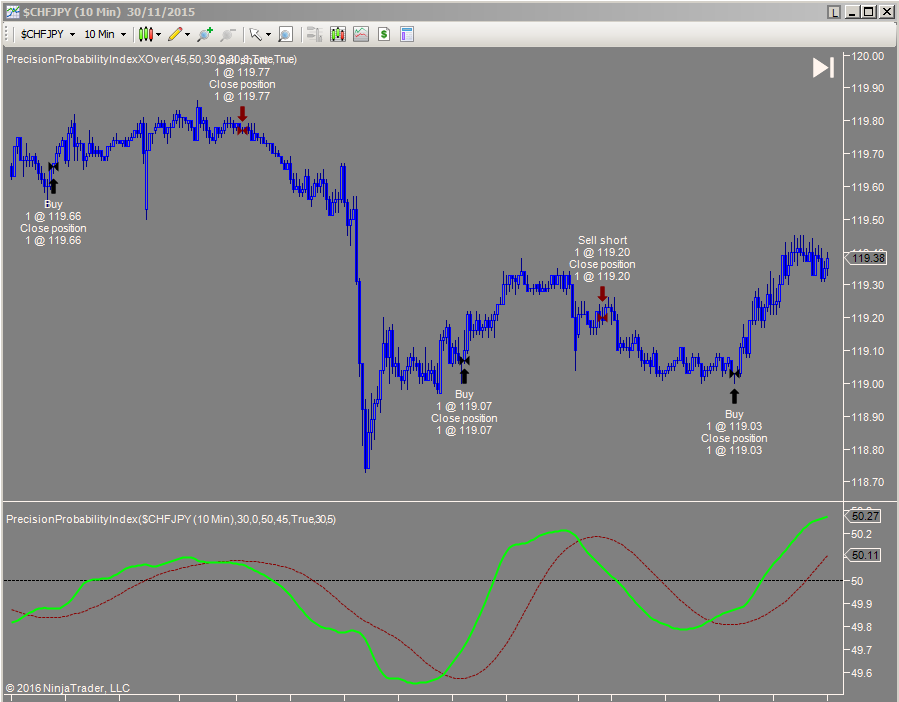

Chart below: CHF-JPY 10 Minutes

Precision Probability Index is used

to trade on the crossing of the signal line

In the image below you

can notice the signal line smoothing is increased to 30, this helps to

reduce whipsaws and over trading on a noisy data series

| FAQ for dummies | Response |

|---|---|

| Question: Which markets can PPI be used on? Answer: Anything with a price that can be used in NinjaTrader, such as stocks, forex, futures, bonds, indices etc Red peppers seem to be bottoming out.... |

|

|

Question: If I pay for a one month trial what happens when it expires? Do I have obligations to renew? I am a bit worried about this please advise Answer: The are two possibilites. 1. Don Corleone visits you and you will wake up with a horses head in your bed. 2. The Pi-Osc will stop working. More likely that it is No2. |

|

|

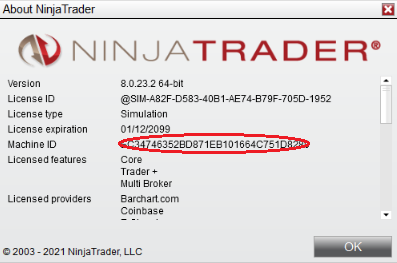

Question: I cant find my machine id number in NinjaTrader 8 Where is it? Answer: Click help > about and its on the 5th line. Copy and paste it in the Paypal form when ordering |

|

|

Question: Your FAQ is funny! Did you ever think of offering a prize for the most stupid question? Answer: My research shows a bit of humour helps to encourage careful reading and avoids having to ask me something which is already written clearly on the site. I like your idea, and might do an email shot which will add an extra free month onto an existing license for the funniest silly question. Even my dog can read, here he is studying Elliot wave theory although he finds it confusing. Fletcher trades charts See my dog Fletcher trading with Elliot wave theory (old page) |

|

|

Question: I trade mostly on the 1 minute chart for the currencies 6E & 6A and was wondering if your indicator is practical and effective to use on a 1 minute time frame? I see most of the screenshots are 10 minutes and up Answer: I may be talking myself out of a sale here, but I know of no system that is profitable in a 1 minute time frame over an extended period. Mostly the vendors of these " fantastic day trading models " are scammers who know people are attracted to the excitement of high speed trading, and milk it accordingly, please understand there is a big difference between them and me. And... Send me the code for a strategy that is consistently profitable over the last 3 years of SP500 futures that samples data using a 1 minute chart and you can have a free 10 year license for Pi-Osc on Tradestation 8. |

|

|

Question: I have 8 computers here that I use. As they are all my own computers I want you to set up 8 licenses for me for the same price. If you can do this for me I will subscribe immediately. I tell you in all honesty that they are mine and I am not ordering on behalf of my friends using them. Answer: See this video clip |

|

|

Question: I have not received my indicator yet and ordered it 45 minutes ago. Why is this? Answer: You did not include your machine id number in the Paypal payment page. |

|

Always remember to back test your ideas and use risk management

-----------------------------------------:

Like what you see? Sign up to get notified of new products when released

Thanks for viewing this page, I hope it was helpful.

Precision Trading Systems was founded in 2006

providing high quality indicators and trading systems for a wide range of

markets and levels of experience. Supporting Tradestation, Tradestation and

MultiCharts. MetaTrader 4 products are currently unavailable. Admin notes

Page updated - June 29th 2023 GS No

?-responsive table added GA4 code- canonical this.

Some html4 code snippets on tags- needs updating Ligatures

About