Simple to understand examples of how to calculate a moving average.

The name SMA is used to identify a simple moving average, which is the same as a moving average and the same as a rolling average. It is a very frequently used metric for use in all kinds of statistical analysis. For example. One school might be considered better than another school because the average pass rate is higher. A moving average pass rate is one which is updated at the end of term and will move less drastically than the actual result for each term.

This example below shows how to calculate a 3 day simple moving average of the daily temperature

The daily temperature is known as the "raw" data as it has not been cooked or treated or smoothed yet.

Daily

Temperature16

19

21

20

24

16

17

11

14

13

20

21

Three day

average

-

-

18.6

20

21.6

20.3

18

14.6

14

12.6

15.6

18

The above table shows that the first two days are blank as we need three days to compute the first value for the moving average. For the first moving average value we add up the first three days of the temperature which is 16+19+21 and that makes 56 and then we simply divide it by the number of days used which is 56 / 3 =18.6

The correct mathematical statement for this is (16+19+21) /3 which is 18.6

The above is the answer to the first three days average made of days 1, 2, 3. Next we need to calculate the value of the moving average for days 2, 3, 4.

Therefore (19+21+20)/3 =20. This number 20 forms the 2nd value in the three day moving average calculation to turn our average into a "rolling" average or a "moving" average. (Rolling and moving are the same thing just with different words)

When you have the 2nd value of 20 you can proceed to calculate the third moving average value by using the temperature of the 3rd 4th 5th day. This is (21+20+24)/3 = 21.6 and after this you continue to calculate the next values. This can be done in an excel sheet very easily

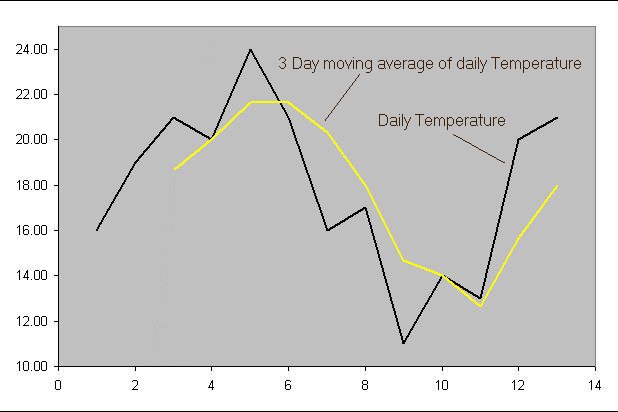

Below is a chart image of the above three day rolling average of daily temperature.

Key points to remember

A rolling average is the same as a moving average

A simple moving average "SMA" is the same as both the

above.

Moving averages produce a smoother output value than the actual

data value ( Note the yellow plot is smoother than the black plot.)

Moving averages produce a delay know as lag.

This is because they respond slower than the actual raw data.

Moving averages need 3 days to compute the first value ( if a three day

average is required )

Moving averages reduce fluctuation and smooth

out "noise" ( Noise is a term used for jagged and messy data fluctuations

)

Next we will construct a 6 day moving average of a stock which is called SMA PLC

Stock price

41

42

40

38

39

36

33

32

28

29

33

36

Six day

average

-

-

-

-

-

39.3

38.5

37

34

32.3

31.8

31.8

In the table above you can see the daily stock market

price and below is the "six day simple moving average" of that stock

price.

The first six days are 41,42,40,38,39,36 which produce

an 6 day average of 39.3

The calculation is very simple and follows

the same method as the first example. However this time the first 6 days

are added together and divided by 6 because this time it a 6 day average

instead of 3 days as was used in the first example.

Day 1 (41) +

Day 2 (42) + Day 3 (40) + Day 4 (38) + Day 5 (39) + Day 6 (36) = 236 then

we simply divide 236 by the 6 days ( as we are making a six day moving

average )

The correct mathematic statement for this would be

(41+42+40+38+39+36) / 6

The next stage in creating a true moving

average is to roll forward to the right by 1 number. So for the next value

we will use Days 2, 3, 4, 5, 6, 7

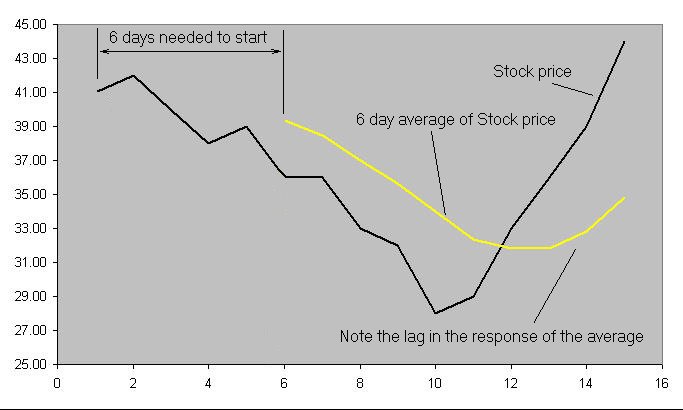

The chart below is a

graphic illustration of the daily stock price SMA PLC and six day average

of it.

Key points to remember

A six day rolling average is smoother than a three day moving average

A raw data line cross above or below its simple moving average "SMA" can indicate a change in trend direction.

On day twelve in the image above the black line of the

raw data crosses above the yellow six day moving average indicating a new

uptrend.

Moving averages crossovers are often used in trading

systems to generate buy and sell signals to help a trader decide what to

do.

Moving averages are smoother when more days are used to

calculate them.

The lag produced by a rolling moving average is greater

if the number of days are increased.

The simple moving average is the easiest of all types of moving average to

understand and calculate.

Moving averages reduce fluctuation and smooth

out "noise" ( Noise is a term used for jagged and messy data fluctuations

)

Mathematical symbol for average

When using moving averages in calculations other terms are used in place of the "days" we used above. Length, Period, Smoothing are commonly used words that define the value used to smooth the raw data.

Practial applications of a simple moving average

Below is a 2 hour chart of Crude oil futures

with a 20 period simple moving average plotted in orange.

Below is a 1 minute chart of Cisco systems with a 100 period moving average plotted on it in lime green.

The rolling average is clearly a much smoother and simpler indication than the raw Cisco 1 minute chart data.

Key points to remember

A 100 period moving average of the Cisco systems 1 minute chart can

smooth the data to help beginners in day trading to identify trends.

As the raw data crosses above the 100 period moving average it denotes the trend is rising.

A simple moving average is easy to calculate using trading software such as NinjaTrader shown above.

There are many other types of moving average, some are very complex and others are reasonably easy to compute.

Like what you see? Sign up to get notified of new articles and products when released

A Testimonial from Precision Trading Systems

Precision Trading Systems would like to suggest

NinjaTrader 8 as a platform for trader of all levels of expertise.

The first great thing about it is that you can get a full version

completely free of charge so you can try it out. If you wish to hook up to

a live Kinetick data feed you can do so at a later date for very

reasonable cost click the links below for more information.

It has a

lot of useful features including automated trading, SuperDOM single click

order entry and amendment. The charting package is excellent in particular

the quality of the candlestick charts is outstanding. For those with

programming knowledge there is a powerful language which can be used to

create your own complex add on indicators and systems. It is very similar

to C# and has the look and feel of a full blown programming package.

A very notable quality from my point of view is the blisteringly fast

speed at which this language computes indicator values.

This is very

noticeable for me as some of my systems contain many many pages of highly

complex number crunching algorithms and when first plotting the indicator

on the chart it just zaps into place instantly. Obviously the programming

behind the scenes of NinjaTrader platform is very efficient.

This

factor is a prime benefit to any trader who needs high speed execution and

computation.

To my knowledge there are over 100 other vendors of add on

trading software to choose from. You can back test systems to ascertain

performance and the help knowledge data base and user forum is very

comprehensive.

Thanks for viewing this page, I hope it was helpful.

About

Precision Trading Systems was founded in 2006 providing high quality indicators and trading systems for a wide range of markets and levels of experience.

Supporting NinjaTrader, Tradestation and MultiCharts. MetaTrader 4 products are currently unavailable.

Admin notes

Page updated - May 24th "moving

average" GS 0 GS 0. "what is a moving average" not in

first 17 pages. Same for what is a simple ma.. 2nd 2023 GS No

?-responsive table added GA4 code- canonical this.

Some html4 code snippets on tags- 1st June 2023 fixed schema