PLA Dynamical GOLD for MultiCharts for advanced users and wise guys

Designed to be the most powerful moving average on the planet. Giving supreme control to you the user with some unique features

Tired of all the other moving averages? Need to get somewhere fast? Need to filter out small whipsaw trades? Solve the problems with PLA Dynamical here and now!

Comes with indicator and strategy that trades when PLA Dynamical GOLD is < or > than the previous bar

| Advanced features PLA Dynamical for MultiCharts has 101 different speed inputs for each length Comes with an overshoot true or false input command. Set it by typing 1 or 0 for on or off. Unique anti-reverse true or false input command. Set it by typing 1 or 0 for on or off. The anti-reverse is percentage adjustable to give fine or coarse adjustments PLA Dynamical has a fast starting algorithm which requires only a few bars of data to compute its output value Before complaining that the videos have no sound - Please note I am a trader and not a salesperson - The videos speak fine without the words PLA DYNAMICAL GOLD 1 MONTH TRIAL IS AVAILABLE FOR $77 View license prices for this and other PTS for MultiCharts products. |

|

Anti-reverse feature video: Shows the difference when anti-reverse is on or off

-

| Standard features PLA Dynamical for MultiCharts has adjustable length from 4 to 200. ( Gold version has 200 ) Comes with a colour changing for up or down to suit user preferences. PLA Dynamical works on any type of chart in the MultiCharts platform. Comes with Indicator and strategy which trades when greater or less than the previous bar. Technological advancements PLA Dynamical is the fastest responding commercially available MA available ( Overshoot = True and speed 100) Paradoxically it is also the slowest responding commercially available MA's available. ( Overshoot = False and speed 0 anti-reverse on- set to big percentage) PLA Dynamical is the most flexible commercially available MA available at this time. ( Gold version has 404 basic settings per length) Comes with more user inputs than any other commercially available moving average. Fast start algorithm allows more back testing and gives a value after just 10 bars in MultiCharts , no need to wait for length bars to complete Idiosyncrasies and notes The PLA Dynamical moving average has more than 1900 lines of code used to generate its complex algorithm For the above reason maximum length of the GOLD version has been restricted to 200 due to the heavy calculations and CPU time. |

Speed setting video:

Hold your mouse pointer over one of the peak turning points to make it easier to see the velocity shift changes

The overshoot features gets to the new price level very quickly during a volatile session. The volatility algorithm is the governer in the fast bursts to new price areas and controls this feature When you need it to get there fast it does it for you. Notice it instantly goes into downtrend "short mode" before most moving averages even started to notice the new price zone. |

|

Overshoot feature video:

Featured in the video below to demonstrate the huge difference that occurs in high volatility conditions note the instant velocity change in PLA Dynamical GOLD

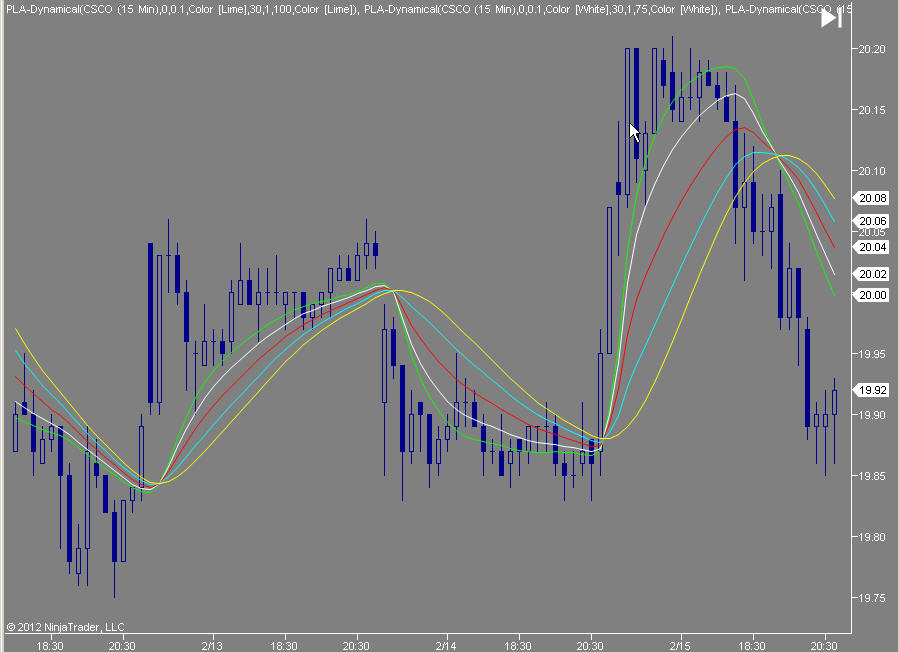

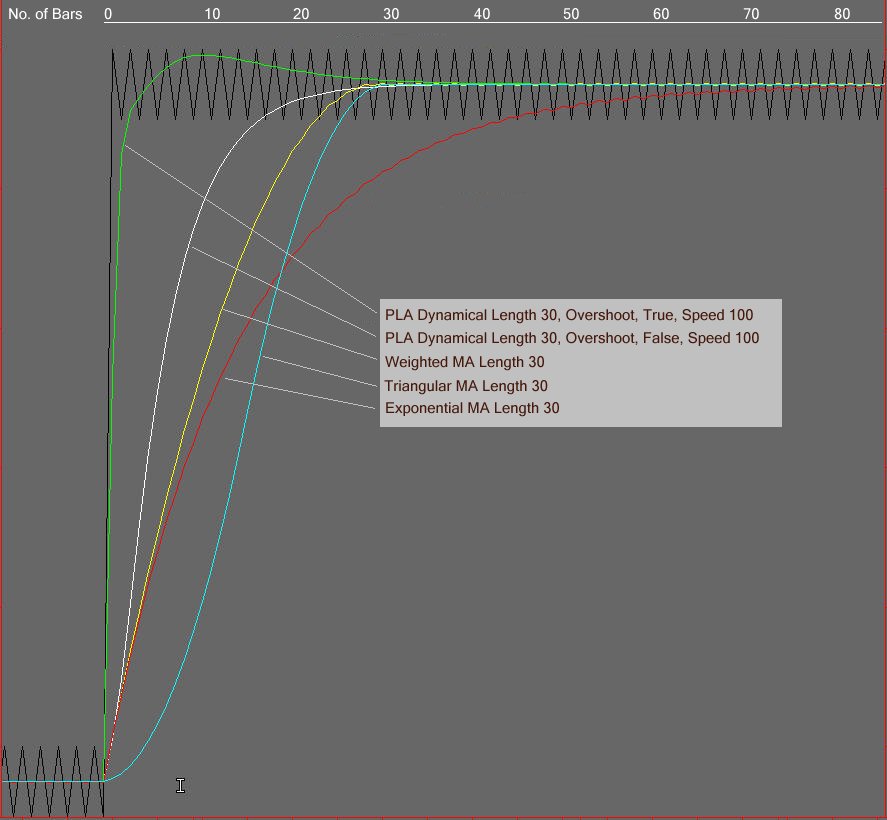

All the plots below are the same length 30 but the speed settings are different

The difference in response times is because the user

adjustable speed input settings are changed.

Lime speed = 100 White

speed = 75 Red speed = 50 Cyan speed = 25 Yellow speed = 0

|

-

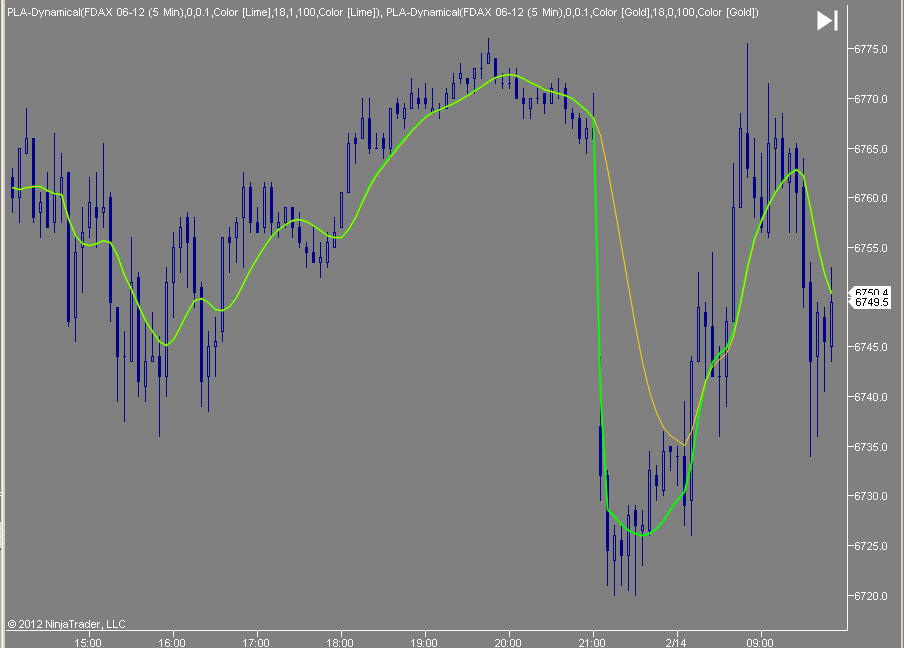

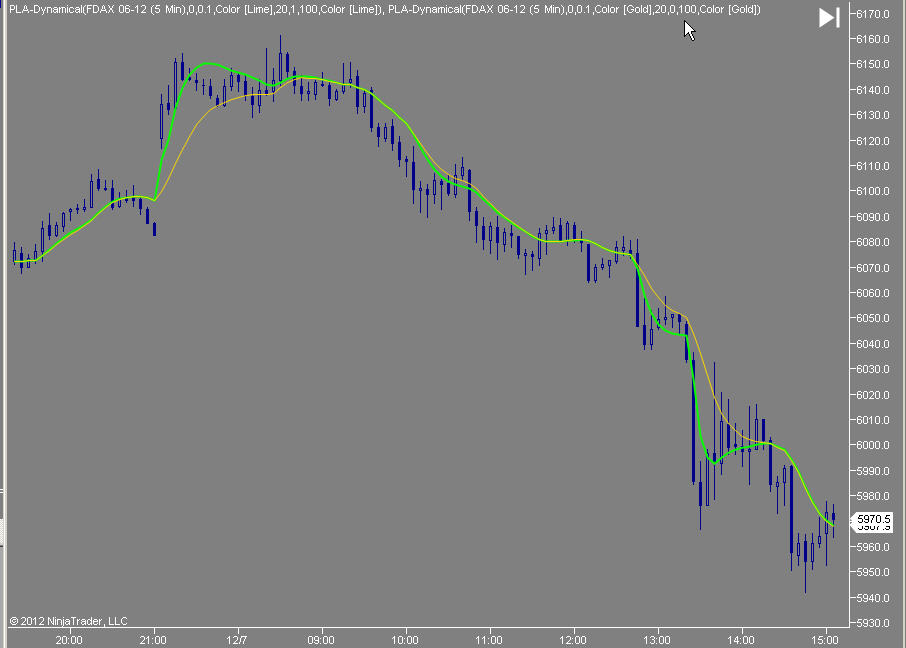

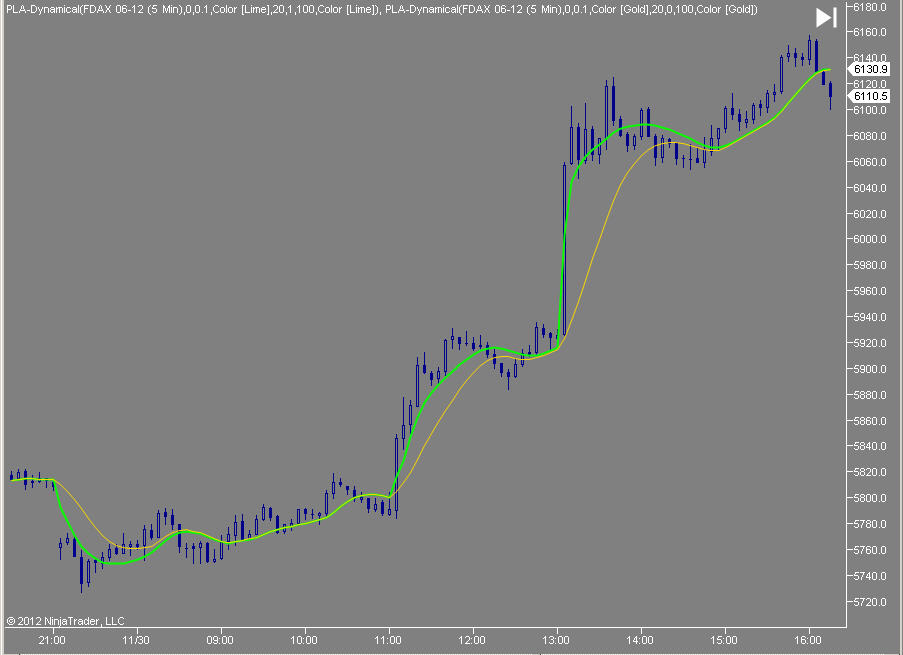

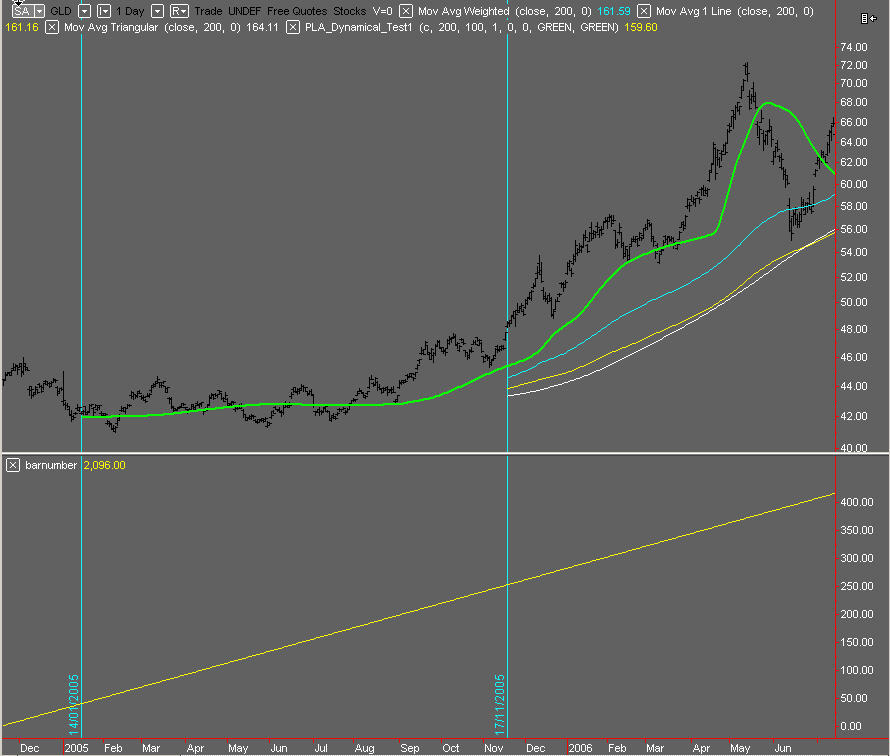

| Overshoot image below The two different PLA Dynamical plots in the shot below are both set to length 18 and speed 100. How are they different? Green plot overshoot =1 and the yellow plot is overshoot = 0. The difference in response times during high volatility is the overshoot feature enabled in the Lime plot and disabled in the yellow plot. |

|

PLA DYNAMICAL GOLD 1 MONTH TRIAL

IS AVAILABLE FOR $77

View

license prices for this and other PTS for MultiCharts products.

Below image Overshoot on green plot- overshoot off in yellow plot

|

Below image Overshoot on green plot- overshoot off in yellow plot

|

| Anti-reverse feature PLA Dynamical GOLD's anti-reverse is designed to reduce whipsaw when the prices resonate around during dull sessions making annoying small moves. You can adjust its sensitivity from tiny percent to massive percentages. (It can take three decimal places) Adjustments to these percentage can improve statistical lake ratios, Sortino, Sharp ratios etc |

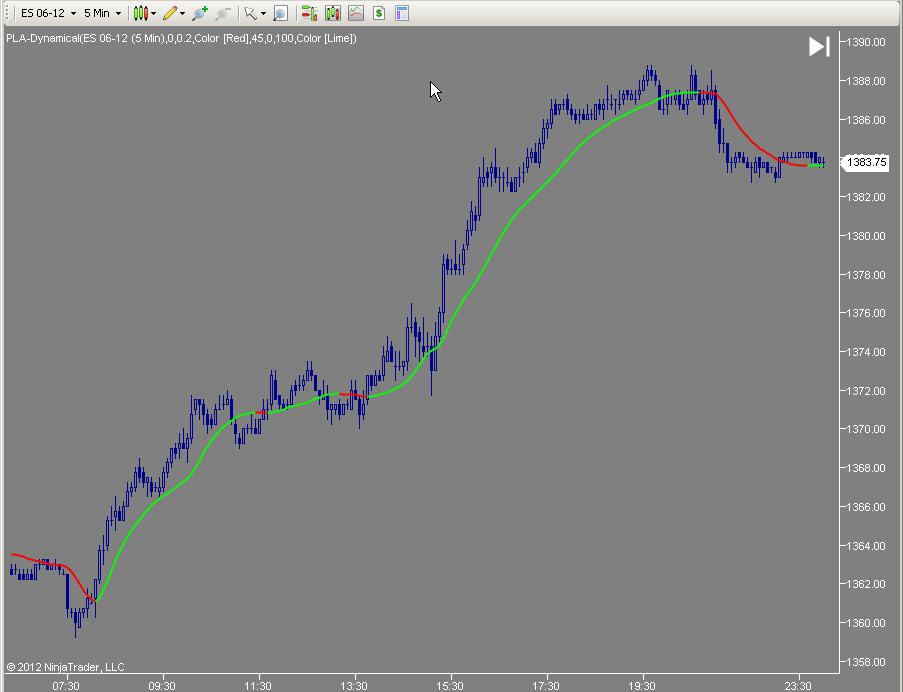

Below image anti-reverse is turned off, you can observe the small amplitude red areas where it turns down into short mode |

|

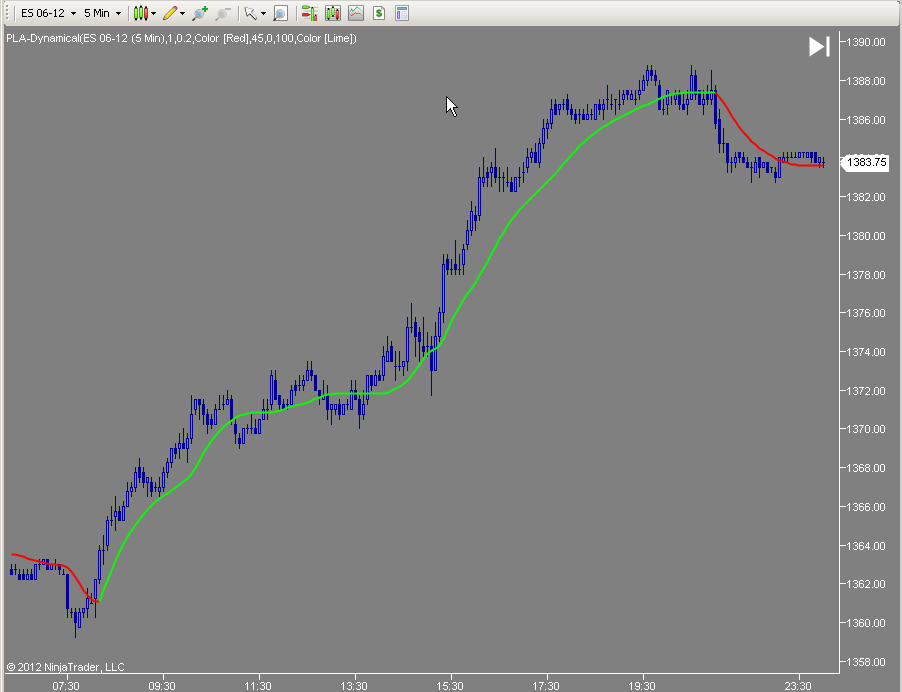

Below image is anti-reverse turned on which removes the small whipsaw red areas on the same data (*Doing this delays the later signals on the right*) |

|

PLA DYNAMICAL GOLD 1 MONTH TRIAL IS AVAILABLE FOR $77 View license prices for this an also other PTS for MultiCharts products. PLA Dynamical is made in England - Old school quality is GUARANTEED. |

|

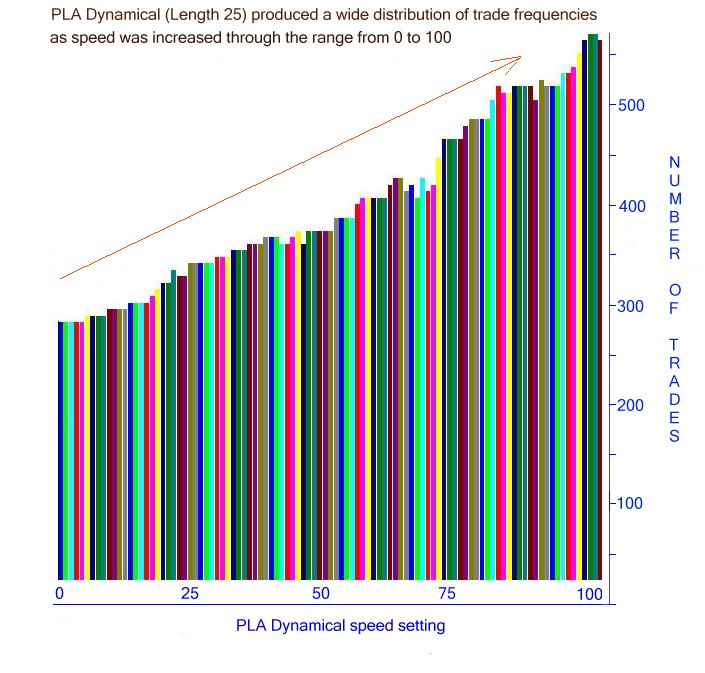

| PLA Dynamical GOLD for MultiCharts produced the trade frequency

plot shown below when the speed setting was

iterated from 0 through

to 100. The number of trades changes gradually as each iteration was made. Only by changing the speed settings - All used length 25. This speed feature empowers the trader with more flexibility and choice than has previously been possible with a moving average. It will run as fast or as slow as required for each individual users required frequency spectrum |

|

PLA Dynamical GOLD - The fastest moving average on planet earth |

|

Response time table PLA Dynamical is the fastest moving average on planet earth if overshoot = 1(True) and Speed = 100 anti-reverse=off ( 0 ) PLA Dynamical response times compared to standard type MA type filters which are tested at length 30 You can also make PLA Dyanmical GOLD the slowest moving average setting anti-reverse = true and putting in a big percentage value. |

PLA Dynamical for MultiCharts |

| For advanced users and maths geeks who enjoy scientific

experiementation Fast start algorithm The first plot is produced very quickly - in less bars than the length used Many of the advanced moving average types can start off life with spurious values until the set length bar number is reached. PLA Dynamical GOLD starts off with an intelligent value, getting more intelligent with time as more bars are encountered. The first plot is produced sooner than regular moving averages and even with length 200 it will begin a plot on bar 40. Length 4 to 48 will begin plotting on bar 17 Lengths 49 to 132 will begin plotting on bar 26. Length 200 (maximum) it will begin plotting on bar 40.  Fast start algorithm: All the averages in the Video clip are set to length 50 but PLA Dynamical GOLD starts in 17 bars on the MultiCharts platform |

-

Technical details features PLA DYNAMICAL GOLD 1 MONTH TRIAL IS AVAILABLE FOR $77 View license prices for this and other PTS for MultiCharts products. After a few years of high sales with the Gold version and lower sales with Silver and Bronze version, the decision was made to discontinue the Silver and Bronze Speed settings (101 different gears-speeds in the GOLD version) A complex algorithm iterates through 101 different steps that increase the speed up from the minimum of 0 to the maximum of 100. This feature requires a minimum of length 3 before there is enough data running through the code to produce this facility. The beauty of this component is that if you are optimising lengths from 20 to 30 ( which would normally giving you 11 outcomes ) you can also test speeds from 0 to 100 at the same time resulting in ( 101 x 11 ) = 1111 different possible outcomes. If you try riding a one geared bicycle around an undulating track and then a 10 gear bicycle on the same track. You know very well which one will get through it better. Overshoot TRUE-FALSE feature, ( user input is 1 or 0.) A very useful component that adds even more flexibility to this product. A a new method to release the overshoot has been devised which can result in a much more responsive plot under volatile market conditions. It is not suitable to be applied to slower speeds due to incompatible dynamic system arguments contained within this complex algorithm. Overshoot OFF will engage only on lengths of 12 and above Overshoot ON mode is designed to be used with speeds above 70 however it has not been restricted so you can experiment. Anti-reverse TRUE-FALSE feature User input is 1 or 0 which means 1 = On and 0 = Off, this was done to enable the changes in optimizations) This feature when enabled (1 = TRUE) is designed to reduce sensitivity to the very smallest changes in the output of the PLA Dynamical filter. It takes the average of the highest price and lowest price over half the length period and computes a percentage of that range. Making it both simple and fractal at the same time so you dont need to guess the percentages used If the PLA moves in the opposite direction of the prevailing trend by less than this amount it will be overridden by the anti-reverse function. This means a large reduction in whipsaw trades that occur in tight trading ranges. Anti-reverse percent adjustment feature ( user input is 0 to 100) But please note values above 3 will result in "silly looking" charts. Values of 0.001 up to 0.2 are better for the anti-reverse percent. When doing this is it prudent to reduce the speed setting a bit. You will see this better when you use it. To be fractal and respond correctly to any time frame, the anti-reverse percentage uses a marker based on the local range of the market. It is not using a fixed percentage. This is the user adjustable sensitivity of the anti-reverse. E.G. if you type in 0.1 it will prevent PLA Dynamical reversing a trend unless it has moved by more than 10% of the high-low range over the length duration. The obvious benefit of this is to reduce false signals that occur in tight choppy trading ranges. With Anti-reverse TRUE the PLA Dynamical will generate less trend changes for this reason and if larger numbers are typed into it, you can observe a plot which becomes a true net percent of trading range trend change indicator. Some test results will show this feature actually creates a whole new plethora of possible system testing outcomes. With Anti-reverse FALSE = 0 the PLA Dynamical will resume its regular plot without restriction. The key is experimentation, you will be amazed at what it does. PLA Dynamical Gold for MultiCharts : Standard features Colour up-down adjustment: This feature enables a clearer definition of when the PLA Dynamical has changed trend direction. I was asked by several customers for this component to be added, so its added as standard kit now. If you want PLA Dynamical to stay the same colour you can set the up and down colours to the same value. Length adjustment: This is a standard feature of most moving averages and is of course included in PLA Dynamical Gold PLA DYNAMICAL GOLD 1 MONTH TRIAL IS AVAILABLE FOR $77 View license prices for this and other PTS for MultiCharts products. ADD ONS AND USING THE BESPOKE PLA DYNAMICAL FUNCTION CALL COMMANDS TO FORM OTHER INDICATORS AND SIGNALS.Smooth your jerky indicators with PLA Dynamical GOLD The regular indicators

available in MultiCharts can be smoothed with the PLA Dynamical GOLD

algorithm using the Power language editor.

( Please note this code is the same for Tradestation and MultiCharts, hence the page title) Analogous notes to aid understanding: As with all moving average filters, one needs to understand that if you put rubbish through it you will get rubbish out of it. In the shot below the very easy price action of this trending stock is effortlessly tracked by PLA Dynamical GOLD the moving average. Superbly clean price action: Image below  PLA Dynamical is a filter. It works like a water filter removes particles, debris and impurities...please read now because this is important. Imagine a muddy puddle in a meadow after some heavy rainfall. It contains some blades of grass, live insects, grit, organic matter etc. If this is poured through a water filter of high quality with silver impregnated carbon and 1 micron screen mesh filter, I would feel safe to drink it afterwards as it would be pretty clean. Please imagine ( although it may be a little disgusting ) a pool of water next to the Fukushima nuclear reactor after the catastrophic earthquake which contains some rotting dead animals and radioactive waste. If this is poured through the above water filter, I would not drink it even if the filter was 100 times better. Would you? The moral of this analogy....Rubbish in = Rubbish out. The practical result of understanding this analogy is that things can be good and then turn bad.... Superb price action turns into ugly price action after the blue line If you like to use filters to trade markets full of noise, where robots and high frequency trading machines are prevalent and are highly populated with highly geared day traders who risk way too much. Then that is the same as the example above when drinking radioactive waste. If you like to use filters on 2nd line markets which are less popular and contain less noise, robots and scalping day traders, you are drinking from the puddle in the meadow. So you might have a better chance of latching on to a clean trend that runs further. The point is to spend time on market selection to find those markets with natual trending attributes. They are there if you look. |

-

|

-

-

-

|

||||||||

|---|---|---|---|---|---|---|---|---|

The help and advice of customers and readers is valuable to me. Have a suggestion? Send it in!

The contact page here has my email address and you can search the site

If you

like what you see, feel free to

SIGN UP to be notified of new products - articles - less

than 10 emails a year and zero spam

Precision Trading Systems was founded in 2006

providing high quality indicators and trading systems for a wide range of

markets and levels of experience. Supporting NinjaTrader, Tradestation and

MultiCharts, coming soon are TradingView and possibly a resumption of

products on the MetaTrader4 platform. About

Admin notes

Page created on August 15th

2023 - New responsive page GA4 added canonical this. 5/5 html

sm links added - 4 responsive videos