Please visit the product guide above if you require this

Tradestation drawing tool for a different trading platform.

Video

below shows how Precision Divergence Finder does its task on speeded up

data

This indicator for Tradestation saves you time when searching for divergences in Demand Index in a fully configurable format

Indroduction and concepts of Precision

Divergence Finder for Tradestation

The Precision Divergence

Finder Indicator was designed by Roger Medcalf to accurately

identify divergences between Demand Index and price.

These

divergences ALWAYS occur at a new low price. It is therefore advised

to wait for some strength to appear before buying these dips.

Such a method is defined in the combos page where more than one

product is used to created entry and exit signals.

When a

divergence is pure and simple, huge rewards are possible plus the

added satisfaction of buying very near the low of the week

On

the other hand when one of these signals fail, it often heralds a

continuation of a sharp drop in price. Using a stop loss therefore

is ESSENTIAL.

The Precision Divergence Finder for

Tradestation is a very simple to use indicator, which can benefit a

expert and a beginner. Video examples below show how it plots

Special features of the

Precision Divergence Finder Indicator Tradestation

( See for yourself below )

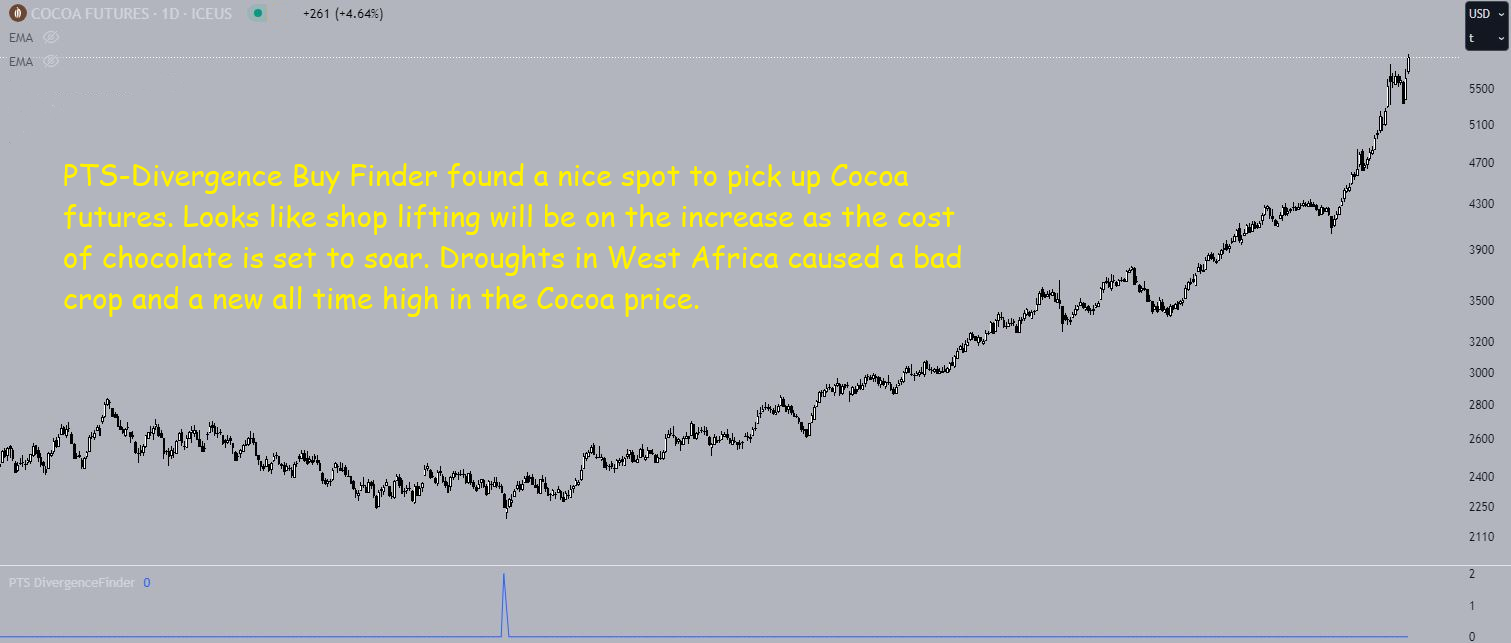

The absolute lowest low in Cocoa

futures shows a buy signal and the only signal in three years of

daily data, still moving up two years later.

The Precision Divergence Finder

Indicator tells you in real time if Demand Index is not making a new

low when the price is making a new low.

What does this mean?

Why is it so significant?

This is a good indication of

institutional patient accumulation of the market while the public

continues selling and panicking.

It really is that simple.

The examples below show how to trade these events.

Why is

Demand Index used to measure divergences? Simply put this wizard of

an indicator does a better job than most to find professional buying

just as its creator Mr James Sibbet

intended it to do. It was

always a favourite of mine as it is like having an inside track as

to what is going on.

View

license prices for Precision Divergence Finder

The power

of Demand index is put to its best use when measuring divergences

between itself and the price data series.

When we see a weakening of prices that are making new lows and

the Demand Index is not making a new low this known as a bullish

divergence

The Precision Divergence finder harnesses the true

power of Demand Index and removes all the hard work of measuring

these divergences.

Please note this product is also available

for NinjaTrader8, MultiCharts and MetaTrader 4

Why this indicator gives you so

much power

See when the professional traders are quietly trying to buy

stock without showing their hand

Measures a multitude of

divergences and only flags up when significance is evident.

Observes 20 different look back periods of Demand index

simultaneously at blinding speed

Calculations over a whopping

200 bar range of prices

Computes a consensus of how many

divergences are occurring on any given bar.

Gives you a

simple at a glance reading between 0 - 20 showing the strength of

signal FAST

Can be used in signals and systems

Adjustable sensitivity settings

Adjustable core Demand Index

Lengths

Chart below Etherium USD

The indicator does a lot of hard work to identify the divergences

that occurs in cryptocurrencies during the selling panic.

The shot below of Ripple finds some nice bottoming divergences

View

license prices for Precision Divergence Finder for Tradestation

Some

FAQ's

Does the Precision Divergence Finder work on futures and

stocks in real time?

Yes, the Precision Divergence

finder works in any time frame, but best on daily or weekly price

sets.

Although it can give some good signals on shorter time

frame data, generally speaking intra-day signals are always less

reliable than signal generated in longer time frame samples.

For example, you can see a hundred double tops and head and

shoulders in a tick chart of a busy market every single day, but

these are very insignificant in comparison to a head and shoulders

occurring in a daily or weekly chart.

As with all signals in

technical analysis the rarer the signal, the more significant it

becomes.

If I don't like the product can I

get a refund?

Precision trading systems has a 30 day

money back guarantee on all products.

See conditions below.

Refunds will be given for the following reasons.

1. If a

bug - error is found that cannot be fixed within 7 working days of a

report being sent to Precision trading systems. (The 7 working day

limit, does not apply if we are on vacation )

2. Nobody has

ever reported a bug in this product, so you won't ask for a refund.

Do you provide a Precision Divergence Finder

that shows a bearish divergence for sell signals?

No, the Precision Divergence finder only issues buy signals when

there is a bullish divergence. The explanation is rather complex,

but here goes...

I did code up the bearish equivalent of this

product, and noted the behaviour of bullish and bearish divergences

were very different, while it may seem to be a symmetrical equation

it actually is not. Market psychology during peaks and troughs are

very un-symmetrical in their nature and market tops are the result

of the polar opposite emotions of fear - greed - euphoria.

It

is often said that tops sneak up on us without fair warning, and

this is very true. Market bottoms generally display much lower

levels of volatility and this is due to investor expectations being

much more conservative with less hope of success. (The attitude

would be, XYZ stock is low at the moment, maybe I will start quietly

buying a few and take my chances, as opposed to the euphoric

excitable view of ...wow this stock is flying up, I must get these

before I miss out on the huge profit chance) Frequently the 2nd

scenario is followed rapidly by "buyers remorse" and "feeling

stupid" and hence causes a wave of panic selling.

Furthermore, the Demand Index code while being an utterly superb

piece of work by Mr James Sibbett, it just does not lend itself to

handling panic selling and high volatility situations, I have spent

many long hours pouring though the code for DI, as well as the code

for my Divergence Indicator and have not found a way of altering it

to provide good sell signals without jeopardising the excellent

qualities of its buy signals.

Unfortunately, the sell signal

( bearish divergences ) of demand index are not as effective, and I

never used it in my trading as it gives many fake signals during up

trends which renders it useless. Sure there will be big divergences

at most tops, but these cant be given validity because of the

plethora of fake signals on the way up to the tops.

I never

sell anything on my site which does not deliver good trading

results.

Sorry for the long answer, but it had to be

explained.

Does the Precision Divergence

Finder work on tick volume or only actual trade volume?

Yes, the Precision Divergence finder works on both tick

volume and trade volume, but frankly speaking I would not trust it

when used on tick volume as the whole purpose of DI, is to reveal

which direction big volume trades are place in.

E.G.

If someone bought 1,000,000 shares in a stock, it would only show as

1 tick up on tick volume analysis, but on actual volume data, you

will likely see a large rise in the value of DI, which in turn would

be intercepted by the algorithms contained in the Precision

Divergence Finder causing it to give a reading if a divergence was

evident.

Does the Precision Divergence Finder

work on static end of day data? ( Not real-time )

Yes, and this was the data type used in the chart examples above. (

I will post some real-time examples soon)

You must have

volume with the data, or you will not get any signals.

View

license prices for Precision Divergence Finder for Tradestation

The contact page here has my email address and you can search the site

If you

like what you see, feel free to

SIGN UP to be notified of new products - articles - less

than 10 emails a year and zero spam

Precision Trading Systems was founded in 2006

providing high quality indicators and trading systems for a wide range of

markets and levels of experience. Supporting NinjaTrader, Tradestation and

MultiCharts.

Page Created June 22nd 2023 - New responsive page GA4 added canonical this. 5/5 html baloon

Cookie notice added Video resize nicely

About